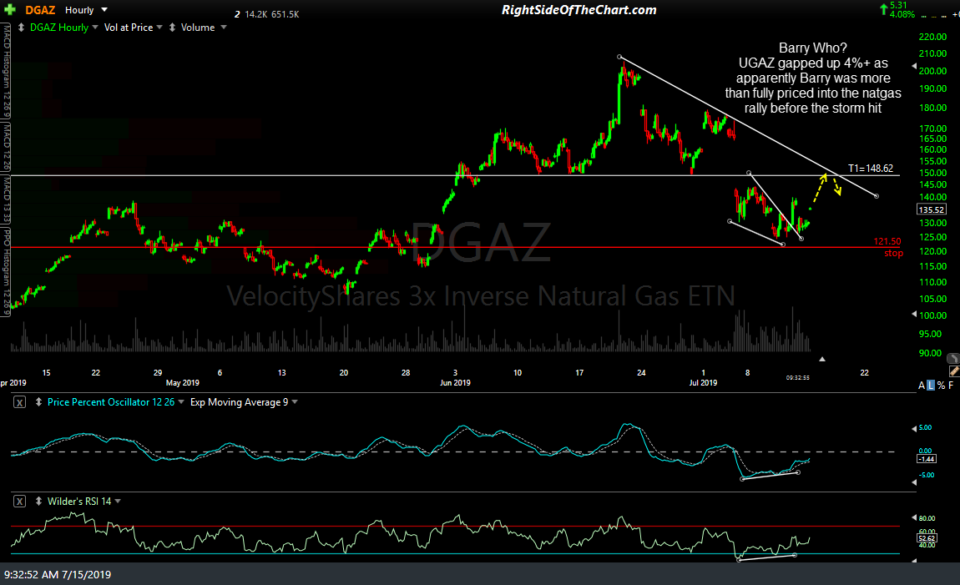

The DGAZ (3x short natural gas ETN) gapped up 4%+ as apparently, Hurricane Barry was more than fully priced into the nat gas rally before the storm hit, at least so far. This, despite the most recent reports that Barry has shut down 73% of crude production & 62% of natural gas production in the Gulf, a good example of a foreseen news event being priced into the charts before the actual event (storm making landfall + the aftermath) occurred. The technicals still indicate more downside in nat gas futures to at least the lower trendline which should roughly correlate into a continued rally in DGAZ up to the first target & while I might normally consider raising stops to entry at this time, I’d rather keep the suggested stop as is (121.50) to allow for any post-storm volatility in NG prices although one could certainly make the decision to raise stops if that is your preference.

So far, our entry on the trade was perfect, with /NG nat gas futures reversing immediately following Friday’s backtest of the recently broken bearish rising wedge pattern right after we shorted it there. On a related note, the unofficial trade on /CL crude futures, USO or DWT also posted on Friday is also under consideration to be added as an official Active Trade today as well. Previous & updated 60-minute charts of /NG below.

- NG 60-min July 12th

- NG 60-min July 15th