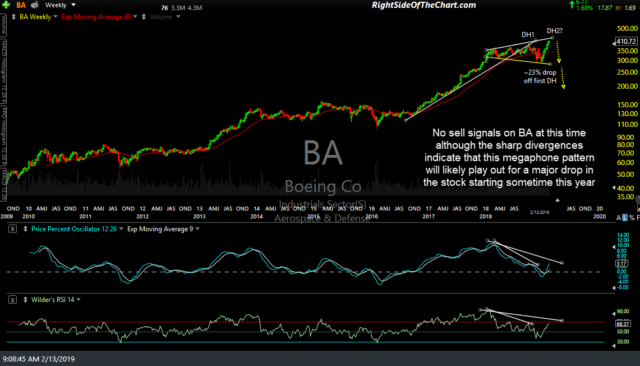

Member @dazi requested an update on BA (Boeing Co.) in the trading room & as there are some key levels & developments worth noting, I figured that I would post the updated analysis here on the home page for anyone else interested. Earlier this year, long before the 737 Max issues began, I started posting some bearish developments on the weekly chart of BA including an Broadening Wedge (aka- megaphone) topping pattern along with negative divergence on the weekly time frame (first chart below from Feb 13th, with the subsequent charts following including today’s updated chart).

- BA weekly Feb 13th

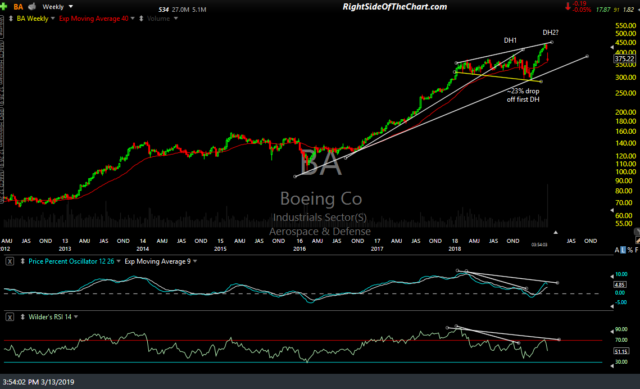

- BA weekly March 13th

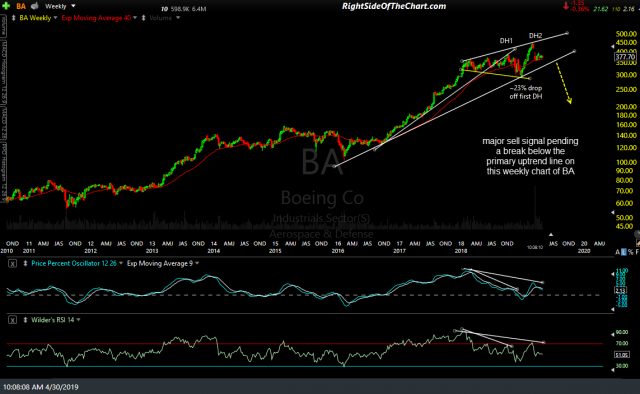

- BA weekly April 30th

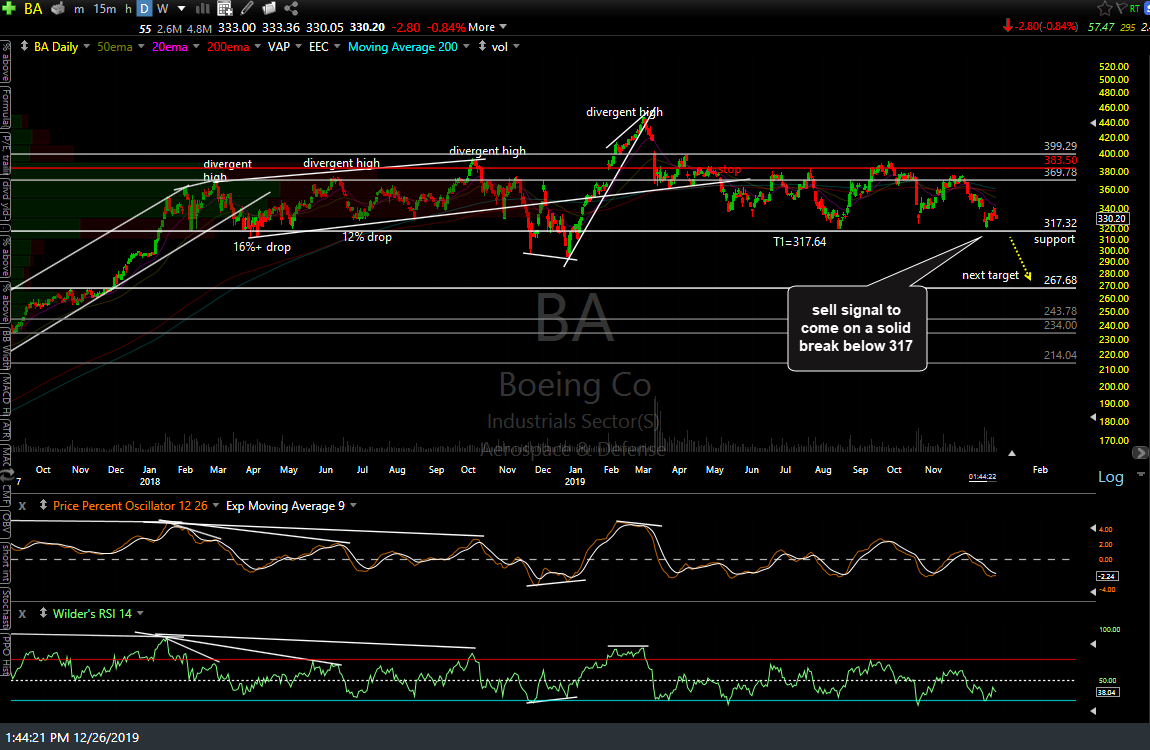

- BA weekly Oct 22nd

- BA weekly Dec 26th

Since that first trading room post back on February 13th (Gold access required to view this link), BA went on to confirm the negative divergence on the week of March 8th, falling over 25% since then and going on to break down below the uptrend line off the January 2016 lows followed by a backtest of the trendline from below & dancing on the 320ish support level since. Zooming down to the daily chart below, BA went on to hit my previous downside target of 317.64 which has formed the bottom of a sideways trading range that BA has spent nearly all its time in other than the brief blow-off top back in late-February/early-March.

As I like to say, support is support until & unless broken so while BA could certainly break either way (above or below) this 2-year trading range, I still favor a downside break with a sell signal to come on a solid break and/or close below 317 with the next swing target just above the 267.68 support level. Of course, those with a bullish outlook on BA could use this and any future pullbacks to the 320ish support to go long with a stop somewhat below, targeting the top of the range (370-400) or even hold out for an upside breakout.

As a component of both the Dow Jones Industrials Average ($DJIA), as well as the S&P 500 ($SPX), any short trade on BA, is likely to face a headwind as long as the broad market remains in an uptrend as such, I’m only passing this along as an unofficial trade idea as well as a follow-up to @dazi’s chart request. However, the downside potential based on the technical posture of BA on the weekly time frame is considerable so I’ll continue to keep an eye on Boeing as well as the broad market as a potential official trade, depending on how the charts develop going forward.