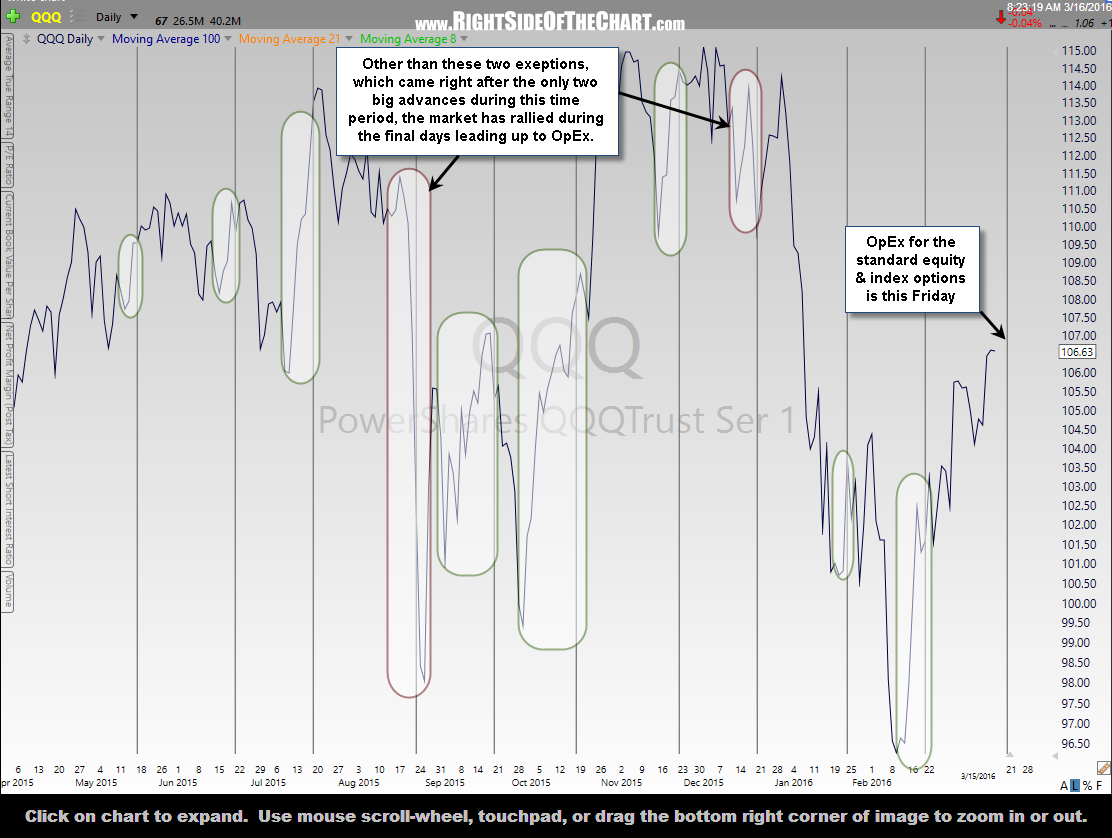

In the past, I’ve highlighted the tendency for the stock market to rally in the final days leading up to expiration for the standard equity & index options contracts, which falls on the 3rd Friday of every month. I’ve also mentioned how the rare exceptions over the last year or so in which the market did not rally during the final days leading up to OpEx were the two instances immediately following a top in the market after a strong advance. The logic behind this, or at least my best guess as to why the OpEx ramp didn’t occur in those two instances is most likely to the excessive bullishness that comes after a strong advance, hence, there were likely more call buyer to be “roasted” than put buyer following those extended rallies.

Whether the next few days will see the market climb or at least hold onto the recent gains that were made over the last few weeks is yet to be seen. One thing that is almost a sure thing is the fact that FOMC announcement days, such as today, have a shown a fairly consistent pattern in recent years of stock prices typically meandering around somewhat aimlessly throughout the trading session up until the FOMC meeting announcement is released, typically followed by a very sharp & fast knee-jerk reaction in one direction or the other. Add to that the initial reaction is often quickly faded.

With the chances of a rate hike near zero, I’m not expecting a big fireworks show this afternoon although I will say that I expect trading to be choppy for the remainder of the week. I should also add that I typically try to avoid entering any new positions that trigger breakout on the post-Fed announcement volatility, as those breakouts have a considerable higher rate of failure due to the erratic swings in stock prices that typically follow the FOMC announcement. I will, however, take advantage of any post-FOMC volatility to close positions that hit any of my preferred price targets. Bottom line is that, for the most part, I will be sitting tight on my current swing positions for the remainder of the week while being very selective on adding any new position, long or short.