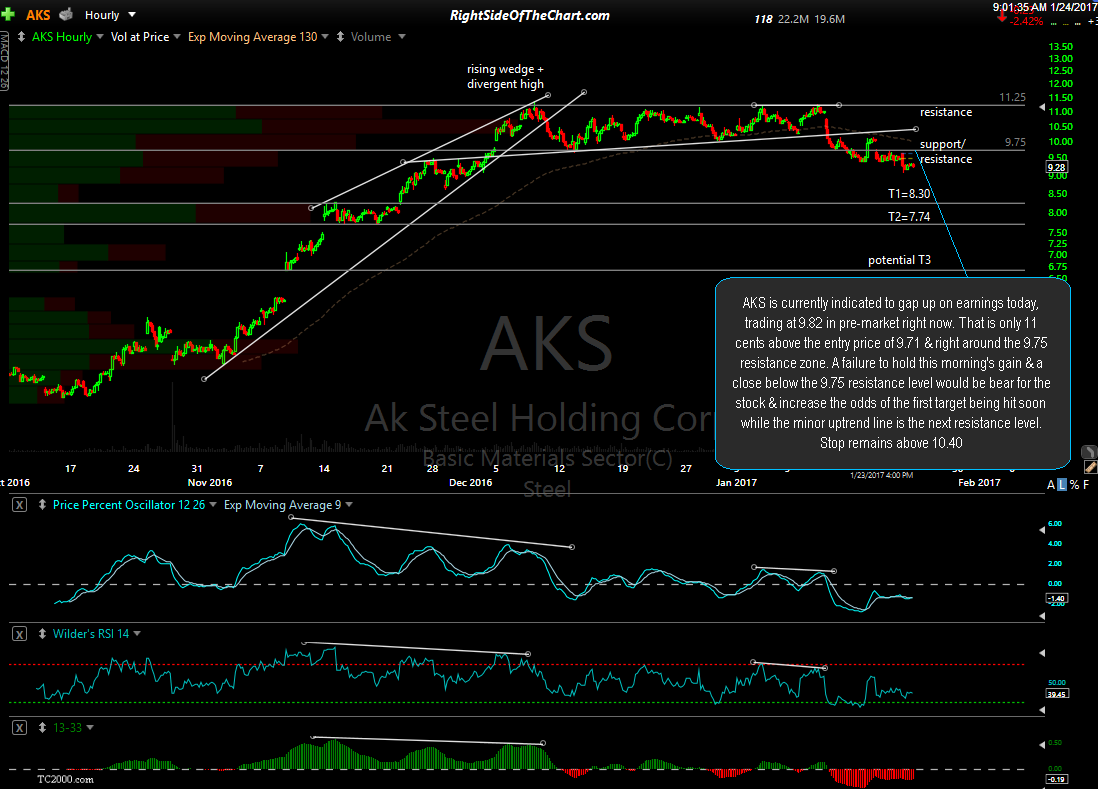

AKS (AK Steel Holding Corp) is currently indicated to gap up on earnings today, trading at 9.82 in pre-market right now (or at least when I started to compose this update). That is only 11 cents above the entry price of 9.71 & right around the 9.75 resistance zone. A failure to hold this morning’s gain & a close below the 9.75 resistance level would be bearish for the stock & increase the odds of the first target being hit soon while the minor uptrend line is the next resistance level. The suggest stop remains above 10.40.

Bottom line: I wouldn’t add on the gap up today nor am I concerned about today’s likely gap at this point as there won’t be any technical damage inflicted to the near-term bearish case until & unless AKS were to make a solid break above and/or close above that minor uptrend line with lies just above the 9.75 former support, now resistance level. Of course, a solid break above the 11.25 resistance level would be even more bullish and as such, that is the reason that the suggested stop was placed slightly above that level along with the fact it was calculated factoring in the potential price targets to provide an attractive R/R on the trade. (strike-out text was edited after this post was publish as although the stop was correctly stated as 10.40 in the comments above although glancing the chart, I mistakenly thought I had placed the stop above that 11.25 resistance in composing this update. The stop was & still is correctly set it at 10.40 in order to keep in-line with my typical minimum R/R of roughly 3:1 to the current final target on the trade).

Should most or all of this gap in AKS be faded today or tomorrow, that would clearly be bearish for the stock & provide an objective add-on or new short entry. As such, best to just sit back for a bit today to see how the stock trades through the session before reducing or increasing exposure to a short position on AKS.