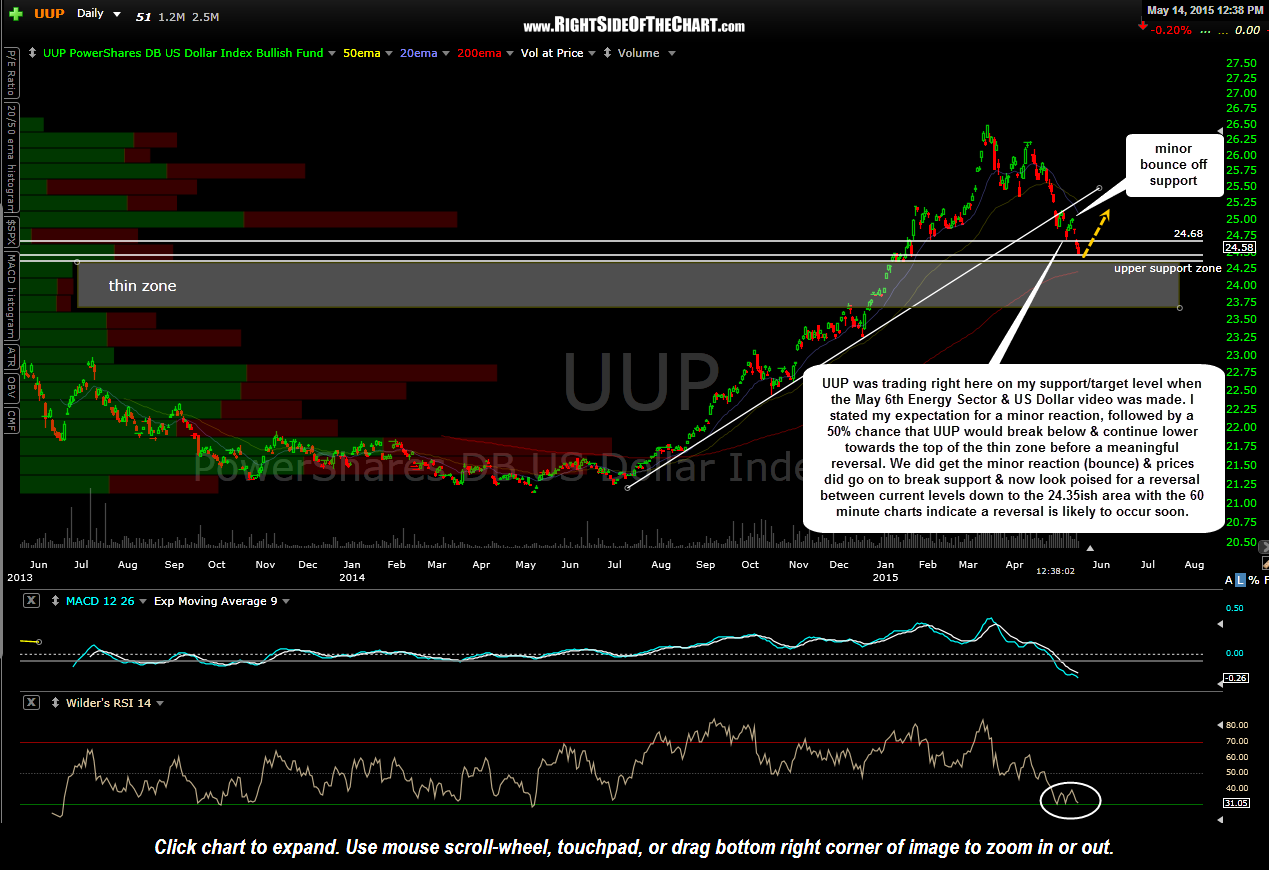

On May 14th, just as the US Dollar was wrapping up the largest correction in years, I stated that a reversal was likely & the net result was that the rally I was (and still am) expecting in commodities would likely have to wait until the bounce in the $USD had run its course (May 14th UUP chart below).

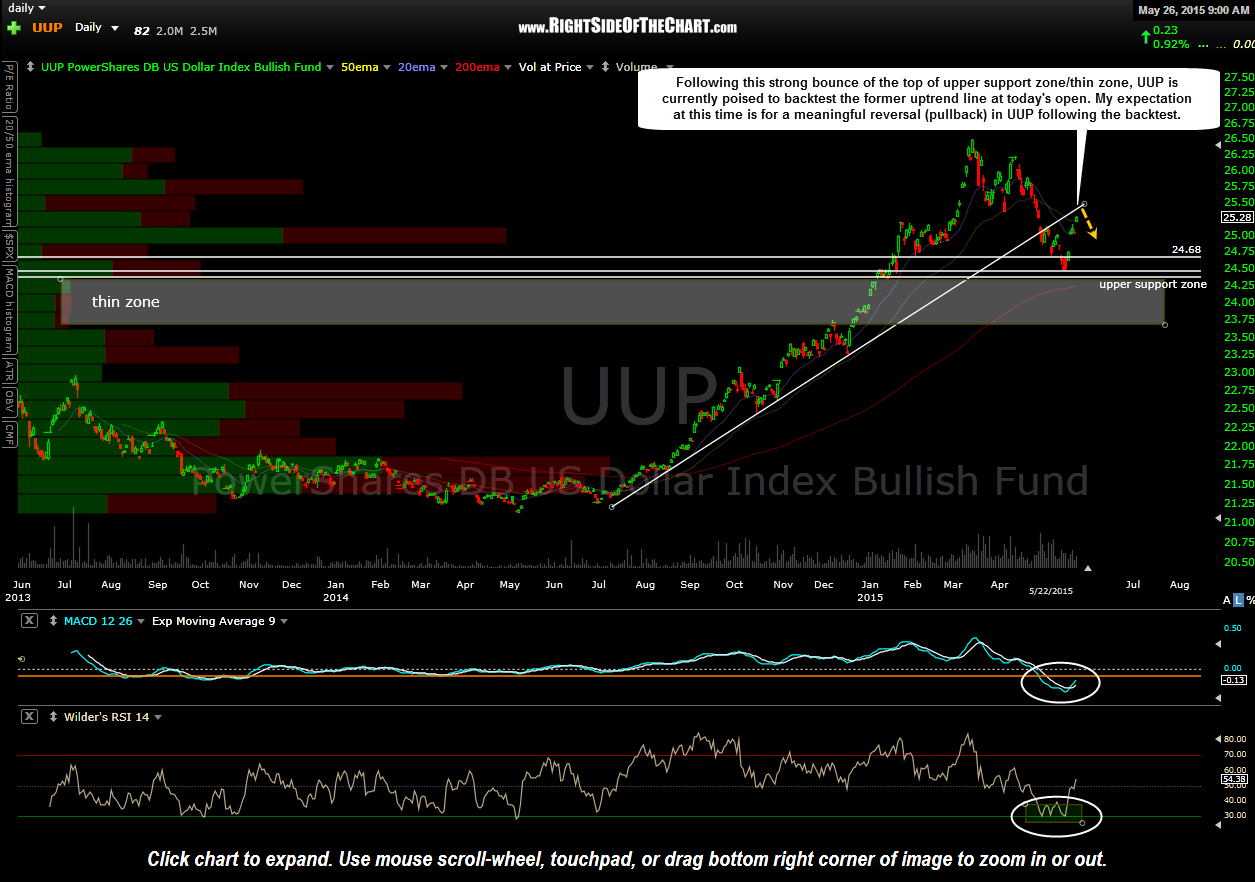

As I type in pre-market trading, UUP is poised to gap up around the 25.50 area which would coincide with the previously highlighted primary uptrend line in UUP. While UUP nor any other currencies are listed as Active Trade ideas on the site, I continue to monitor the major currencies to supplement my analysis on dollar-sensitive assets such as the energy sector, precious metals & various commodities.

While my confidence that the dollar will immediately reverse or possibly drift a bit higher before doing so is not very high, I don’t plan to make any drastic changes to my positioning although I do plan to reduce my short exposure to the energy sector, possibly closing the ERX/XLE short today, and maybe even add some exposure to select commodities, including a starter position in WEAT. Updated UUP daily chart (as of Friday’s close) below: