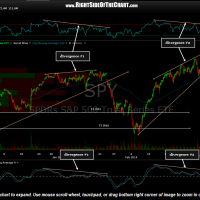

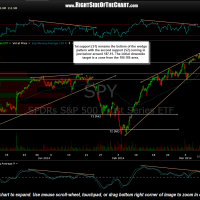

Market updates continue to be light as there have not been any significant technical developments in the U.S. markets lately. The lower uptrend line on the 60 minute bearish rising wedge pattern that I’ve been tracking in the SPY has been slightly tweaked in order to adjust for a better fit on the most recent reaction low. A minor support level has also been added to the updated chart below as well as an initial target zone which comes in around the 184.-185 area. Should the SPY break below both the wedge pattern and the S2 support level soon, as is still my primary scenario, then I would expect the selling to begin to accelerate to the downside. Assuming that my primary scenario continues to play out as expected, additional downside targets for the SPY may be added. I have also been working on updating the trade ideas and will look to share some new trade ideas as soon as the current trade ideas are up to date as quite a few trade ideas have either hit one or more profit targets, exceeded a suggested (or any reasonable) stop, or both and need to be removed from the Active Trades categories. Previous & updated SPY 60 minute charts below:

- SPY 60 minute March 5th

- SPY 60 min March 7th

- SPY 60 minute March 11th

On a final note, I do want to share that my degree of confidence in the near-term direction of the market is not very high and as such, my preference is to continue to keep things light at this time. As evidenced by scrolling down the Completed Trades category, we we able to close a large amount of trades out for some exceptional gains in the first two months of this year and since that time, other than what looked to be a couple of objective shorting opportunities while the markets & certain sectors were backtesting recently broken trendlines, I’m just not seeing many new trade ideas offering very favorable R/R profiles. With all the fanfare it the media about the recent highs in the market, the broad market (S&P 500) is only trading about 2% above where it closed the year on Dec 31st. 2014 has so far proved to be a traders market, not a buy & hold market, with that sharp correction in late Jan/early Feb followed by an equally sharp rise to basically put us back to where we started the year. My expectation for the remainder of 2014 is much of the same: Some big dips followed by some big rips. Rarely do we get two back to back, slow & steady grind higher years as we did in 2013. Whether or not that does happen, I believe it is best to sit and wait for the market, or any individual stocks, to set up in well defined technical patterns offering the best risk/reward profiles. You can’t squeeze blood from a stone nor should a trader expect that he/she can always extract money from the market.

First, do not be invested in the market all the time. There are many times when I have been completely in cash, especially when I was unsure of the direction of the market and waiting for a confirmation of the next move….Second, it is the change in the major trend that hurts most speculators. -Jesse Livermore