I figured I’d pass along my current thoughts before the market opens today. The first chart & comments below were my thoughts I posted in this comment reply to @EMFO shortly after the close yesterday regarding my expectations for a bounce into the overnight session & into today, as the market had just fallen to a very key support level:

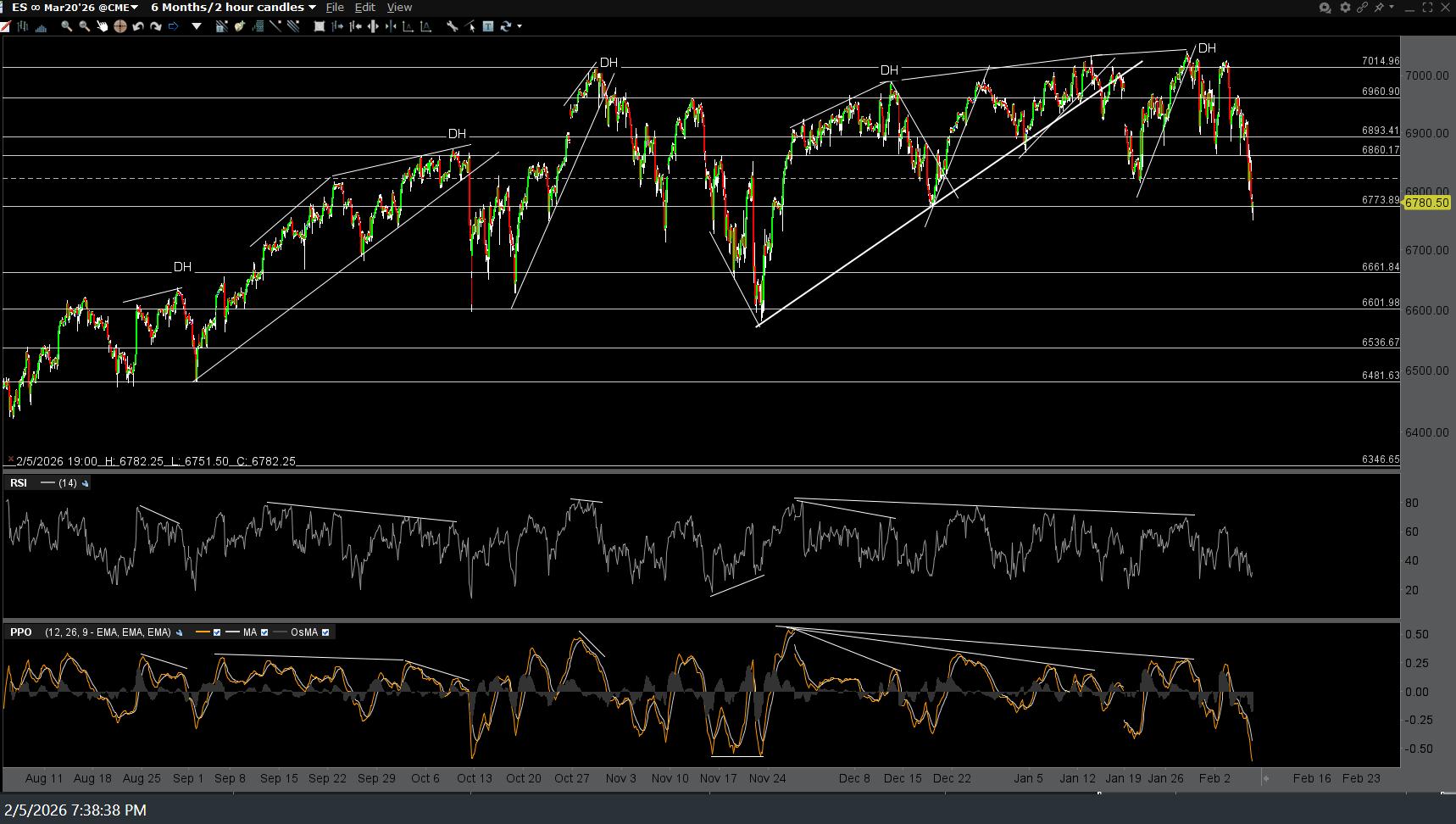

Here are the 120-minute charts of /NQ & /ES I posted in that same comment thread for @bertha888, followed by the updated charts, showing that initial resistance level/bounce targets have just been hit in the pre-market session:

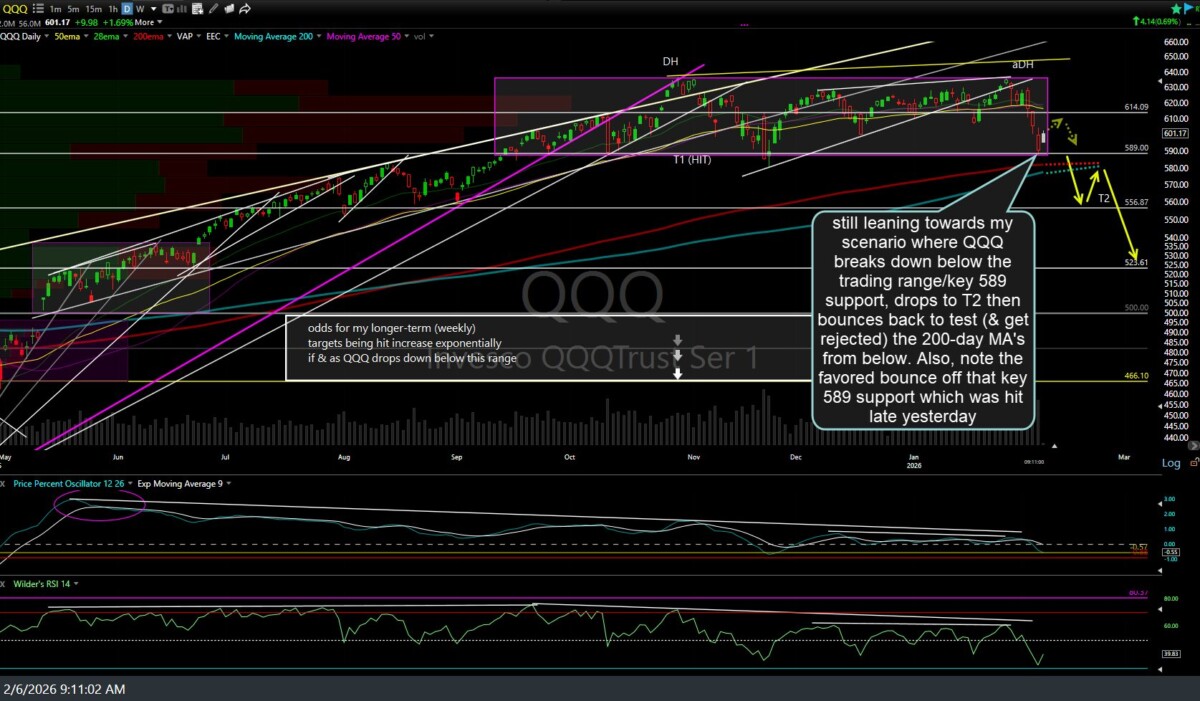

..and here’s the daily chart of QQQ, showing yesterday’s & today’s after-hours & pre-market trades in the white candles. I’m still leaning towards my scenario where QQQ breaks down below the trading range/key 589 support, drops to T2, then bounces back to test (& get rejected) the 200-day MA’s from below. Also, note the favored bounce off that key 589 support, which was hit late yesterday.

Bottom line, while I favor at least a minor reaction/pullback off these resistance levels that are currently being tested, as well as an ultimate breakdown below the multi-month trading ranges in QQQ & SPY, I suspect the market might grind around a bit today & wouldn’t be surprised to see these resistance levels taken out, with a decent rally today, nor would I be surprise in the least to see the market crap out & go on to break below the key support levels that were tested late yesterday.

As such, other than a reversal (long to short) for a quick pullback trade here (might even just trail down a stop), I might keep things light today unless I see a solid break above the aforementioned resistance levels or below the aforementioned key supports.

I’m also very eager to see if yesterday’s drop in Bitcoin & the Bitcoin proxies (MSTR, RIOT, MARA, etc..) were selling climaxes or if there is more to come.

No, decent odds of an overnight & possibly into Friday bounce.. QQQ too. The Q’s fell to that key Oct 10th low/bottom of the trading range (box on my daily chart) & former T1, 589 support in the AH session, which was already hit back in late Nov (and is still trading there in AH now) so even if RTY makes a slight overshoot, it will likely bounce if QQQ makes one last hurrah off 589 (which I think has a decent chance.

However, that works the other way too. As I like to say; Support is support until & unless broken. Therefore, if the /NQ smash down through that support overnight & that breakdown holds into tomorrow’s regular trading session, IWM & just about all other things with a positive correlation to the stock market will get dragged down with it, kicking & screaming. For now, I think the odds for a bounce are decent. Not great, but decent. Remember too, the risk of an outright margin-call induced crash are ticking up with each tick down in the risk-on assets (stocks, crypto, silver, etc..).