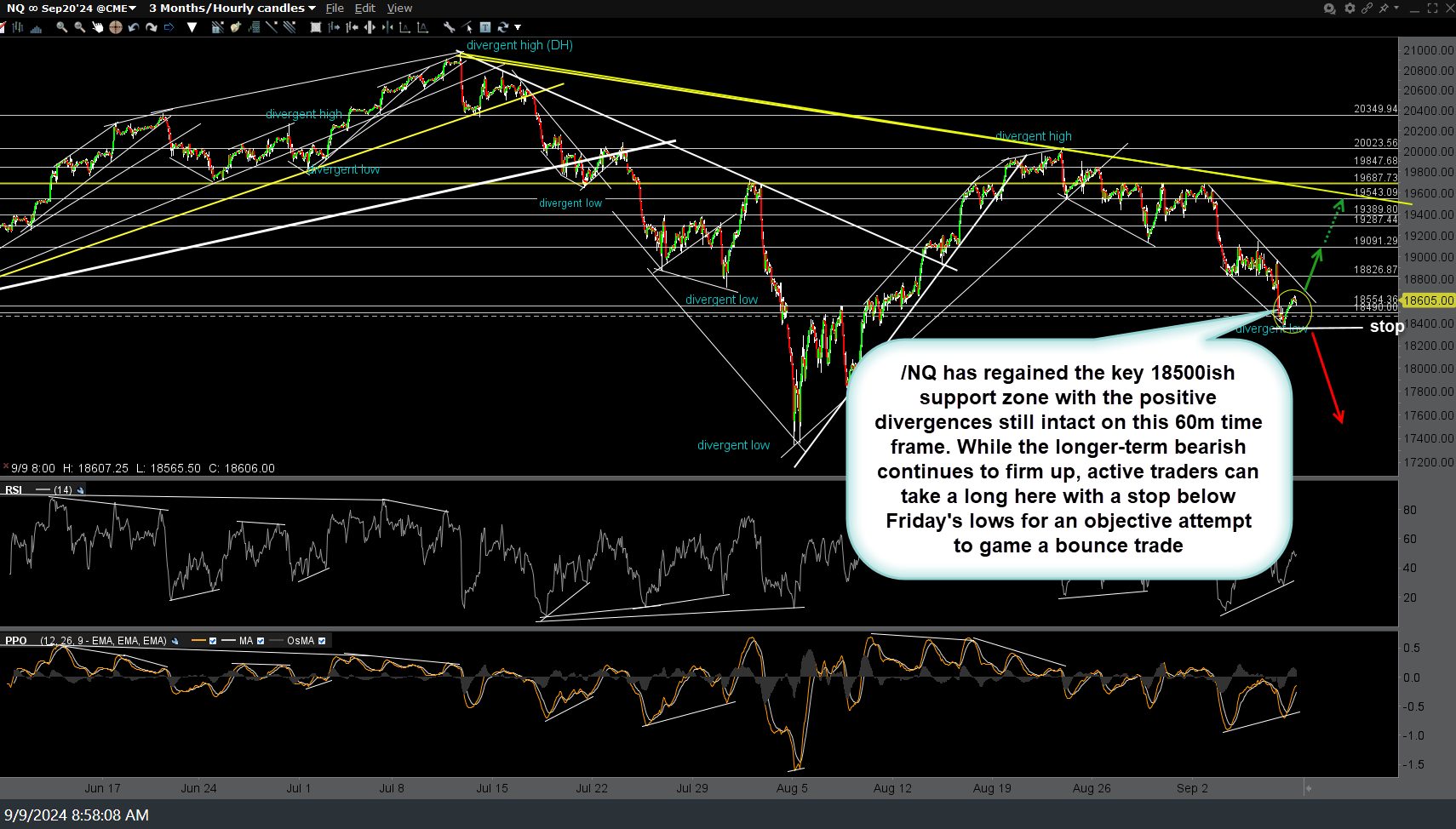

With just over 20-minutes to go before the opening bell, it appears that we’re likely to kick off the week not far from where we started on Friday morning. /NQ (Nasdaq 100 futures) has regained the key 18500ish support zone that it undercut on Friday with the positive divergences still intact on this 60-minute time frame. While the longer-term bearish continues to firm up, active traders can take a long here with a stop below Friday’s lows for an objective attempt to game a bounce trade. 60-minute chart below.

Likewise, we also have a potential whipsaw/bear-trap scenario on /ES (S&P 500 futures) which has regained the key 5442 support following a brief undercut on Friday with the positive divergences still intact. While the longer-term bearish case remains solid, active traders looking to game a bounce could go long here with stops around Friday’s low. 60-minute chart below.

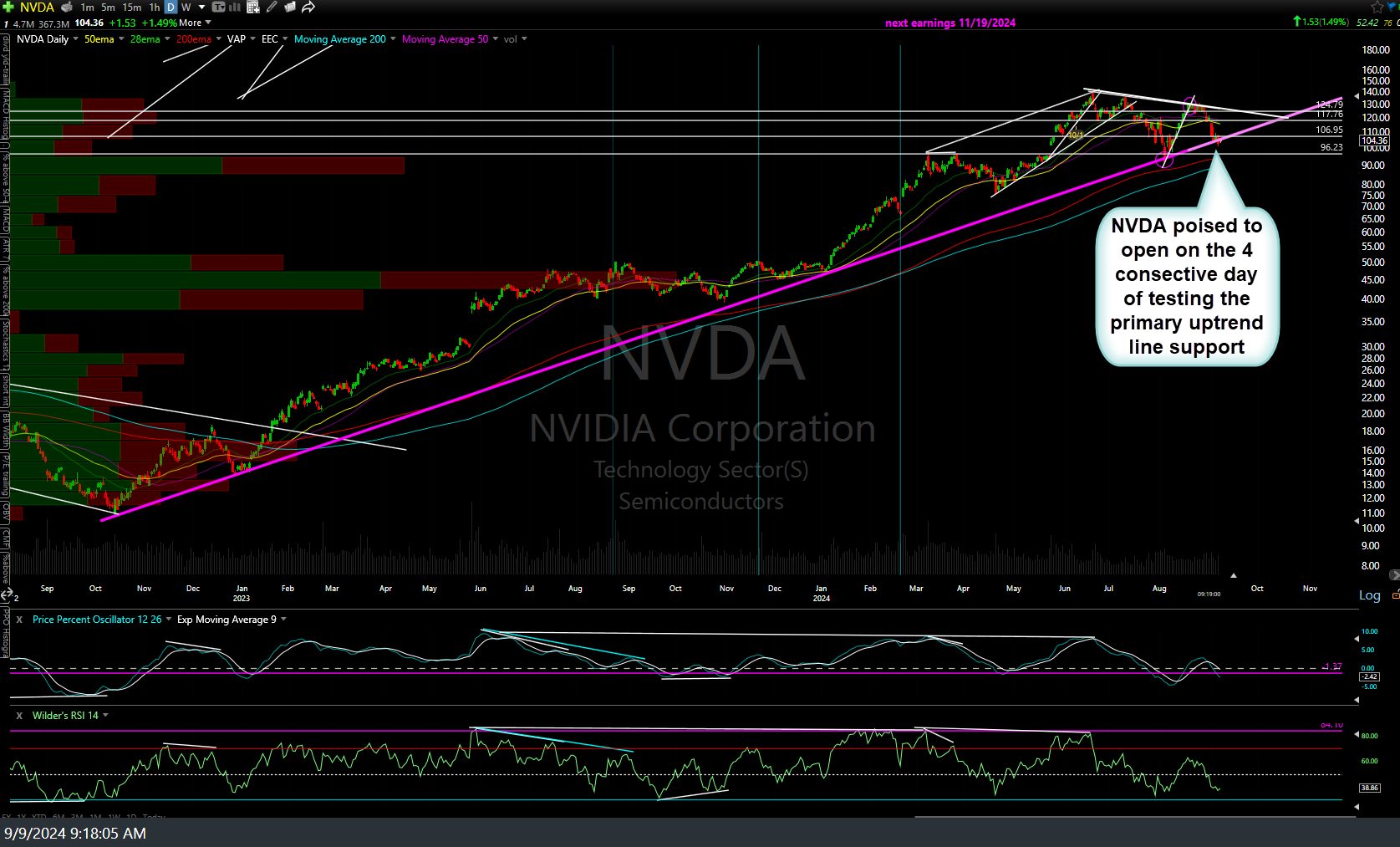

A couple of other things to watch today: NVDA (NVIDIA Corp), is currently poised to open on what will effectively be the 4th consecutive day of testing the primary uptrend line off the Oct 2022 lows. While I remain longer-term bearish on NVDA, as I like to say, support is support until & unless broken. As such, the potential for one last hurrah rally off that uptrend line still can’t be ruled out just yet.

Additionally, SOXX hit my 2nd price target, the primary uptrend line, on Friday & remains above it so far today. So essentially, while the longer-term bearish case remains solidly intact, the potential for an oversold, counter-trend rally, assuming the aforementioned support levels hold today, is decent. Not great but decent. As such, longer-term swing & trend traders might opt to continue to sit tight on swing short positions where active traders could take a shot at a counter-trend bounce with a potential loss of about 1.5-2% if stopped out (via the parameters above) vs. profit potential of about 3-5.5% to the minimum (solid arrow) & max. (dotted arrow) targets on /NQ or QQQ.