Today looks to be shaping up as a potential near-term key inflection point for the stock market, semis, & big tech stocks. Please pardon any typos or grammatical errors as I’m doing my best to fire off all of these key charts asap as I covered my /NQ short position in my active trading account & reversed to long in pre-market as QQQ & SPY both fell to key gap support with positive divergences & bullish falling wedge patterns on the intraday time frames.

QQQ, /NQ, SPY, & /ES all have positive divergences with bullish falling wedge patterns on the 15-minute (ETFs) & 60-minute (futures) charts below. As the employment situation continues to deteriorate with an imminent (and quite likely, already started) recession & continuation of the bear market that started with the early July peak in QQQ likely, it appears the odds for a decent & tradable bounce, at least today, appears likely.

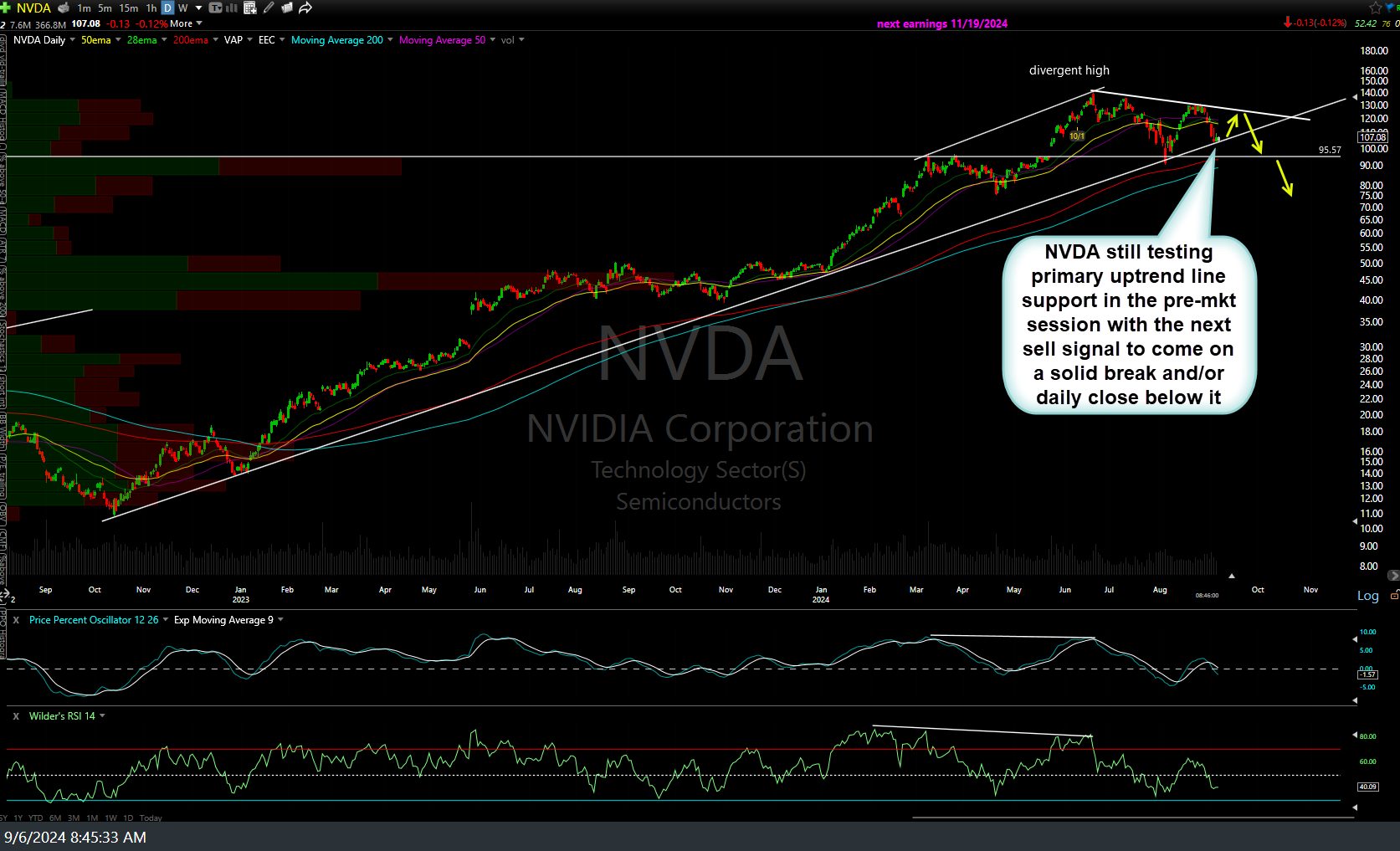

At the very least, this appears to be an objective level to cover shorts & reverse to long with a stop somewhat below the bottom of the gap on QQQ. Additionally, I have both NVDA & AVGO, the two most important semiconductor & AI stocks IMO, at key uptrend line support. While I believe that a breakdown & much more downside in both of those stocks in the coming months is likely, I think the R/R for a long here with stops somewhat below (if/when those TL’s are clearly taken out, especially on a solid daily closing basis) is favorable. Again, I have pivoted in my active trading account & won’t hesitate to flip back to short should the market & those key stocks just crap out in the regular session today & take out the key support levels that it has just tested in the pre-market session today.