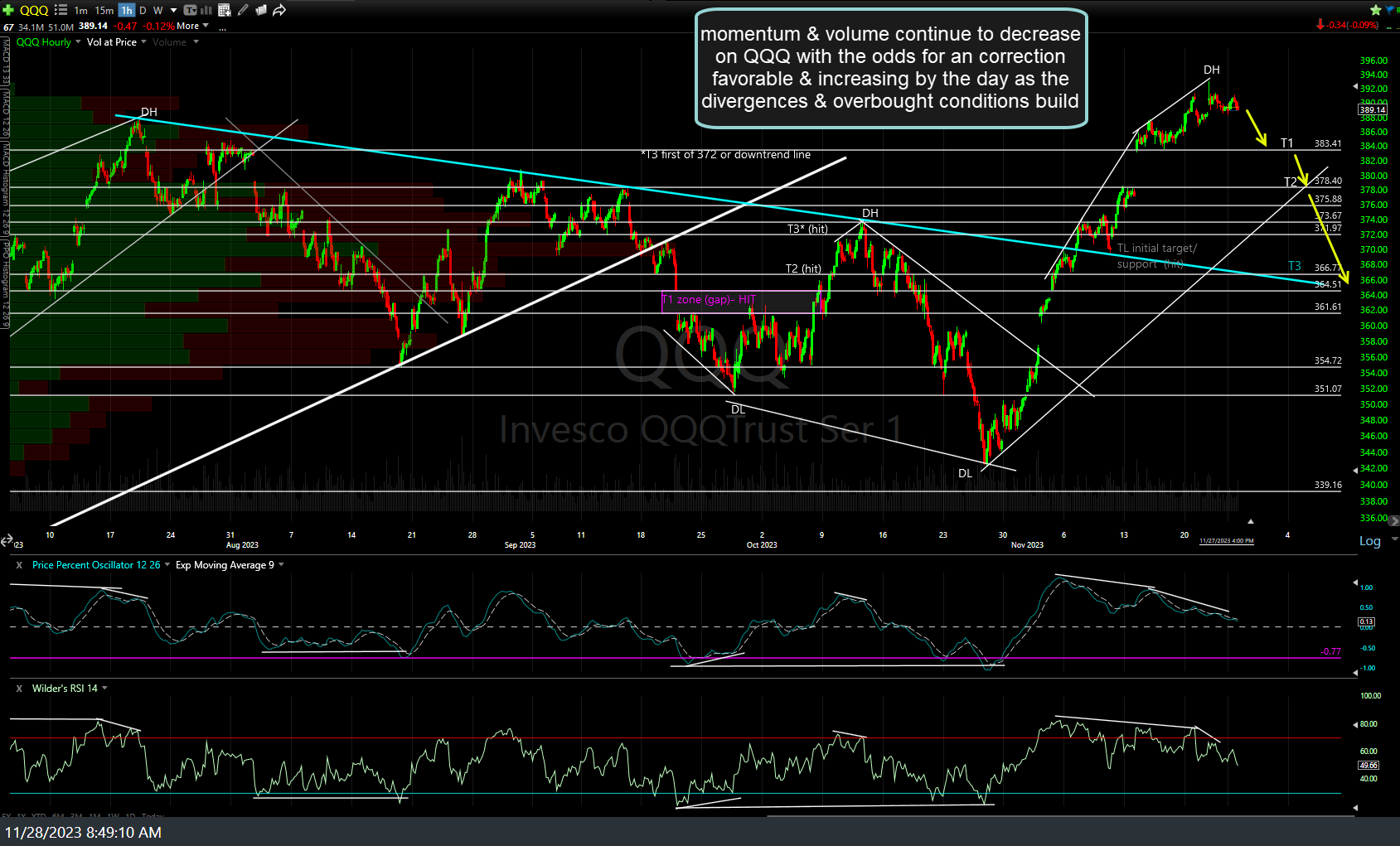

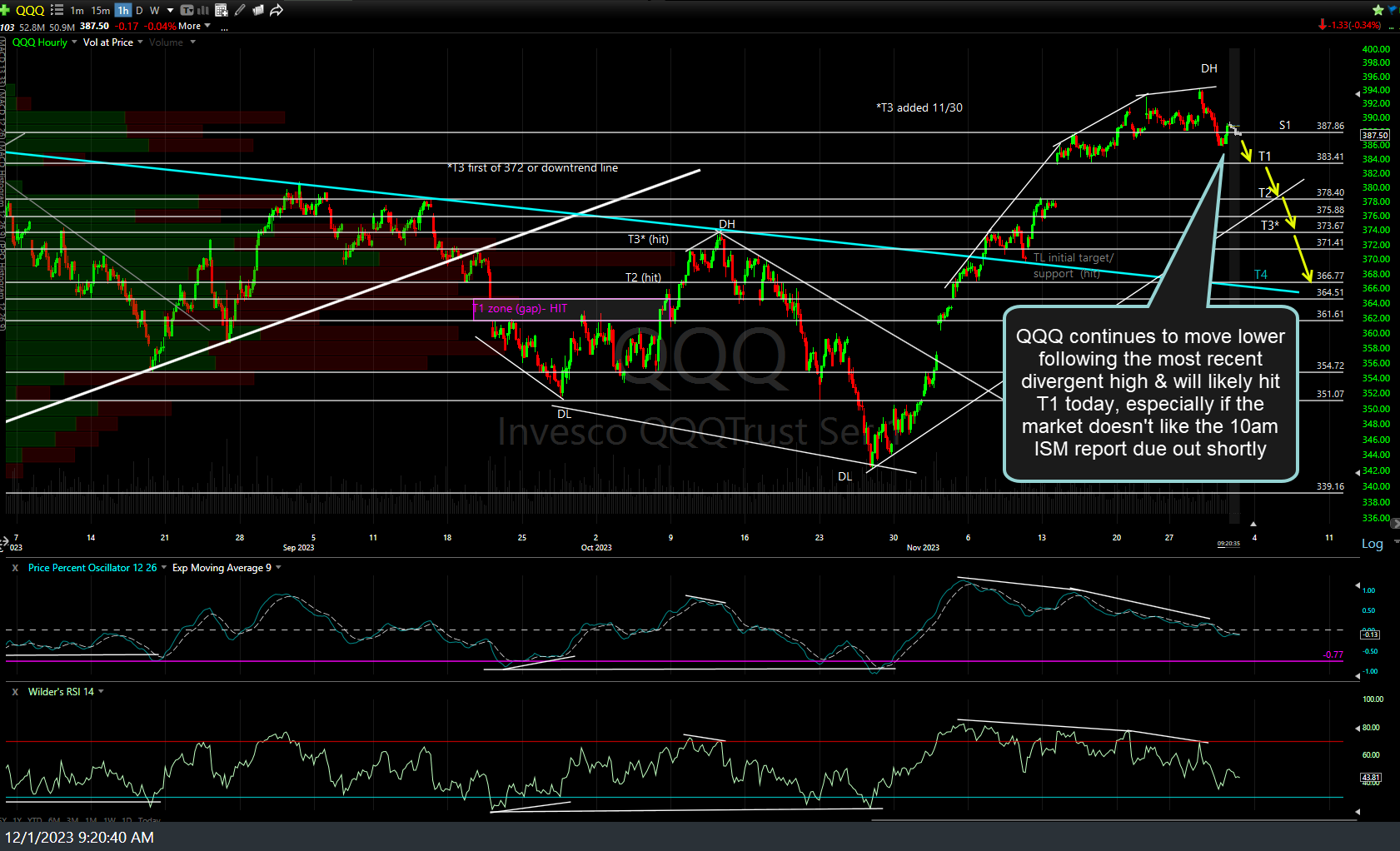

As an update to Tuesday’s “The BIG 3 Appear Ripe for a Correction” post, all 3 (stock, bonds, & EUR/USD) continue to move lower & appear to have more downside to come. The previous (Tuesday’s) and updated 60-minute charts for each are shown below.

EUR/USD broke down below the recently highlighted 60m bearish rising wedge & as expected, has taken the stock market down with it so far.

As expected, TLT has reversed off T3 (which was highlighted when hit during Wednesday’s video) & pulling the stock market down with it.

QQQ continues to move lower following the most recent divergent high & will likely hit T1 today, especially if the market doesn’t like the 10am ISM report due out shortly.