I’m finally back home, partially up & running on generator power. Still without power & internet and expect to be for some time although they recently put up temporary cell towers so I should be able to resume posting periodic updates while tethering off my cell phone although I might be limited to posting static charts (no videos) until the cellular upload/download speeds increased.

I spent quite a bit of time reviewing the charts last night for the first time since evacuating from the storm on Tuesday & spent some more time today in order to clear my mental cache, doing my best to analyze the charts from a fresh perspective in a focused attempt to avoid carrying over any biases that I might have had before Ian decided to pay us a visit.

Although post-storm distractions will force me to spend quite a bit of time away from my desk this week (clean-up, insurance claims on homeowners, auto, & boat policies, new roof needed & tarped asap, etc…) I should be able to gradually return to spending most of my day in front of the computer going back to trading & providing analysis full time, hopefully within the next week or two. I will do my best to monitor the charts & post any significant developments, potential trading opportunities, and/or changes to my outlook on any recent trade ideas asap.

Starting with the equity markets, after catching up on the charts with fresh eyes, it still appears to me that more downside in the coming days & weeks before any substantial counter-trend rallies is the most likely scenario although there are most certainly some potential developments worth closely monitoring that could change that. The yellow “preferred scenario” arrow on the second 60-minute chart below (prices reflecting Friday’s close) highlighting another objective short entry at the R1 zone approximates the one from the last update on Tuesday before the storm took me offline. The first chart below is the last 60-minute chart of QQQ that I posted on Tuesday just before evacuating.

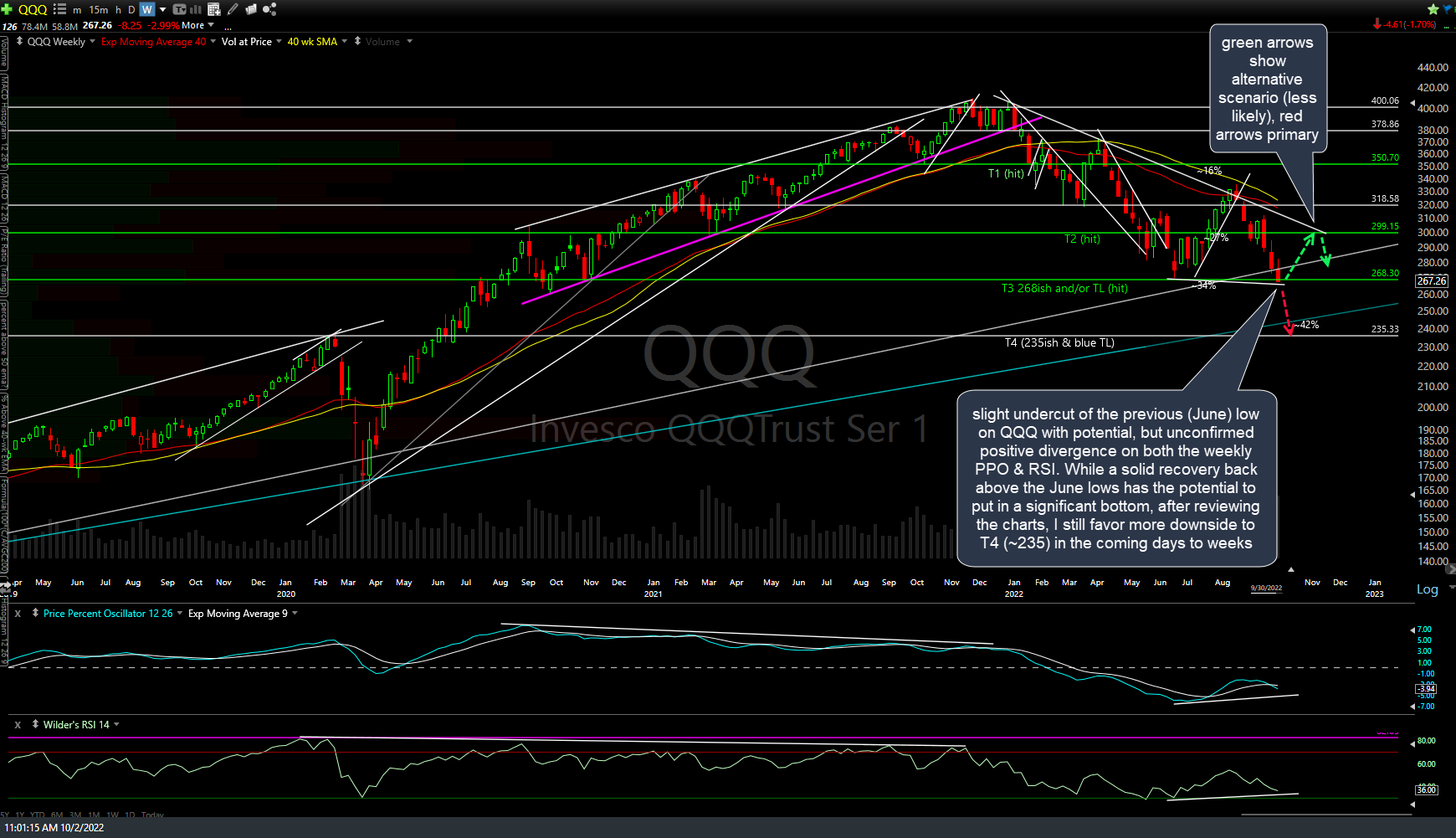

On the updated (Friday’s close) weekly chart of QQQ below, the green arrows show my alternative scenario (less likely) & red arrows are my primary scenario. The Nasdaq 100 finished the week to make a slight undercut of the previous (June) low on QQQ with potential, but unconfirmed positive divergence on both the weekly PPO & RSI. While a solid recovery back above the June lows has the potential to put in a significant bottom, after reviewing the charts, I still favor more downside to T4 (~235) in the coming days to weeks. Essentially, a solid recovery, especially if & as built upon, would help to firm up the divergences & also set the stage for a “bear trap” or false breakdown that could be the catalyst for a decent rally…unless, of course, that recovery gets sold into. Should that (a false breakdown followed by a failed/false recovery back above those lows) occur, then the next move back down below last week’s lows would likely usher in a very powerful wave of selling that should take the Q’s down to T4 in relatively short order.

GLD (gold ETF) remains below the key 158ish support/buy zone although a solid breakout above this minor (blue) trendline & especially back above the key 158ish support/resistance level would trigger a potentially powerful buy signal for gold. As with US Treasury bonds, I continue to suspect (based on both technicals & fundamentals) a return to the historical “risk-off/flight-to-safety” for Treasuries & gold, should the equity market continue lower although there are only some potentially early signs of a possible bottom in both at this time.

TLT (30-year Treasury bond ETF of /ZB 30-yr T-bond futures) offers an objective long entry/add-on at primary long-term trendline (blue) plus 102ish price support with potential positive divergences on this weekly chart.

Off-topic, here’s a video taken inside our friend’s home about 12-minutes from us where we sheltered, as his home sits on a higher elevation than ours (plus, we live on the mouth of the Caloosahatchee River). His hurricane doors & sliders acted as aquariums, holding back the storm surge, at least to some extent.

Just one of the many bizarre things I saw on the way back to my house after the flood waters receded was this barge sitting on terra firma, miles from the water (the nearest water where a barge this size could have normally floated would be Fort Myers Beach). For those of you in or near Fort Myers, I took this photo at the end of the short road at the entrance to that Fast Trax (FKA- Zoomers) go-cart track/amusement park off Summerlin Road.