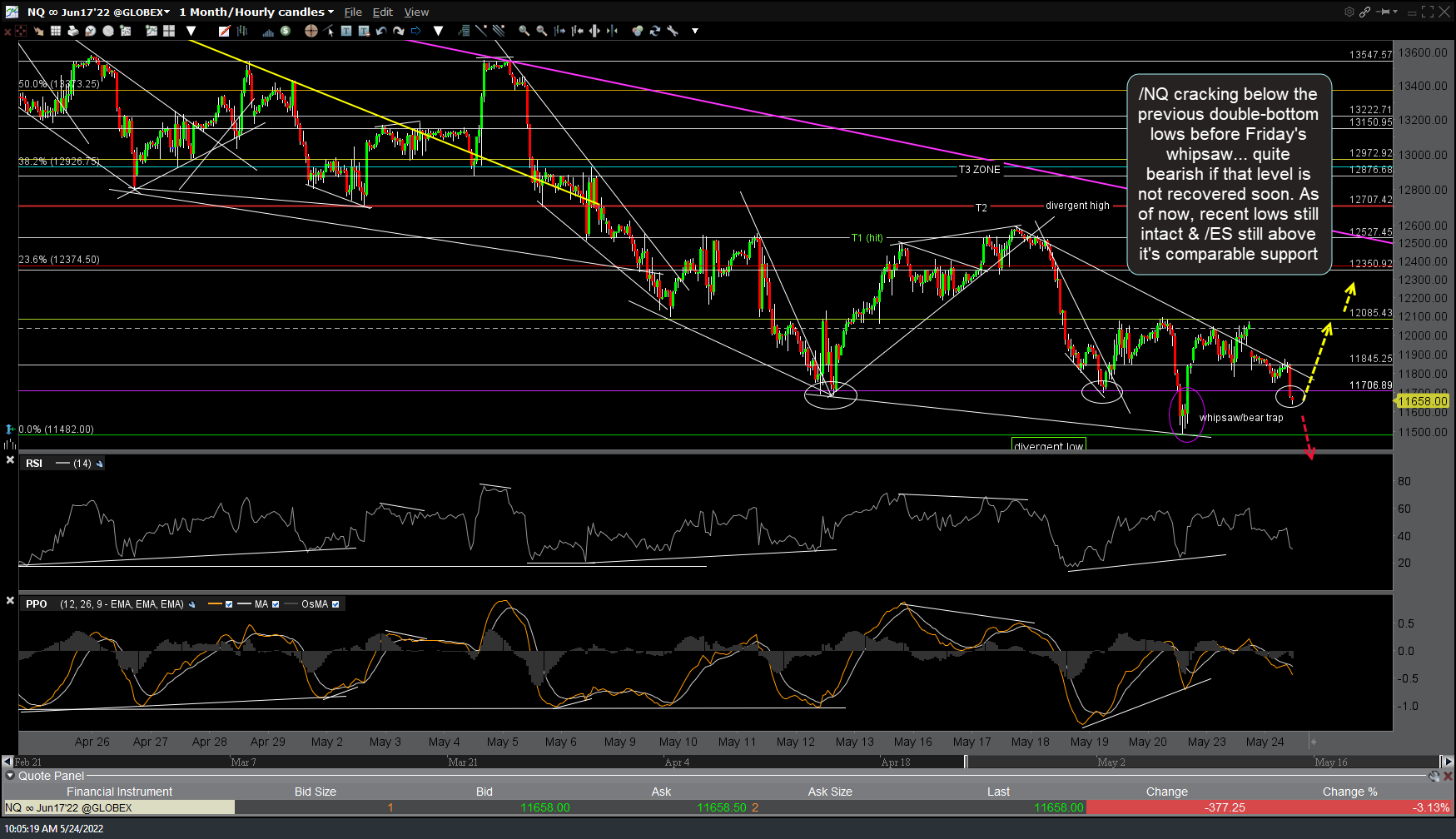

/NQ is cracking below the previous double-bottom lows before Friday’s whipsaw… quite bearish if that level is not recovered soon. As of now, the recent lows are still intact & /ES is still above its comparable support. 60-minute chart below.

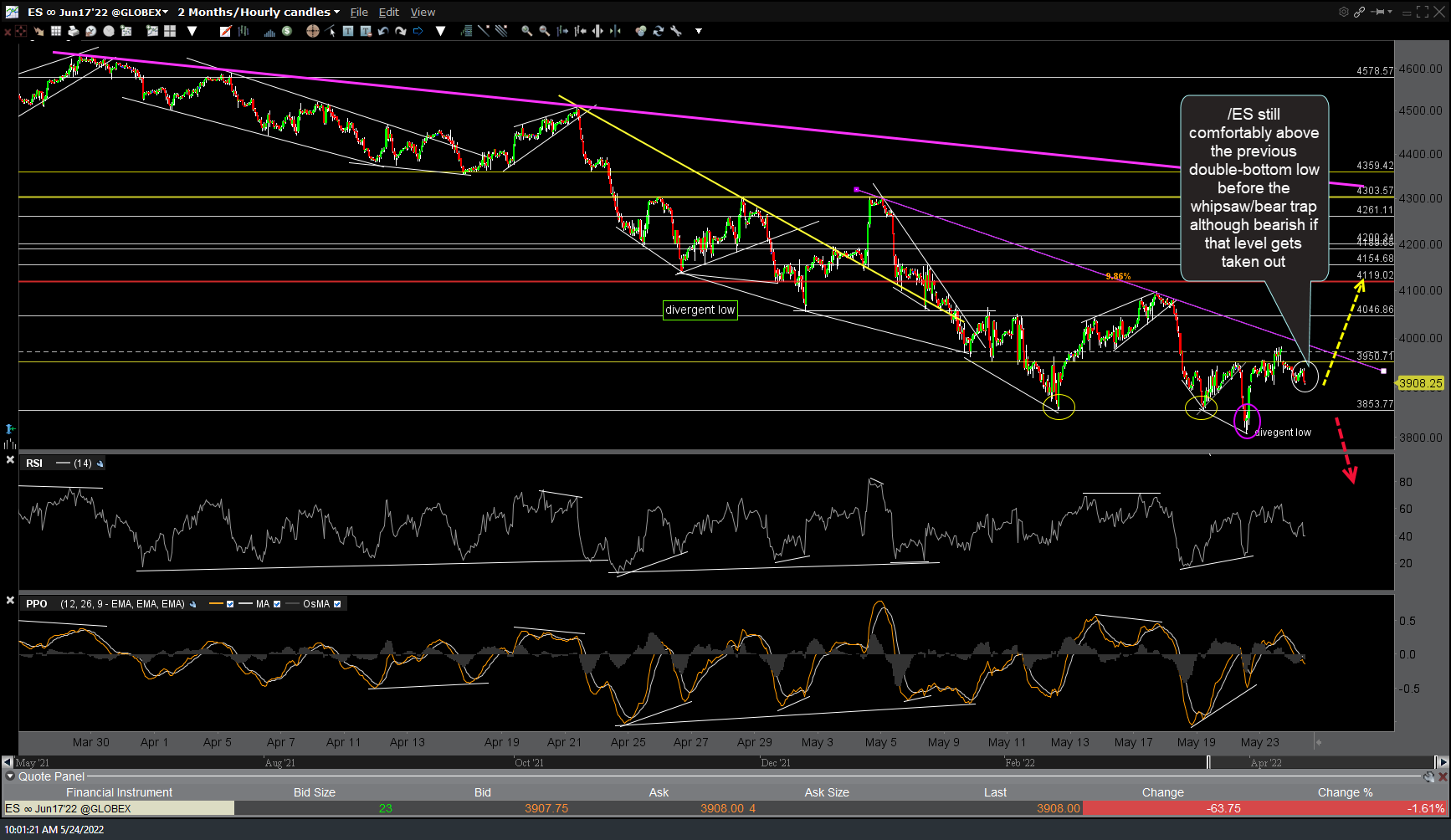

As of now, /ES is still comfortably above the previous double-bottom low before the whipsaw/bear trap although bearish if that level gets taken out, likely opening the door to the next targets (T3) on the weekly charts of QQQ & SPY. Treasuries ripping indicting institutional rotation to a risk-off trade (selling equities, buying bonds as well as gold). Stay flexible & be ready to pivot out of longs (if still long) and into shorts. Could be a final shake-out move but if the Friday’s lows are taken out on /ES & /NQ, anything other than another brief whipsaw/bear-trap, that would be hard to spin as anything but bearish.