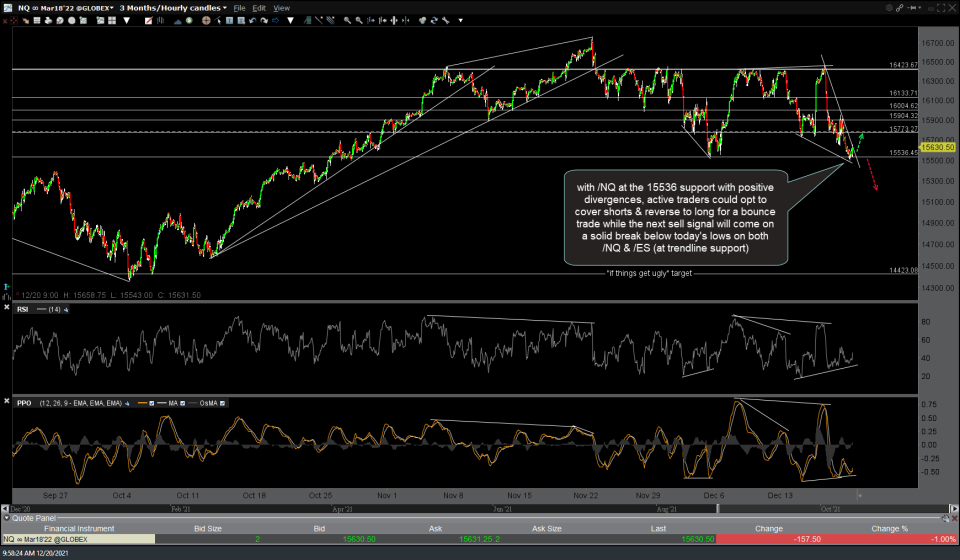

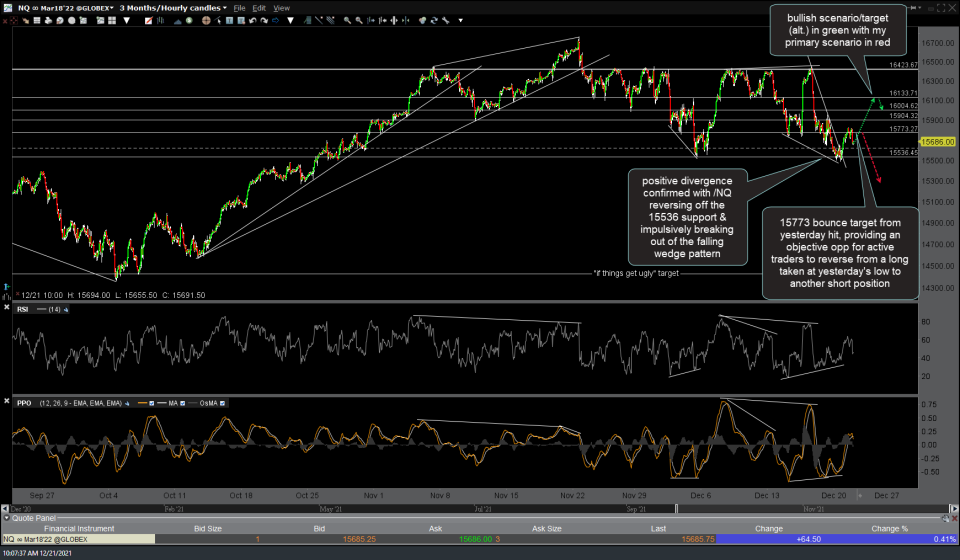

The 15773 bounce target posted yesterday morning (first chart below) has been hit, providing an objective opp for active traders to reverse from a long taken at yesterday’s low to another short position for the next leg down, which is my preferred scenario. However, with positive divergence now clearly confirmed coupled with /NQ reversing off the 15536 support & impulsively breaking out of the falling wedge pattern, one certainly can’t rule out more upside in the comings days. As such, those that went long at support yesterday holding out for additional upside should consider raising stops to protect profits at this time. Previous & updated 60-minute charts below.

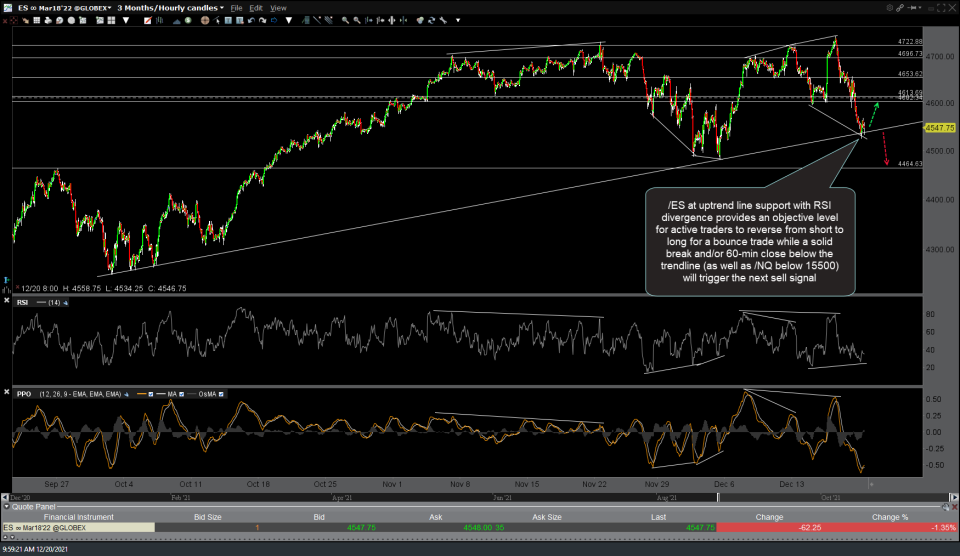

Likewise, the /ES minimum bounce target/first resistance level has also been hit. The updated (second) 60-minute chart below list my primary (bearish) scenario in red & bullish (alternative) scenario/target in green. Solid breaks below yesterday’s lows (key support) on both /ES & /NQ (as well as SPY & QQQ) will trigger an objective short entry or add-on to existing short positions.