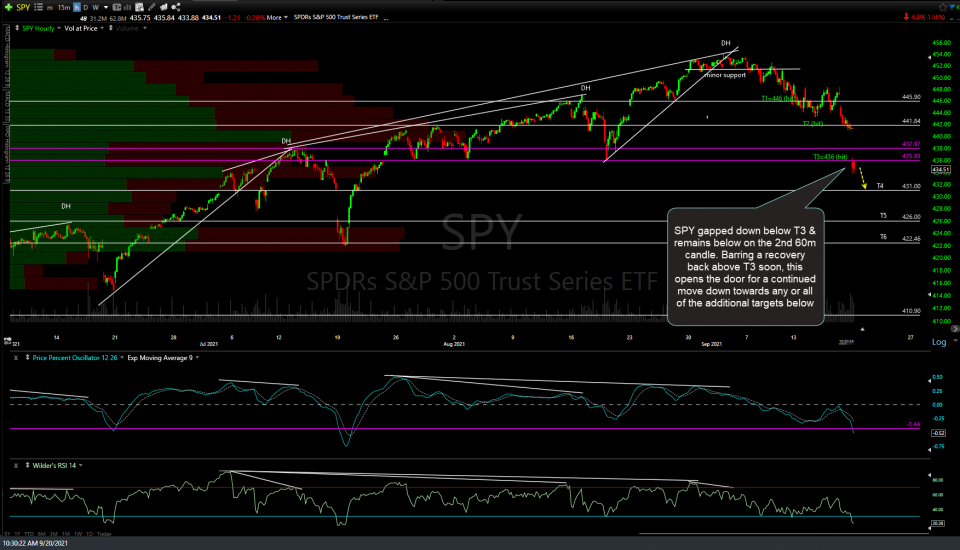

SPY gapped down below T3 & remains below on the 2nd 60-minute candle. Barring a recovery back above T3 soon, this opens the door for a continued move down towards any or all of the additional targets below. 60-minute chart below.

Likewise, QQQ gapped down below T1 & remains below on the 2nd 60-minute candle. Barring a recovery back above T1 soon, this opens the door for a continued move down towards T2 (and quite likely beyond). With that being said, both SPY & QQQ are quite oversold on the near-term time frames & as such, the odds for a snapback rally start to increase with each tick lower. Should both SPY & QQQ manage to solidly regain those overhead targets/former support, now resistance levels, a backfill of today’s gap would provide another objective shorting opp. Translation: If short, consider staying short if holding out for additional gain, with the appropriate stops in place. Otherwise, this isn’t the most objective time to open a new short position as there were numerous objective shorting opps over the past couple of weeks but not so much at this time IMO as