/E7 (Euro futures) has taken out today’s previous low, triggering the next sell signal as per today’s video. Should this breakdown stick with the Euro continuing to fall in the coming days/weeks, that will likely put pressure on the Dollar-sensitive assets such as the stock market, precious metals, crude oil, etc… 60-minute chart below.

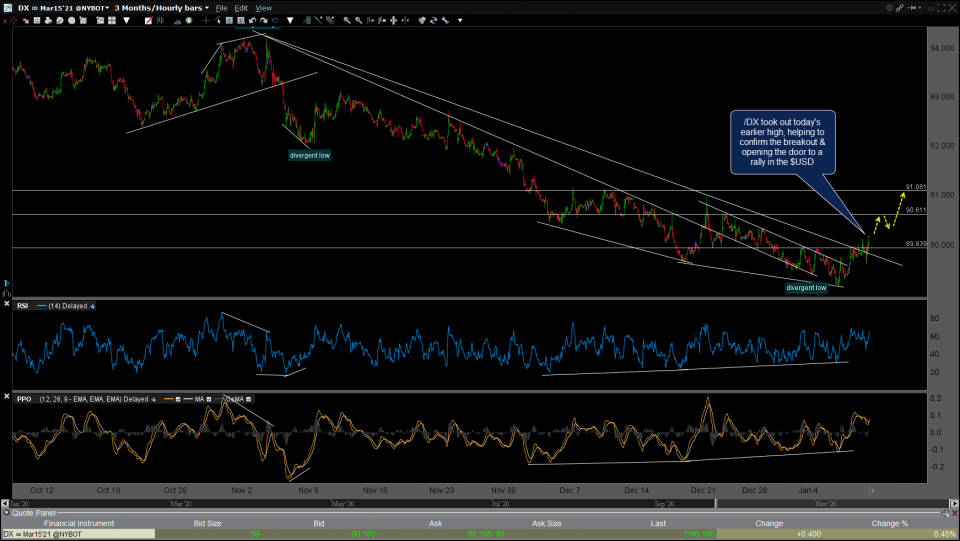

Likewise, /DX (US Dollar Index futures) also took out today’s earlier high, helping to confirm the breakout & opening the door to a rally in the Greenback. 60-minute chart below.

So far, gold has been one of the first victims of the breakdown in the Euro/breakout in the $USD with gold breaking down below a comparable trendline (to that of /E7) followed by impulsive selling. With /GC already falling to just above the 1822-1825 support zone & near-term oversold at this time, the odds for a reaction soon is likely. 60-minute chart below.

Bottom line: As of now, the breakouts in the Dollar & Euro appear legit & while the potential for whipsaw signals (false breakouts) are always a possibility, I’m taking these breakouts at face value until & unless they clearly fail with a solid move back above/below those trendlines. Although the selling on gold since the breakdown below the uptrend line has been very impulsive, my preference would be to short the other precious & industrial metals that are more sensitive to the economy such as platinum, palladium, & copper as gold has the potential to catch a flight-to-safety bid, should the breakout in the Dollar stick & ultimately put the brakes on the stock market rally.