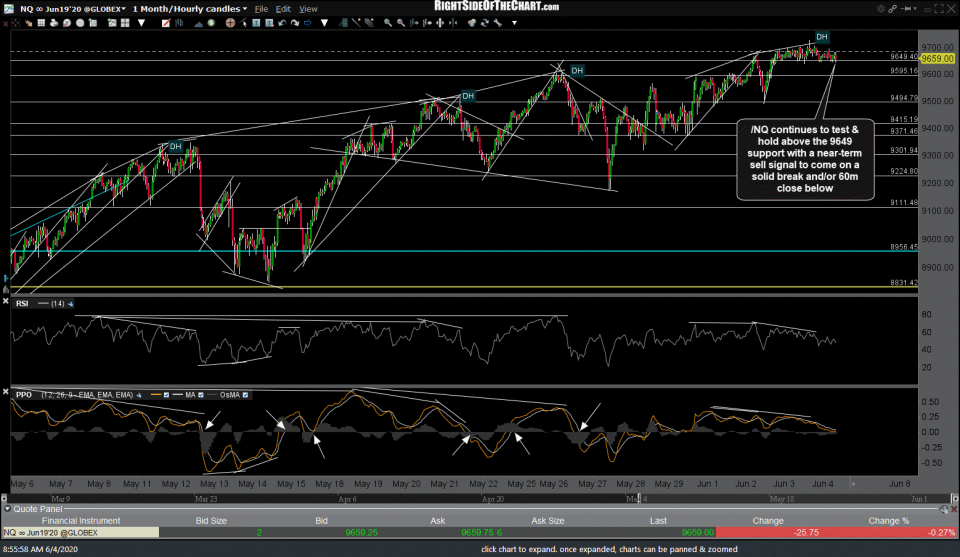

/NQ (Nasdaq 100 futures) continues to test & hold above the 9649 support with a near-term sell signal to come on a solid break and/or 60-minute candlestick close below with a minimum target of 9495, assuming both /NQ & /ES break down.

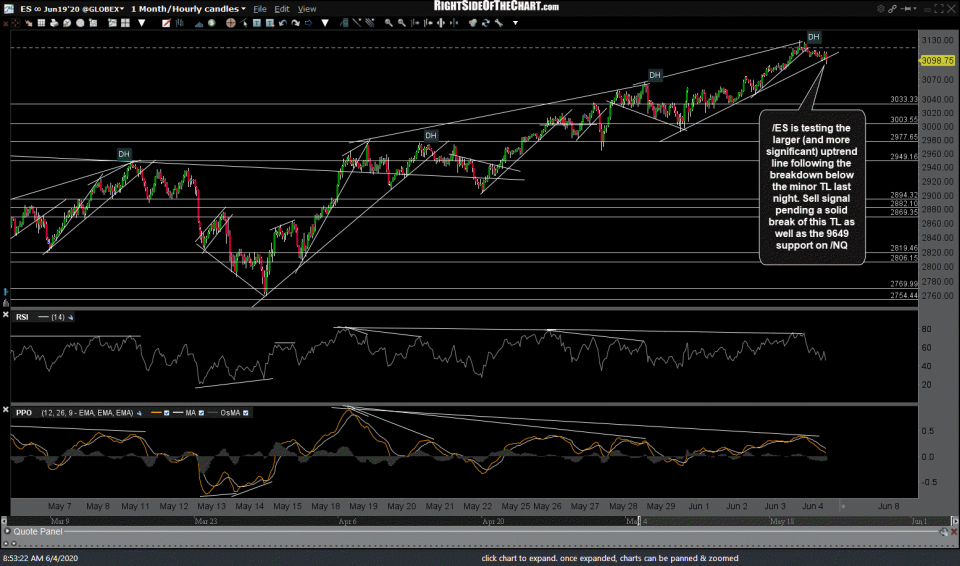

/ES (S&P 500) is testing the larger (and more significant) uptrend line following the breakdown below the minor trendline last night, which was the catalyst for the drop back down to this next support. The broad market remains in an uptrend for now with a sell signal pending a solid break of this trendline as well as the 9649 support on /NQ. Should those sell signals trigger soon, my minimum pullback target for /ES would be 3033.

/RTY (Russell 2000 Small-cap futures) made a breakdown & backtest of the minor uptrend line. With the large-cap futures currently testing support & still in an uptrend, any downside in the small-caps is likely to be limited until & unless the large-caps breakdown & start moving lower as well.

Also, keep in mind that the small-caps have once again rallied into very significant resistance on the more significant daily time frame.