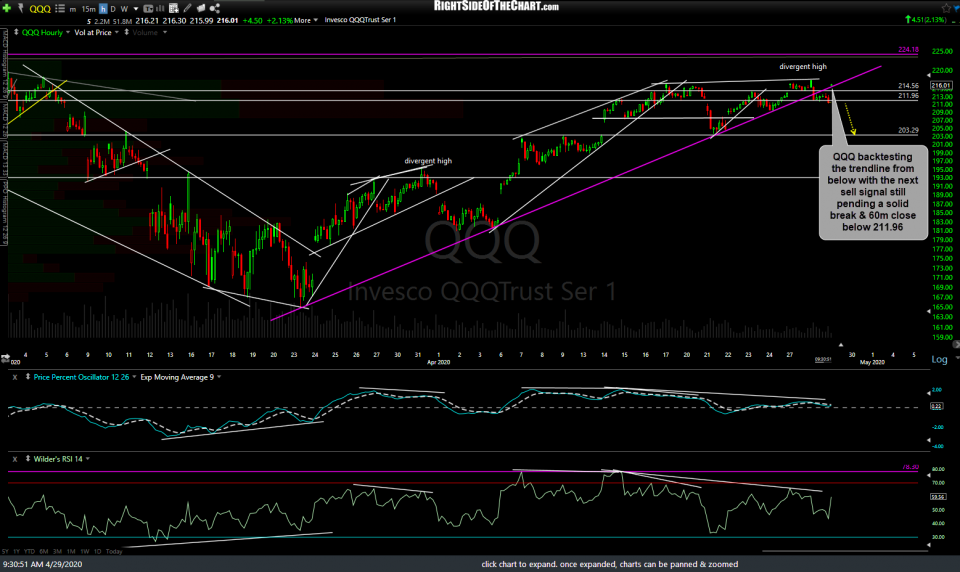

QQQ is backtesting the trendline from below with the next sell signal still pending a solid break & 60-minute close below 211.96. A failure to close solidly back above the trendline followed by an impulsive rejection off the trendline backtest would also be bearish while a solid recovery of the trendline certainly wouldn’t help the bearish case although the negative divergences would still be in place on any marginal new high.

The 8690 support level was successfully defended following yesterday’s brief whipsaw as /NQ remains within the megaphone pattern.

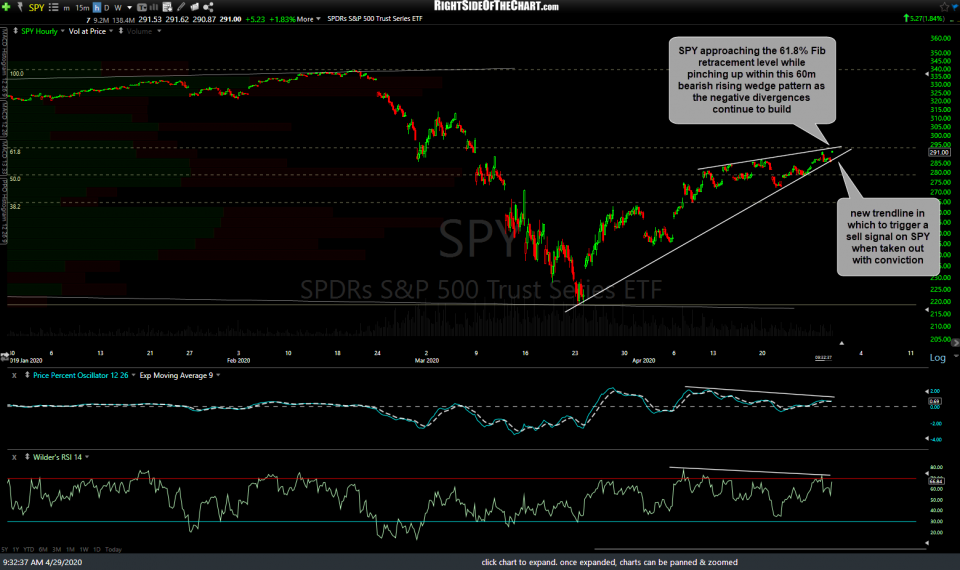

SPY is approaching the 61.8% Fibonacci retracement level while pinching up within this 60-minute bearish rising wedge pattern as the negative divergences continue to build. We now have a new trendline in which to trigger a sell signal on SPY if & when taken out with conviction.

/ES is backtesting the 60-minute minor uptrend line from below as the negative divergences are extended.

Bottom line: The major stock indexes remain in an uptrend but in a clearly bearish technical posture as the negative divergences continue to build & equity prices continue what I believe is nothing short of the starkest divergence between stock valuations & fundamentals since the dot.com bubble back in the late ’90s. With 4 of the 5 market-leading, FAAMG stocks still to report earnings after the market close today & tomorrow coupled with a very heavy economic calendar this week, the odds for whipsaw signals (false breakouts & breakdowns) as well as increased volatility will remain high through Friday & possibly into next week.