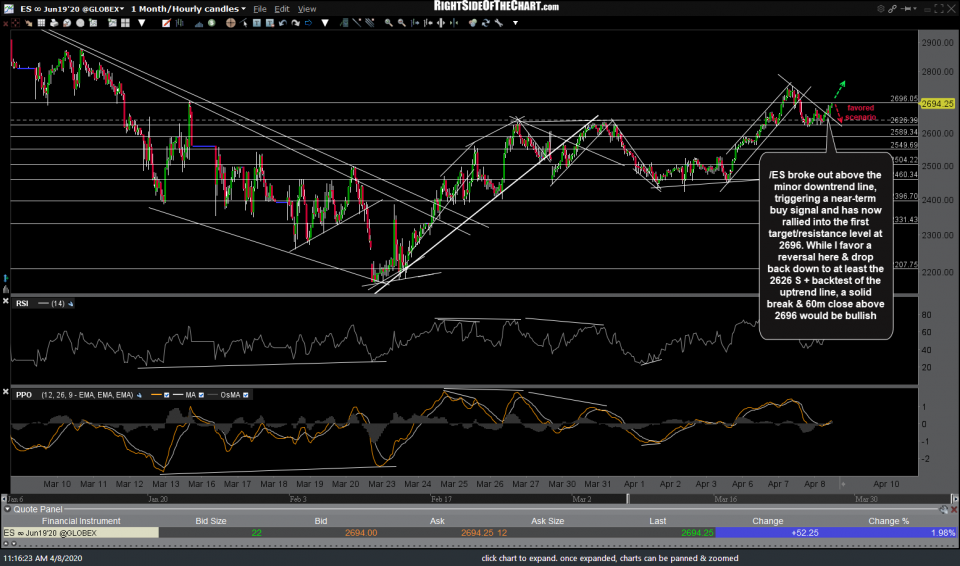

/ES broke out above the minor downtrend line, triggering a near-term buy signal and has now rallied into the first target/resistance level at 2696. While I favor a reversal here & drop back down to at least the 2626 support + backtest of the uptrend line, a solid break & 60-minute close above 2696 would be near-term bullish. Previous & updated 60-minute charts below.

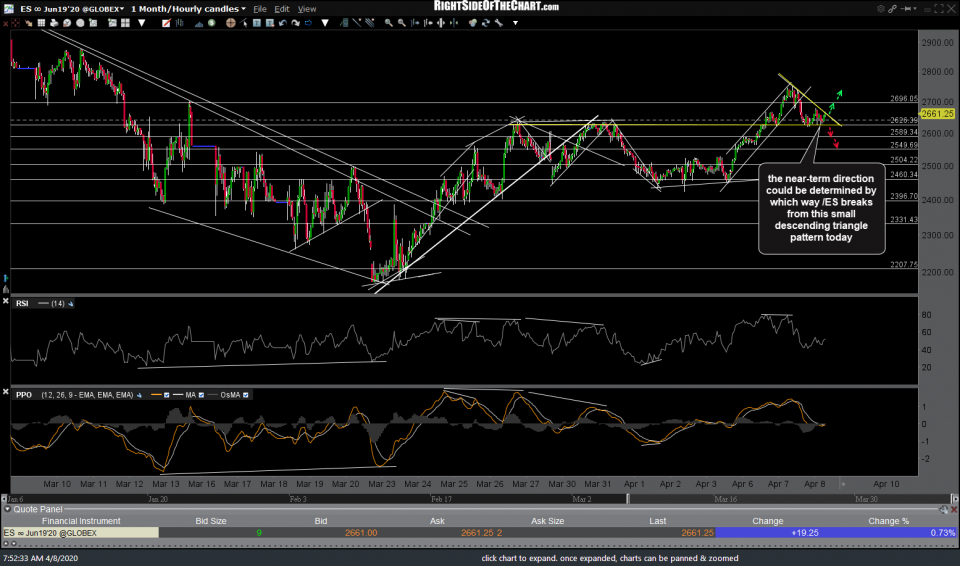

- ES 60m April 8th

- ES 60m 2 April 8th

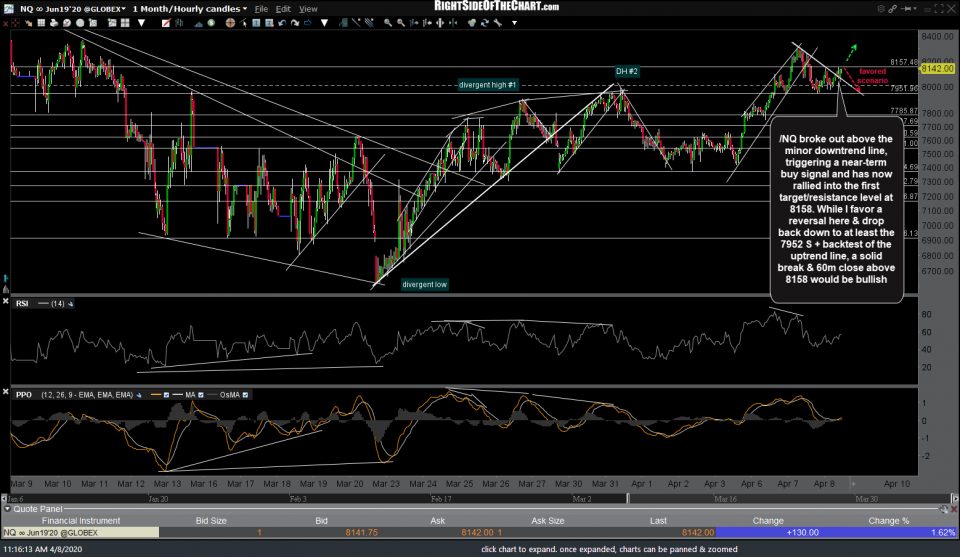

/NQ also broke out above its comparable minor downtrend line posted earlier today, triggering a near-term buy signal and has now rallied into the first target/resistance level at 8158. While I favor a reversal here & drop back down to at least the 7952 support + backtest of the uptrend line, a solid break & 60-minute close above 8158 would be near-term bullish although the major stock indices, as well as many key sectors & market-leading stocks, still have significant resistance overhead. As such, intraday swings are not as significant as are the daily & weekly candlestick closes, especially as this market is prone to large intraday reversals.

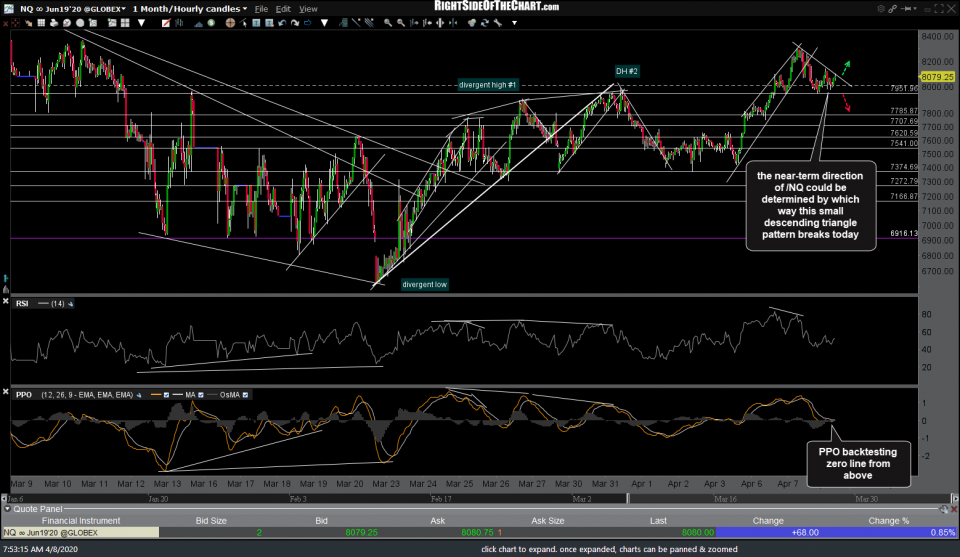

- NQ 60m April 8th

- NQ 60m 2 April 8th