Powell’s Folly, which is the term I’ve given to the ill-timed 50 bp emergency rate cut on Tuesday, which has triggered the opposite of the intended effect on the stock market as I had suspected it would, has now taken the major stock index futures to their last support levels before the key reaction lows from last Friday.

/NQ (Nasdaq 100 futures) has fallen to what is pretty much the last support level before last Friday’s low so while down 3.26% right now, if we’re going bounce this morning before making a run at last week’s low, this is where it will likely start from. Also, note that the small bear flag that formed last night has hit its measured target. Essentially, the near & intermediate-term bearish case (another big leg down below last week’s lows) has only firmed up with /NQ impulsively taking out the 8506 support last night although a solid recovery back above 8506 would obscure that (primary) bearish scenario.

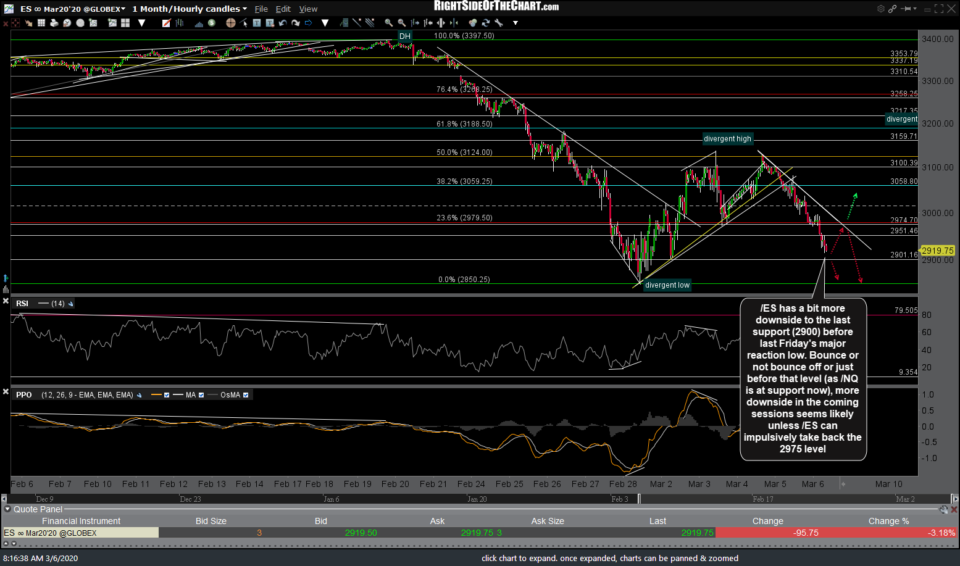

/ES (S&P 500 futures) has a bit more downside to the last support (2900) before last Friday’s major reaction low. Bounce or no bounce off or just before that level (as /NQ is at support now), more downside in the coming sessions seems likely unless /ES can impulsively take back the 2975 level.

FWIW, I am leaning towards at least a minor bounce here & have reversed my /NQ short position (in my active trading account, swing & trend trading accounts still short) to a long & will flip back to short again if these supports don’t hold. My minimum bounce target for /NQ is 8428 although a solid break above 8430 could trigger a larger bounce so I will probably just trail up stops but may very well be back short again by the time this is published. That is active trader stuff while typical swing traders that are short the Q’s (QQQ, PSQ, QID, SQQQ or even /NQ as a swing trade) might consider riding out any counter-trend bounces with the appropriate stops in place.

I still think there’s a decent chance that the selling will start to accelerate if/when we start to approach Friday’s lows but as of now, we are at (/NQ) or just above (/ES) minor support levels that may or may not trigger a snapback rally first. Best of luck on your trades!

Note: It was brought to my attention that the video posted after the market close yesterday was the same video posted shortly before the close. The correct video has been replaced in that post although as the commentary in that post stated, it was essentially a recap of the same technical levels & developments covered in the previous posts from yesterday.