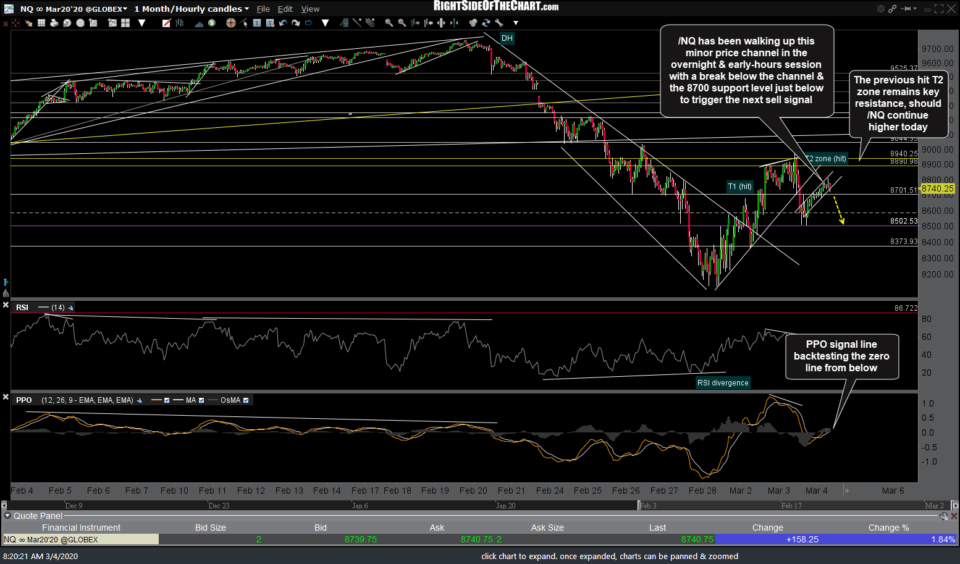

/NQ (Nasdaq 100 E-mini futures) has been walking up this minor price channel in the overnight & early-hours session with a break below the channel & the 8700 support level just below to trigger the next sell signal. The previous hit T2 zone remains key resistance, should /NQ continue higher today.

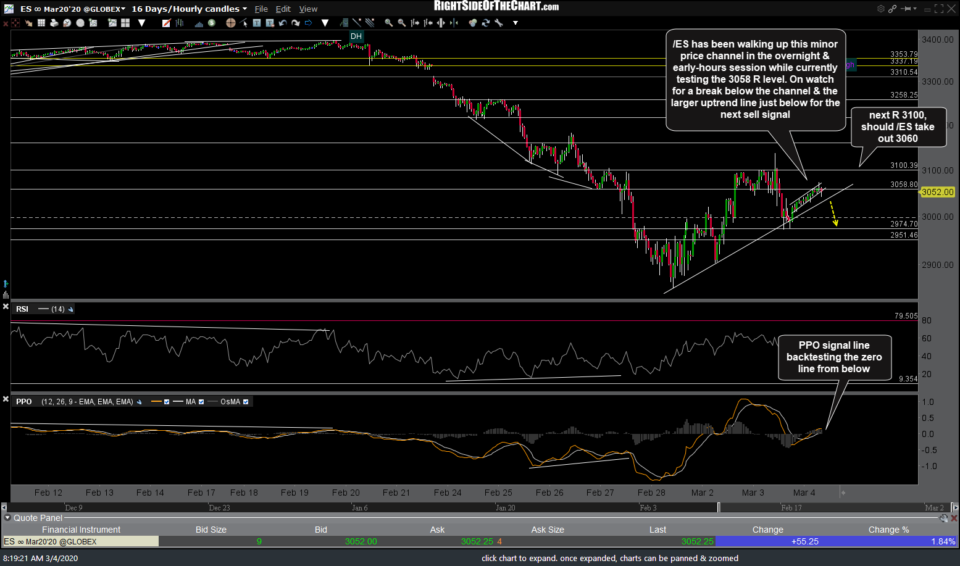

/ES (S&P 500 futures) has been walking up this minor price channel in the overnight & early-hours session while currently testing the 3058 R level. On watch for a break below the channel & the larger uptrend line just below for the next sell signal. Should /ES take out 3060 with conviction, the next resistance level comes in around 3100.

Also, watch the PPO signal line on both /ES & /NQ, which is currently backtesting the zero line from below. The near-term trend is bullish when the PPO signal line (9-ema) is above the zero line, bearish when below & once the signal line crosses above or below, the zero line often acts as support or resistance on backtests.

I expect both the Fed and the powers-that-be in Washington, particularly POTUS, to come at the market with everything they have today after the market’s negative reaction to the Fed firing off the bulk of their remaining dry powder with the emergency 50 bp rate cut yesterday. I’ll leave the suggested stop on the QQQ short trade as-is for now although as with all parameters (targets, stops, position size adjustments, etc..) those are just suggestions & as the stop was set relatively tight in relation to the price target, one could allow for a little more room or use a stop based on a daily close above 218.50 vs. any intraday pop above.

Today has the potential to be a pivotal day so my preference is to watch how the market trades at least for the first couple of hours in the regular session before making any significant changes to my positions, including opening or adding to any trades.