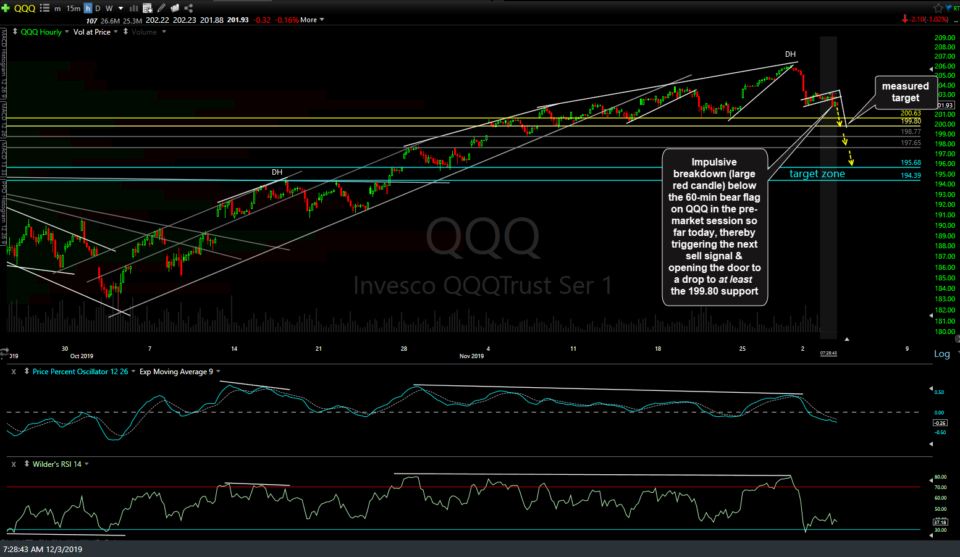

QQQ hit the measured target of the bear flag continuation pattern that was highlighted yesterday in the first chart below, so far reversing essentially right off the measured target which is the distance of the flagpole added to the highest point of the flag, along with all the other idea components one should look when trading a bear flag continuation pattern: Impulsive move down (flagpole) followed by a slightly upwards sloping area of consolidation on decreasing volume then followed by a break below the flag with another impulsive wave of selling similar to the drop leading down to the formation of the flag. Previous & updated 60-minute charts below.

- QQQ 60m Dec 2nd.png

- QQQ 60m Dec 3rd.png

- QQQ 60m 2 Dec 3rd

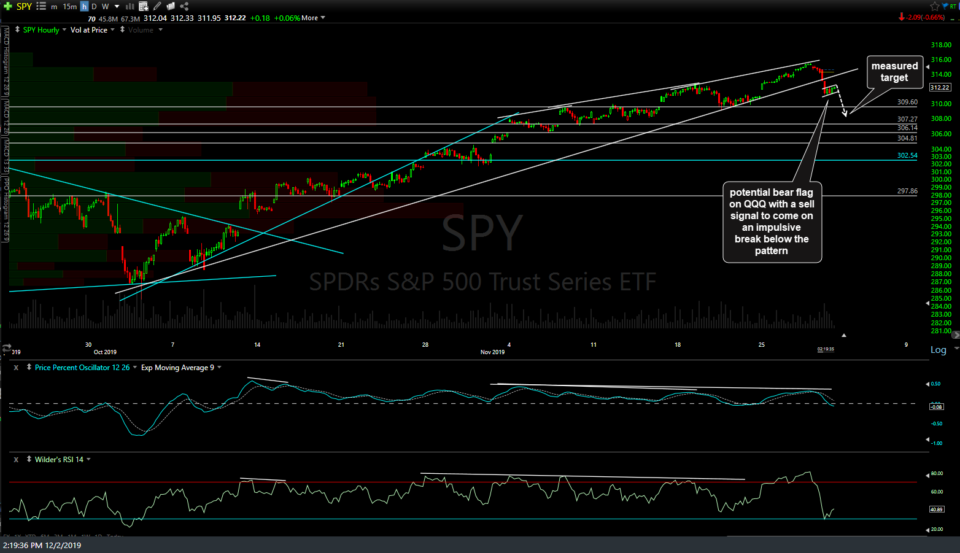

With the impulsive selling following the gap down today, QQQ made a slight momentum-fueled overshoot of the key 199.80 support level with an immediate snap back above that level & has been consolidation around it since (i.e.- a “reaction” off the initial tag of the 8200 level, as expected). I’m still leaning towards at least a slightly larger bounce off this level to as high as the 202ish level on QQQ which is both price resistance as well as the bottom of the flag but keep in mind that is what I refer to as a “micro-call” which may or may not pan out. While QQQ is not an official trade, I just wanted to share my thoughts on both the very near-term direction as well as the intermediate-term direction in which I still favor more downside to the 196-194ish target zone. On a related note, SPY slightly overshot the bear flag measured target to hit & reverse off my 307.27 target so far. Previous & updated 60-minute charts below.

- SPY 60m Dec 2nd

- SPY 60m Dec 3rd

- bear flag pattern