Let me just begin by reiterating that today is likely to see most major asset classes (e.g.- stocks, bonds, gold, etc..) grind around somewhat aimlessly as the market awaits the FOMC rate decision & subsequent comments at 2 pm today (followed by Powell’s press conference at 2:30 pm). Additionally, market participants will also be eagerly awaiting earnings from both AAPL & FB which collectively, account for 15% of the returns in the Nasdaq 100 index (QQQ). As such, I don’t expect to see, or at least take, many day trading opps today. Additionally, breakouts that occur on potential swing trading setups will also run an increased rate of failure (i.e.- whipsaw signals) today. Therefore, my preference is to wait until at least tomorrow before doing much in the way of positioning.

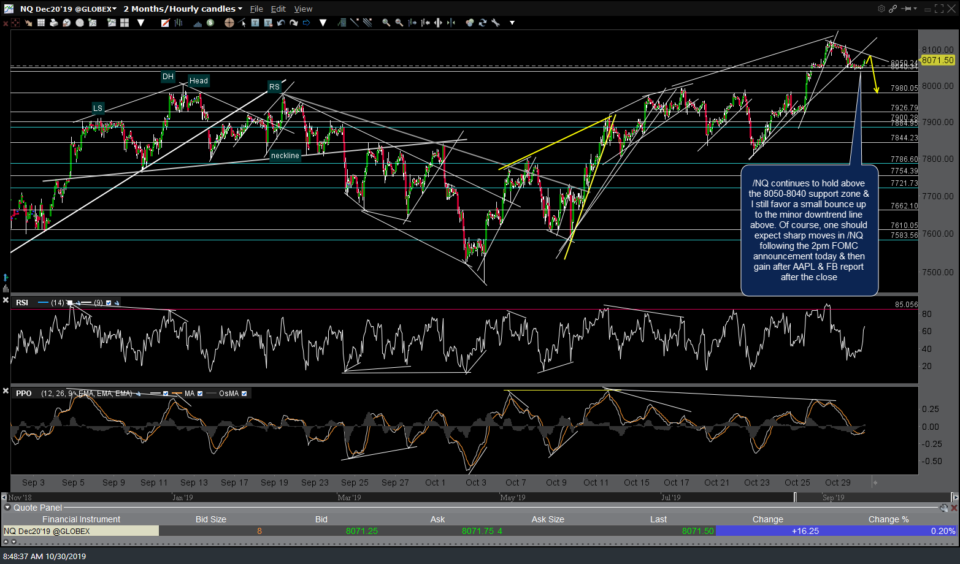

/NQ (Nasdaq 100 futures) continues to hold above the 8050-8040 support zone & I still favor a small bounce up to the minor downtrend line above. Of course, one should expect sharp moves in /NQ following the 2pm FOMC announcement today & then gain after AAPL & FB report after the close.

With quite a few whipsaw signals recently, the bigger picture on /GC gold is that it remains in the large, sloppy consolidation range since early August & still holding onto the 1492 support as it approaches the apex of the triangle pattern.

/ZB 30-yr T-bond looks primed for a rally if it can hold above the 158ish support level following today’s FOMC announcement.

The charts on MJ & the marijuana stocks still appear constructive for a near-term rally although the price action, namely the lack of follow-through to the recent rallies off the divergence lows & breakouts on the 60-minute & daily charts over the last couple days has been less than ideal. Sitting tight on those positions now with stops in place & will only add exposure to the marijuana stocks if they start to perk back up soon & ideally, take out the recent highs.