This is more of an active trading update as until the major stock indexes give us some more clarity on the daily & weekly charts, we just don’t have a market that is very conducive to swing trading. The stock index futures took out those aforementioned key resistance levels of /NQ 7722 + the intersecting downtrend line as well as the minor downtrend on /ES which was followed by the typical impulsive buying that usually follows the breakout of such significant resistance levels. The green & red arrows on the updated (2nd) charts of /ES & /NQ below show the levels that, if taken out, could likely determine the direction of the 5-10% in the stock market.

- ES 60m Oct 10th

- ES 60m 2 Oct 10th

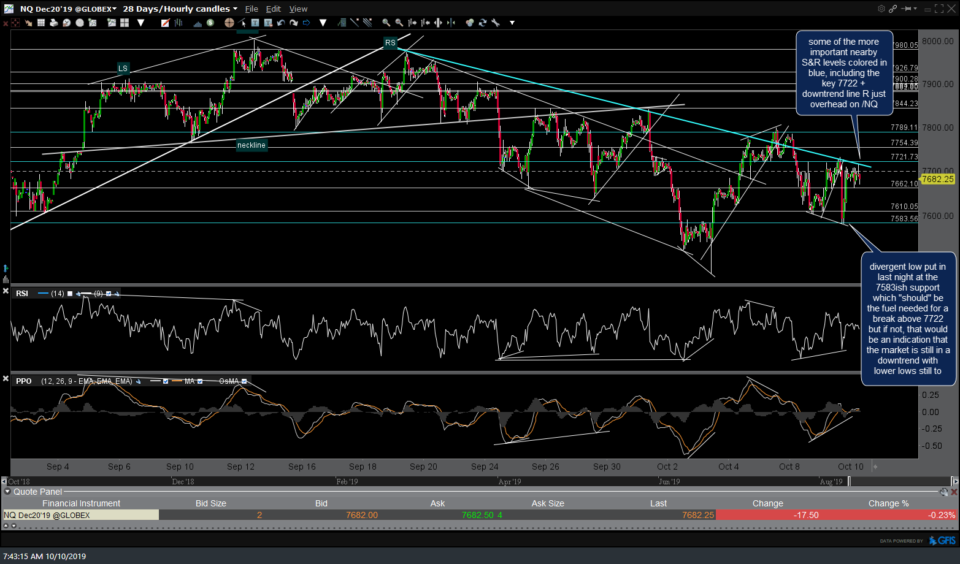

- NQ 60m Oct 10th

- NQ 60m 2 Oct 10th

The rips following those breakouts have taken the index futures as well as both SPY & QQQ right up to the next resistance/target levels followed by the typical reactions at those levels so far. As impulsive as these breakouts are, the indexes still have some fairly significant overhead resistance levels to content with before opening the door for a run at & above the previous all-time highs. SPY has stopped cold at the top of not one, but two recent gaps (Tuesday’s & Wednesday’s of last week) with the downtrend line off the Sept 19th high as well as the key 294 “top of Aug trading range’ resistance just above.

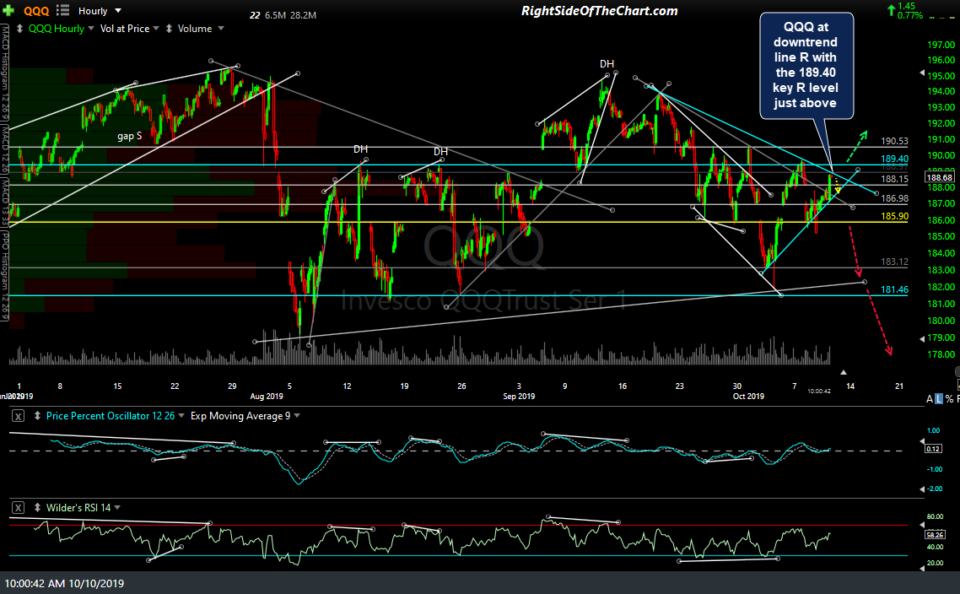

The yellow arrows on the 60-minute charts charts of QQQ & SPY below indicate the odds are decent for a minor pullback off these resistance levels back to the minor uptrend lines as QQQ has rallied into the downtrend line off the Sept 19th high with the key 189.40 “top of Aug trading range” resistance just above as well with SPY also running into that dual-gap resistance with the 294 level just overhead.

- QQQ 60m Oct 10th

- SPY 60m Oct 10th

As predicted this morning, if the indexes broke those overhead resistance levels, which they clearly did, /GC gold would trigger a sell signal on a breakdown below this triangle pattern, which it clearly did as well. However, just as the equity indices have yet to take out those final key resistance level that would likely open the door to a larger rally, /GC is still trading above the key 1492 support level for now (but also likely to take that out if the indexes take out those resistance levels).

- GC 60m Oct 10th

- GC 60m 2 Oct 10th