Both SPY & /ES (S&P 500 futures) have fallen to support on the 60-minute time frames while QQQ has undercut the 166.00 support. The bullish falling wedge patterns highlighted on /ES & /NQ earlier today are still intact, with prices falling to the bottom of the wedge on the post-opening sell-off so far today.

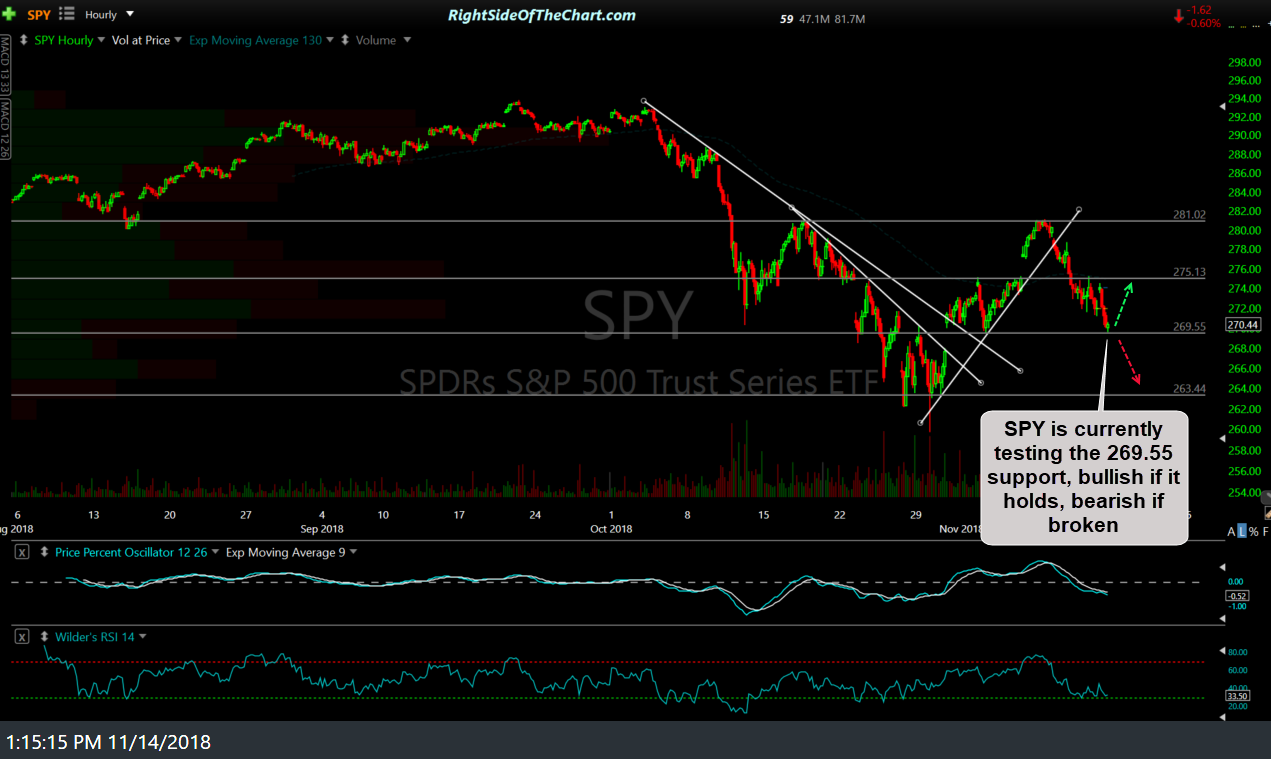

- SPY 60-min Nov 14th

- QQQ 60-min Nov 14th

These divergences & wedges may or may not play out or could play out after some more downside but considering that the near-term & intermediate-term trend is bearish, as there is a decent chance that SPY will go on to break below this support & the divergences that are in place on the futures could be burned through without playing out for a trend reversal/rally.

- ES 60-min 2 Nov 14th

- NQ 60-min 2 Nov 14th

Bottom line: A solid & impulsive break down below 269.55 on SPY, as well as a failure of QQQ to recover the 166 former support, now resistance level, could usher in another wave of selling that takes the market down to & possibly below the October 29th lows while a successful defense of these levels & especially a break above the 60-minute downtrend lines could spark a rally up to some of the nearby overhead resistance levels.