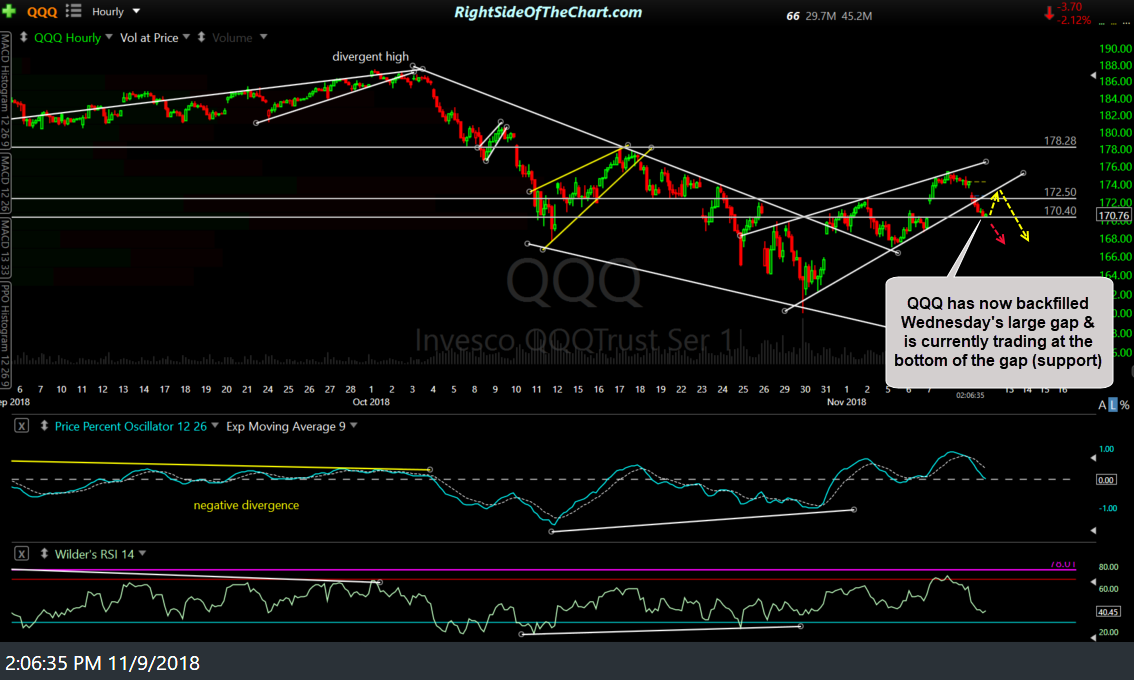

/NQ (Nasdaq 100 futures contract) has now hit my minimum near-term target where the odds of a reaction are decent (click or hover on the word ‘reaction’ for the definition). Likewise, QQQ has now made a full backfill of Wednesday technically significant gap with QQQ trading at the bottom of that gap (support) now. While the odds for at least a minor reaction on (a consolidation) or above (bounce) these support levels are decent, a failure to hold this support would be quite bearish & could trigger more impulsive selling. Previous & updated 60-minute charts of /NQ followed by the 60-minute chart of QQQ:

- NQ 60-min 2 Nov 9th

- QQQ 60-min Nov 9th

/ES is still shy of the 2750ish target although /NQ has hit its first target which could trigger a bounce in /ES along with it. If /NQ & /ES fails to bounce here, a continued move down to the 2750.50ish target/support would be likely & backfill of the Wednesday’s gap on SPY (around 275) would be likely.

- ES 60-min 2 Nov 9th

- SPY 60-min Nov 9th

While I understand that presenting two opposing scenarios might seem confusing, let me clarify that my intermediate-term outlook (days to weeks) remains bearish with more downside from here. However, in the very near-term, the chance of a bounce off this tag of support on /NQ & QQQ is decent but I think it will be quite bearish & it certainly would not surprise me to see the market continue lower from here with little, if any reaction off this support level.

The following question was put to me earlier today in the trading room which might provide some additional clarity:

Q: would u be covering any shorts at bottom of gap? QQQ / SPY thanks

A: Depends. For my swing shorts, no. For any active swing or day trade short positions that I might have at that time, yes, assuming that the charts indicate a bounce is likely.

One more option would be to set a relatively tight stop on QQQ if/when the gap if backfilled, allowing for a relatively small bounce as that would help to protect profits, yet still allow for the potential for much larger gains, should the market continue down from there.