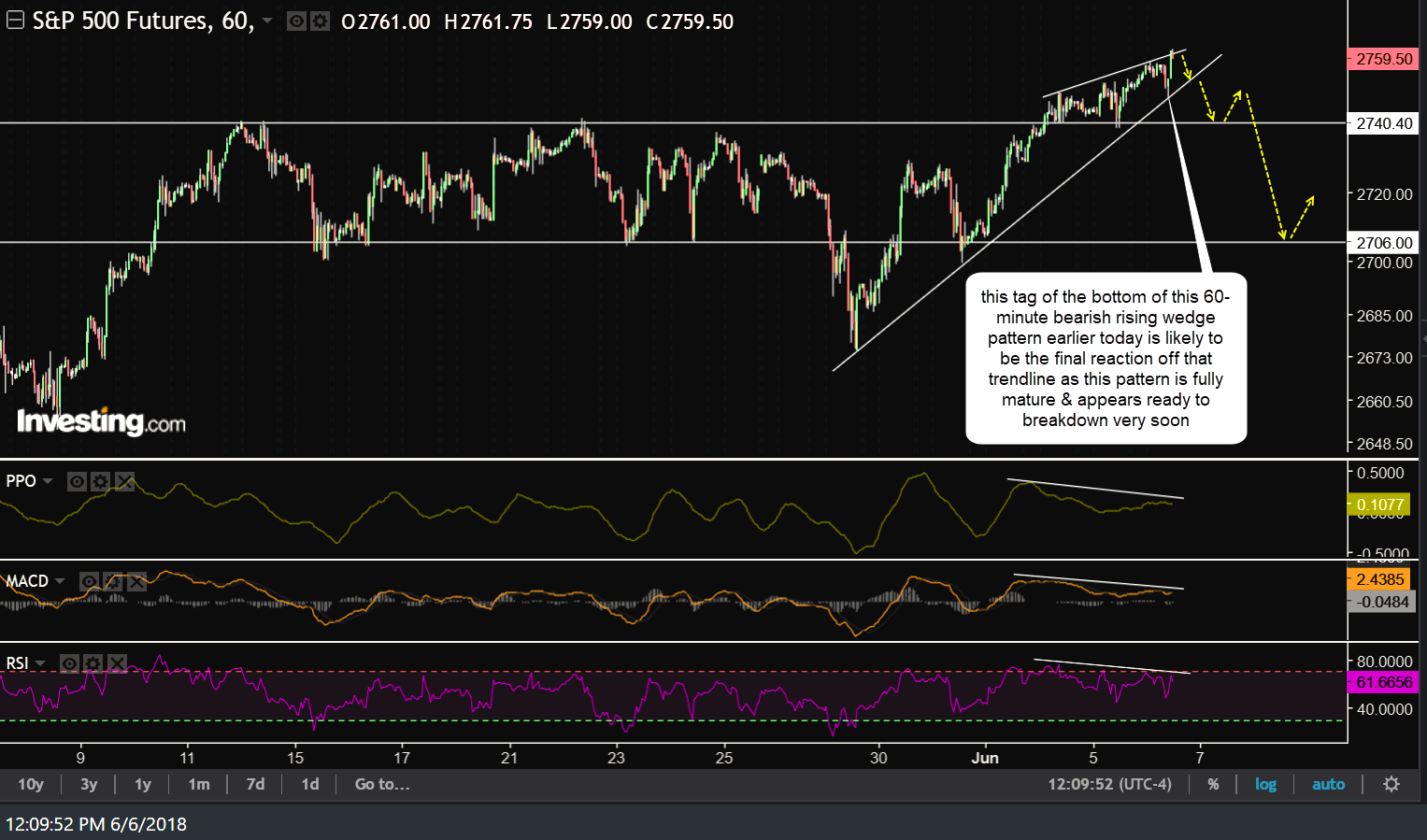

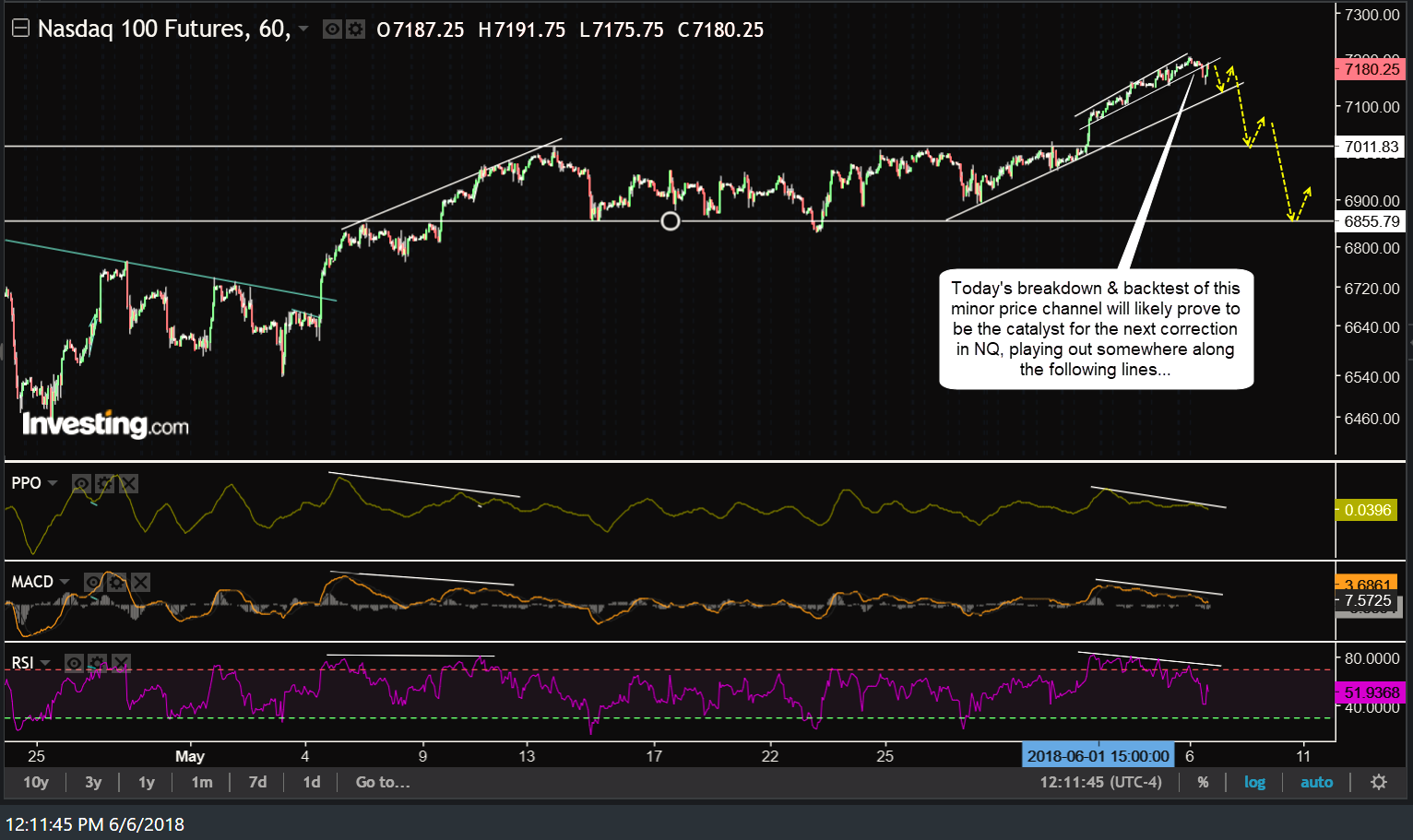

In the charts below, I’m using the E-mini futures for the S&P 500 & Nasdaq 100 as the trendlines, support level & chart patterns appear to stand out better than those of the tracking ETFs, SPY & QQQ, which only show trades during regular trading session hours.

Whether or not the markets make another minor thrust higher, this tag of the bottom of this 60-minute bearish rising wedge pattern on ES earlier today is likely to be the final reaction off that trendline as this pattern is fully mature & appears ready to break down very soon, whether or not the markets need one more thrust up or not.

Today’s breakdown & backtest of this minor price channel will likely prove to be the catalyst for the next correction in NQ, playing out somewhere along the following lines…