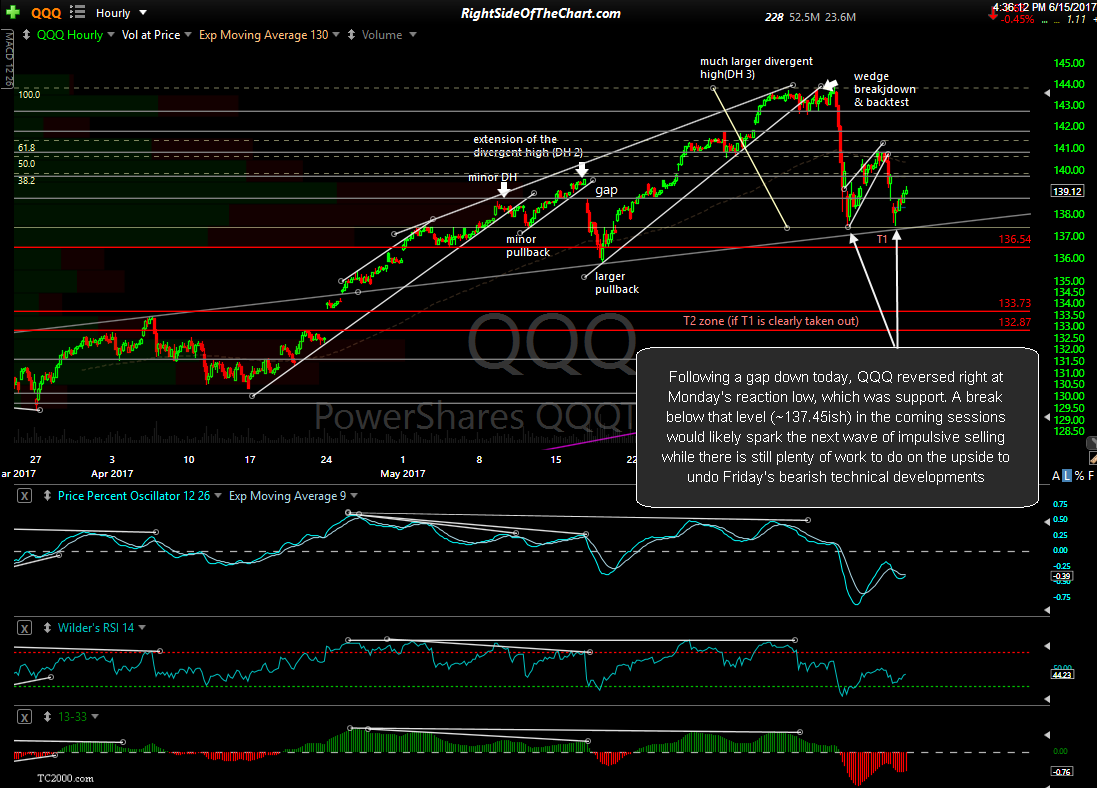

Following a gap down today, QQQ reversed right at Monday’s reaction low, which was support. A break below that level (~137.45ish) in the coming sessions would likely spark the next wave of impulsive selling while there is still plenty of work to do on the upside to undo Friday’s bearish technical developments. 60-minute chart:

All major US stock indices closed red today, including the Russell 2000 Small Cap Index ($RUT/IWM), which put it back down inside the 7 month trading range & (so far) causing last week’s breakout to fail as was my expectation & setting the stage for a potential bull trap & subsequent sell-off. XLF (Financial Sector ETF) also closed negative today & while it still remains above its recent trading range, keeping the breakout intact at this point, several of the leading financial stocks that were highlighted recently are currently backtesting their respective breakout levels or have yet to breakout. That puts the financials in a precarious technical position as the coming trading sessions will likely either prove to be a successful backtest of the recent breakout or a failure, with the recent breakout proving to be a whipsaw signal which would most likely be followed by a impulsive move back down within the recent trading range & quite possibly below.

On an off-topic note, back in October I had posted that I had to suddenly leave town when my brother suffered a life threatening accident. As I still receive inquires regarding my brother’s condition & recovery, I figured that I would share this recent segment that he was featured in.