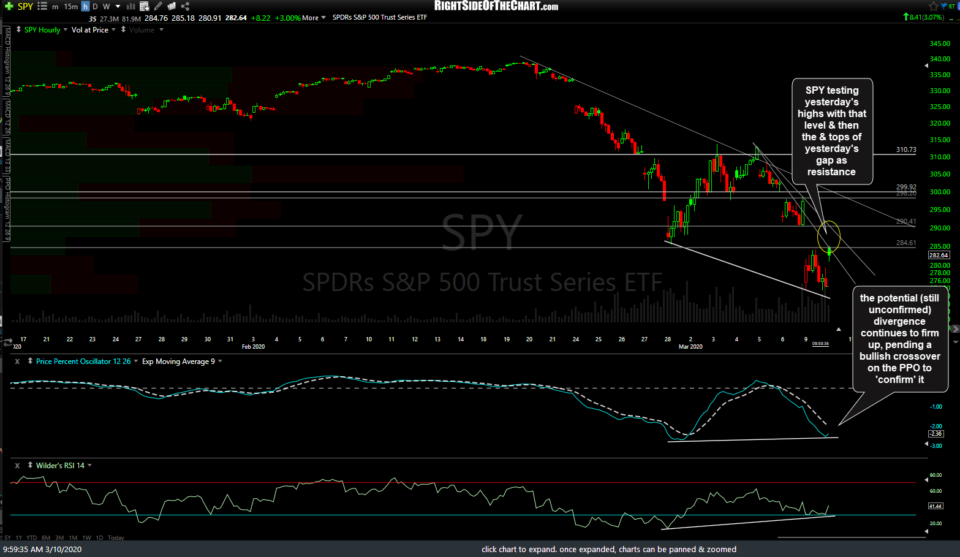

Starting with the 60-minute charts, both SPY & QQQ are testing yesterday’s highs (resistance) with the next significant resistance level the top of yesterday’s gaps, should today’s highs (so far) be taken out. The potential (still unconfirmed) divergence continues to firm up, pending a bullish crossover on the PPO to ‘confirm’ it.

- QQQ 60m March 10th

- SPY 60m March 10th

So far today, /NQ was rejected off the 8355 resistance level (from yesterday’s video) & downtrend line. While this could be the end of the bounce off the key support levels on the /NQ & QQQ daily charts, a solid break above that level (today’s highs) could spark another wave of buying/short-covering. I’ve also extended that near-term downtrend line from the recent /ES 60-minute charts & so far, that has capped today’s rally… another level to watch that could spark more upside if taken out. The positive divergences on both /ES & /NQ are still intact keeping the potential for a more significant rally alive until & unless taken out soon.

- NQ 60m March 10th

- ES 60m March 10th

Zooming out to the daily time frames, QQQ is testing the yesterday’s highs with the 200-day EMA just above as the next resistance along with the top of yesterday’s gap with both roughly coming in together.

/NQ is making another backtest of this uptrend line on the daily chart where it failed on the backtest during yesterday’s early-session snapback rally. Another rejection here followed by a break below yesterday’s lows would likely usher in more selling while a solid recovery of this level would be near-term bullish. However, just as QQQ has regained the key 194 support level on the daily chart following the slight close below it yesterday and an impulsive rally so far today, /NQ has also snapped back above the 8000-8078 key support zone. As such, this appears to be a key battleground between the bulls & bears.

While a very solid case for a substantial rally in the coming days to weeks can be made if those 60-minute divergences on QQQ & SPY are firmed up & the aforementioned resistance levels are clearly taken out, I am still favoring the bearish scenario yesterday’s lows being taken out this week with more downside to come. Of course, the charts are dynamic & so is my analysis so I will adjust/adapt if and as the technicals change.