/E7 Euro futures continue to rally since the breakout & objective long entry posted back on Feb 21st (last Friday) and have now cleared the top of the first price target zone. As a long position on the Euro is effective a short on the $US Dollar and the $USD tends to rise & fall with the US stock market, should my expectation for a reversal & near-term counter-trend rally in the stock market materialize today and/or early next week, that would most likely cause a pullback in the Euro, with the uptrend line in the updated (last) 60-minute chart below a likely target. Previous & updated 60-minute charts below.

- E7 60m Feb 21st

- E7 60m 2 Feb 21st.png

- E7 60m Jan 24th

- E7 60m Feb 25th.png

- E7 60m Feb 27th

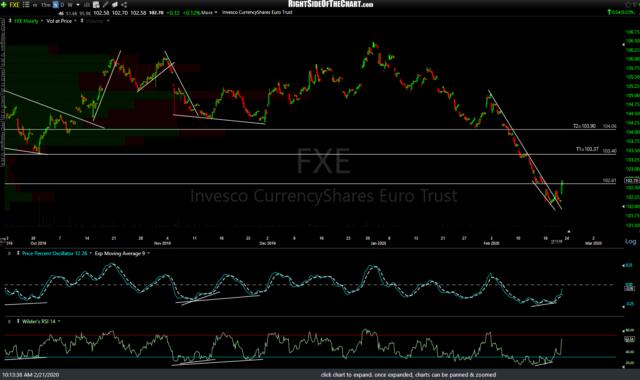

I had also shared FXE (Euro ETN) as a proxy for trading the Euro (unofficial trade), listing the first price target as 103.37. With /E7 already hitting & exceeding its first target zone, whether or not FXE continues up to the 103.37 level before a pullback will likely depend on whether the US stock market continues to fall in the near-term or mounts a significant bounce. Previous & updated 60-minute charts below.

Edit: When the screenshot of the second chart below was taken at 8:15 am today, FXE was only reflecting yesterday’s trades as it hadn’t yet trading in the pre-market session. Shortly after publishing this post, I noticed a print (trade) well above the first price target on FXE.. one more reason to trade futures over ETFs/ETNs as the liquidity on the latter, especially in the after-hours & pre-market session, is usually very poor.

- FXE 60m Feb 21st.png

- FXE 60m Feb 27th

- FXE 60m 2 Feb 27th