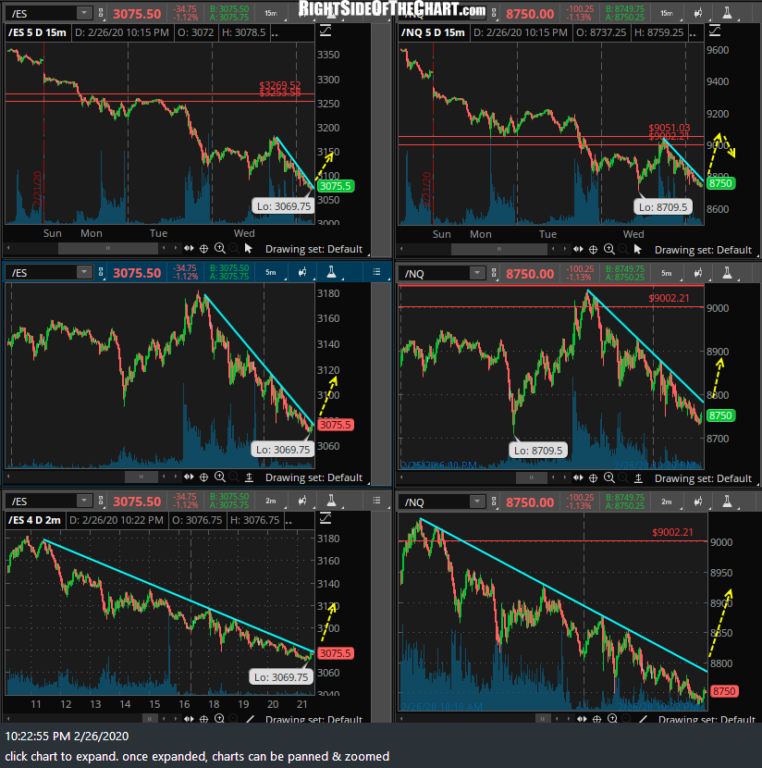

The first chart below is a mosaic of 2-minute, 5-minute, & 15-minute charts of /ES (left column) and /NQ (right) that I had posted in the trading room around 10:30 pm EST last night for the West Coast, late-night, & overseas traders stating that a “break above (the trendlines on) BOTH (/ES is likely to come first) would likely spark a rally in the futures that has the potential to carry at least as high as the 9045ish level on /NQ & quite possibly to that 9212-9246 target zone highlighted on the /NQ 60m charts earlier today.”

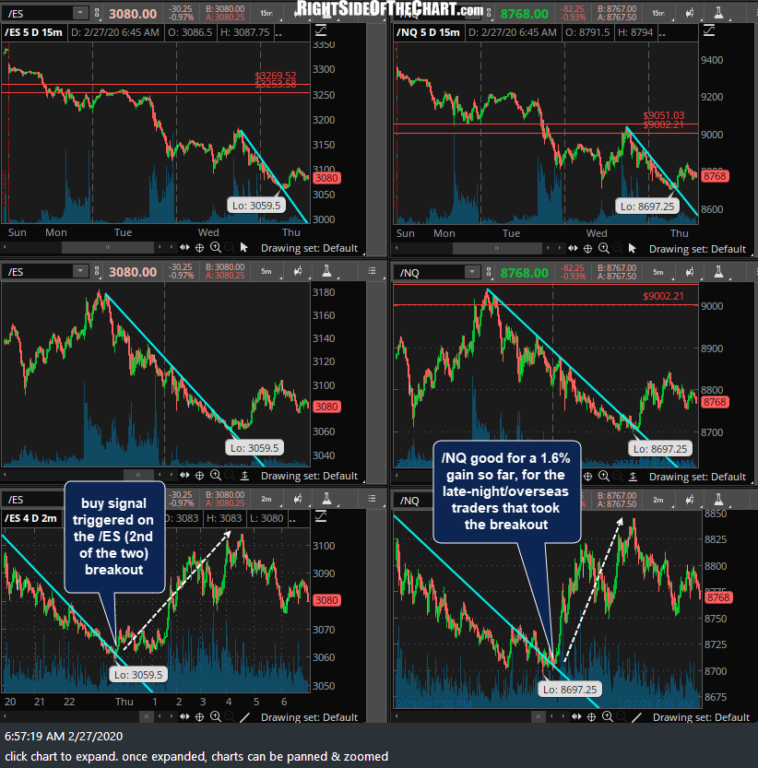

From there, /NQ went on to breakout & backtest shortly afterward with the buy signal, confirmation via the 2nd of the two, /ES breaking out right around 12:00 am on the button (9 pm PST). So far, that was good for a 1.6% rally in /NQ & 1.4% in /ES with the futures coming back in for a potential backtest of those breakout levels now.

While I suspect the futures will continue to build on these gains as per yesterday’s analysis, a solid breakout of both downtrend lines on the QQQ & SPY 1-minute charts below will increase the odds of a rally & green close today. Despite the late-night bounce in the futures, the stock market remains in a downtrend for now while a break above each of these resistance levels, starting with the downtrend lines of both SPY & QQQ, would likely spark a rally up to the next resistance level.

- QQQ 60m Feb 27th

- SPY 60m Feb 27th

Remember; no breakout, no buy signal as a trade setup is only a potential trade awaiting an objective buy trigger. As of now, /NQ continues to hold above the 8700 support which it had successfully tested during Tuesday night’s trading session with /ES slightly below but still within close proximity to the 3075 support while the potential bullish divergences are still intact on both /ES & /NQ. .60-minute charts below.

- NQ 60m Feb 27th

- ES 60m Feb 27th

Should these supports hold once again with the indexes rallying, that would be bullish & open the door to my next upside targets from yesterday while a solid break below could open the door to a drop to the 8485 support level on /NQ. Stay flexible/nimble or stand aside if now sure how to be positioned today.

FYI- I will be away from my desk for a couple of hours later this morning, back by noon & will post any significant developments that might occur as soon as I return.