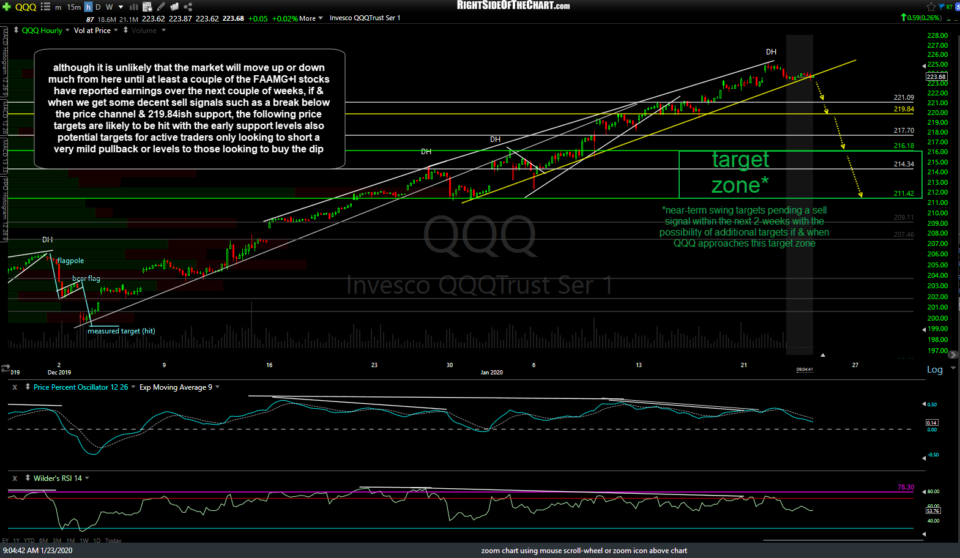

Although it is unlikely but certainly possible that the market will move up or down much from here until at least a couple of the FAAMG+I stocks have reported earnings over the next couple of weeks, if & when we get some decent sell signals such as a break below the price channels & highlighted (yellow) supports just below on QQQ & /NQ, the following price targets are likely to be hit with the early support levels also potential targets for active traders only looking to short a very mild pullback or levels to those looking to buy the dip. 60-minute charts below.

- QQQ 60m Jan 23rd

- NQ 60m Jan 23rd

/CL crude futures made a valiant effort to recover the uptrend line support but failed to hold above it, finally giving up the ghost once the failed attempt became clear, which led to stop being hit the recent UWT swing trade yesterday (an update will follow to re-assign that trade to the Completed Trades category). the last two times /CL hit such extreme oversold readings (around 18 on the RSI) happened to be around this same 55ish level, with those two previous reaction lows likely to act as support on this initial tag to produce to tradable bounce. Translation: /CL offer an objective but aggressive long entry here with a stop on a 60-min close somewhat below the 55ish support with a minimum target of the 56.70ish resistance or one could let the position run as long as the equity market continues to hold up with a trailing stop in place.