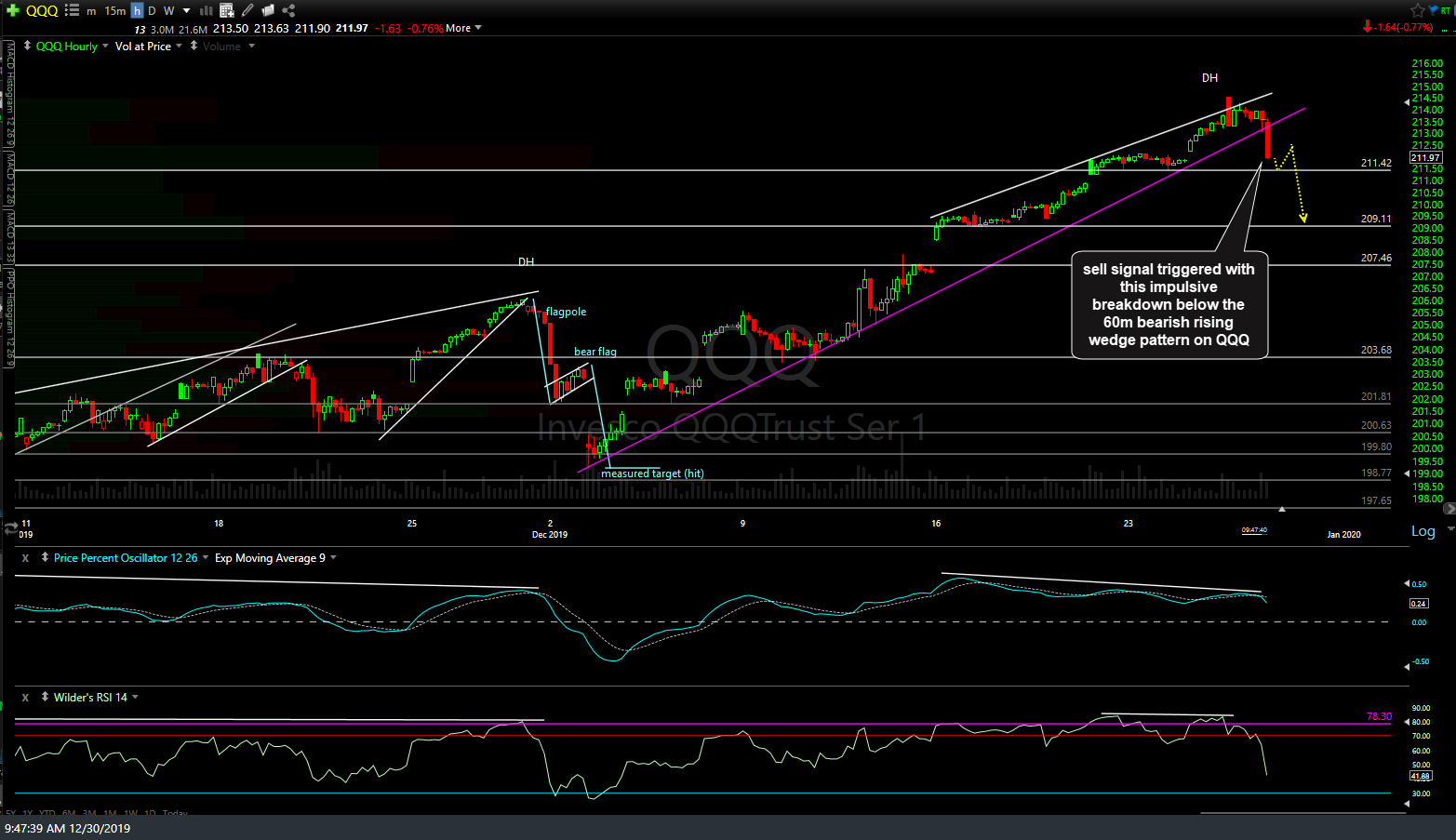

As expected (per Friday’s video), we finally have the first half-decent sell signal on the US stock market today via an impulsive breakdown below the 60-minute bearish rising wedge pattern on the leading index, the Nasdaq 100 (QQQ). QQQ is coming up on the first target of 211.42 where the odds for a minor reaction on the initial tag are decent, followed by another leg down to next target around the 209 level. Although there is a decent chance that we get a reaction off the 211.40ish level before the next leg down, due to many factors in play right now, my preference is to sit tight on my index shorts (in fact, I added shortly after the open today) and ride out any relatively minor counter-trend bounces as I wouldn’t be surprised if the market cuts through these initial support levels soon.

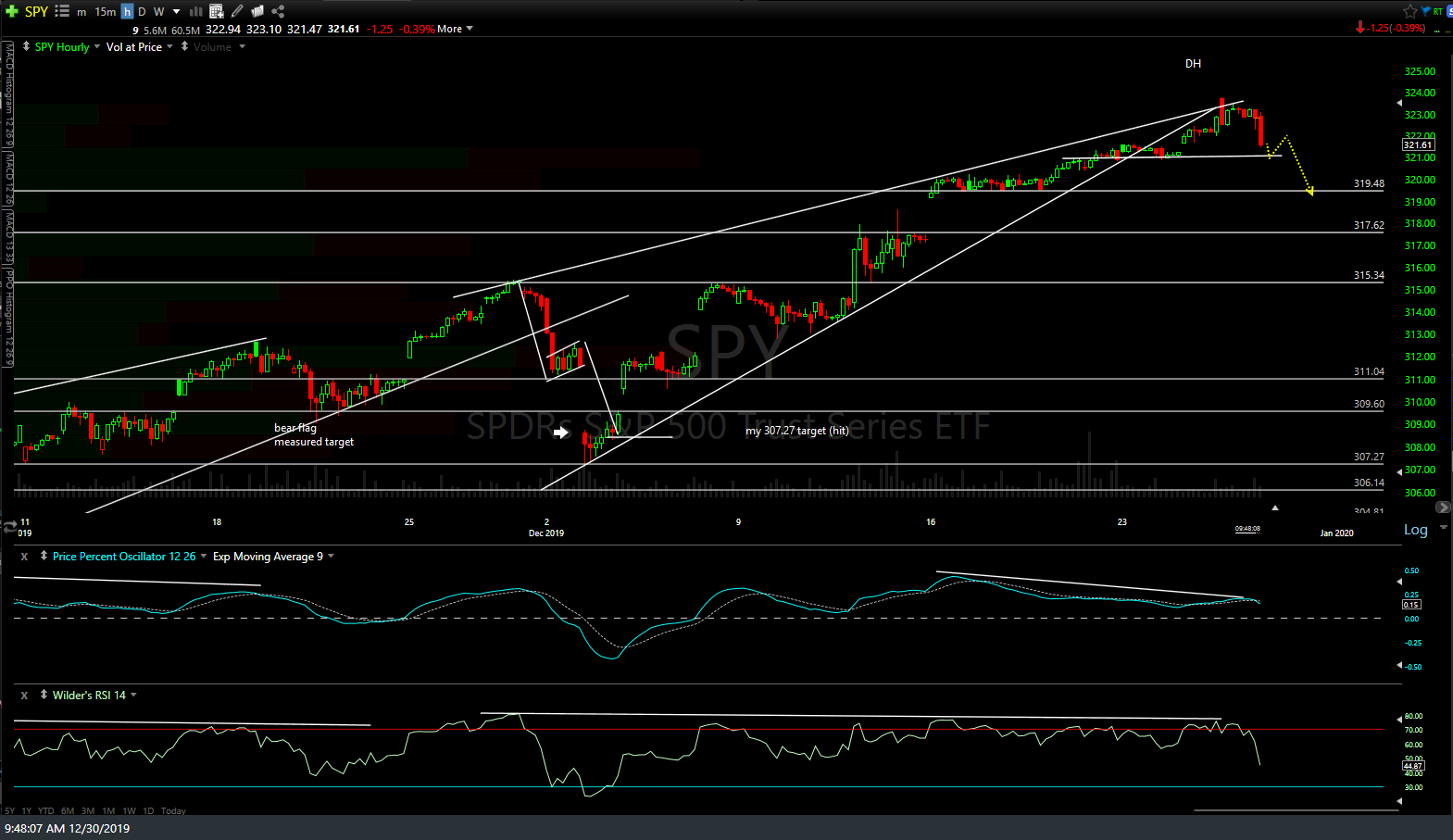

Remember, SPY & IWM had already recently broken down heading into this week & the were just awaiting the leader (QQQ) to follow suit. SPY made a very unimpulsive breakdown below its comparable 60-minute wedge pattern on December 23rd followed back a backtest of the wedge from below on Friday with an impulsive rejection off the wedge so far today. As with QQQ, SPY is coming up on the first minor support where the odds for a reaction are decent although I suspect that any reaction will be relatively minor in scope & duration.

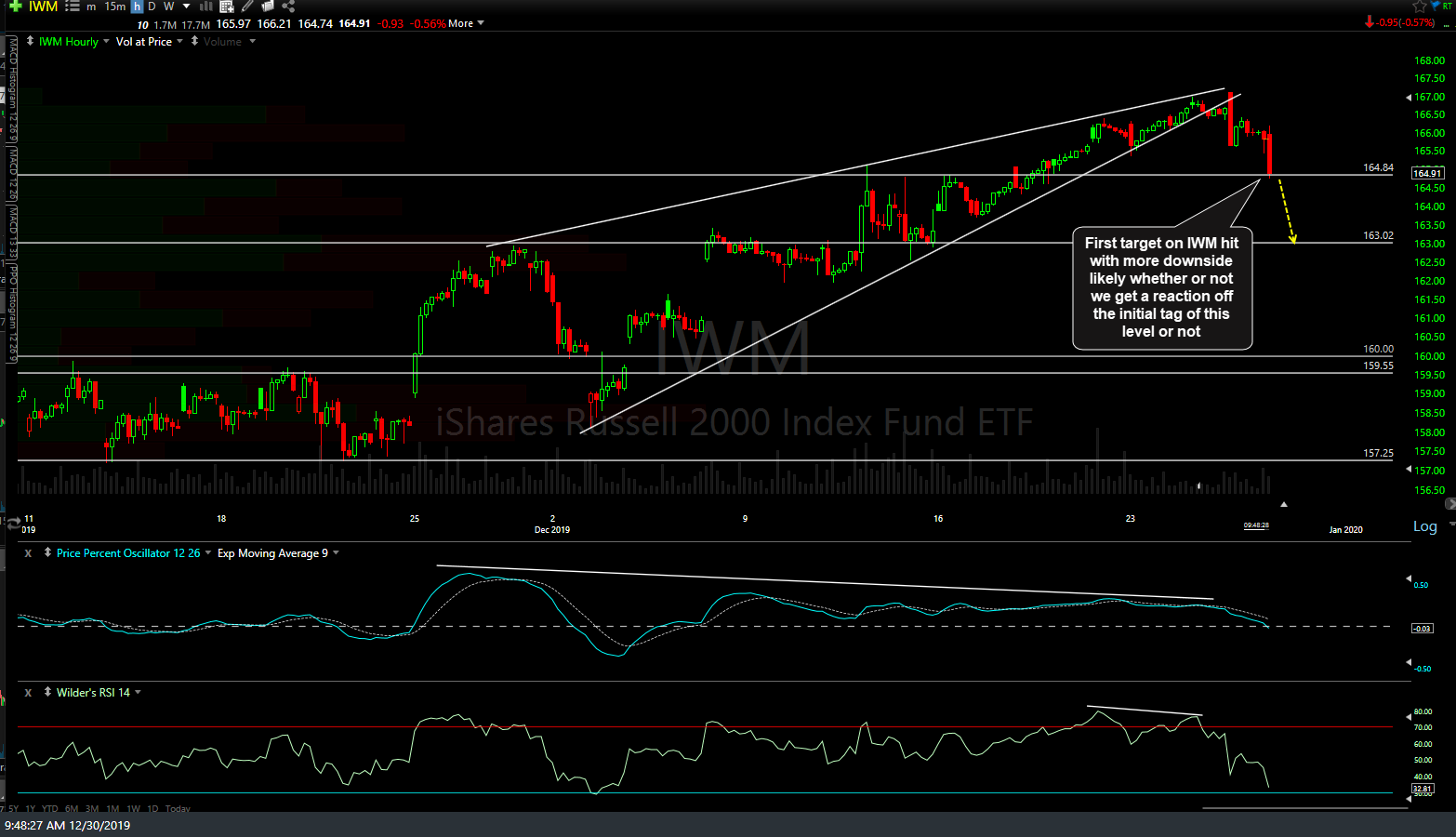

The first target on IWM has been hit with more downside likely whether or not we get a reaction off the initial tag of this level or not.