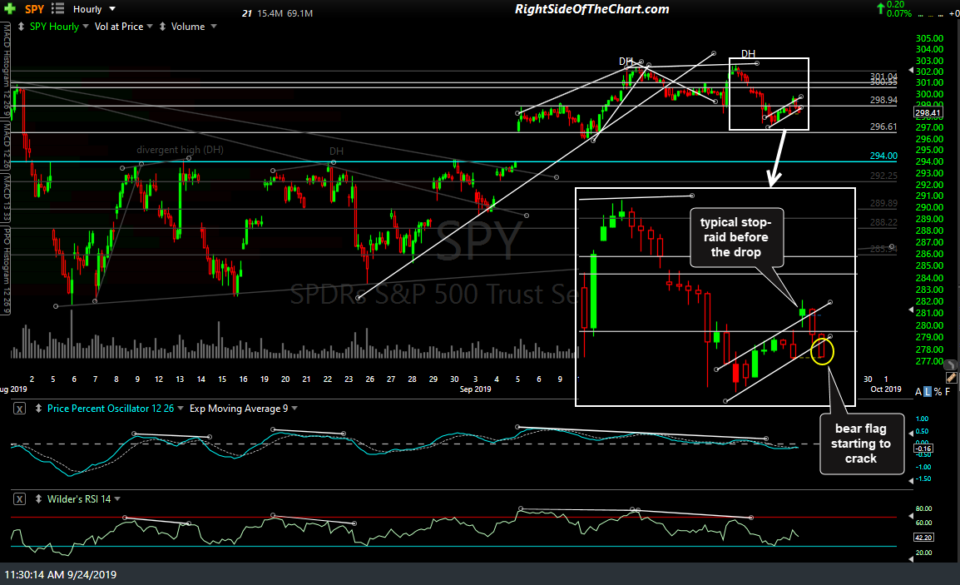

Following a typical & brief stop-raid earlier today, SPY reversed & has now impulsively broken down below the recently highlighted 60-minute bear flag pattern as the S&P 500 & Nasdaq 100 are starting to also crack below the necklines of the recently highlighted Head & Shoulders patterns on the 60-minute charts.

/NQ (Nasdaq 100 futures) has broken below the neckline of the H&S pattern while now testing the 7789 support level where the next sell signal will come if that support is taken out impulsively.

A solid break & 60-minute close below the 2980 support (yellow line) on /ES should open to the door to a test of the top of the Aug trading range. If & when that happens along with an impulsive break below the 7789 support on the /NQ chart above (not just a breif dip below quickly followed by a snap back up above), we will have a high-probability sell signal for a short down to that /ES 2939-2946 target (my primary target even if trading /NQ, QQQ, etc..). FWIW, I would say that the odds of those sell signals being confirmed soon are quite high.