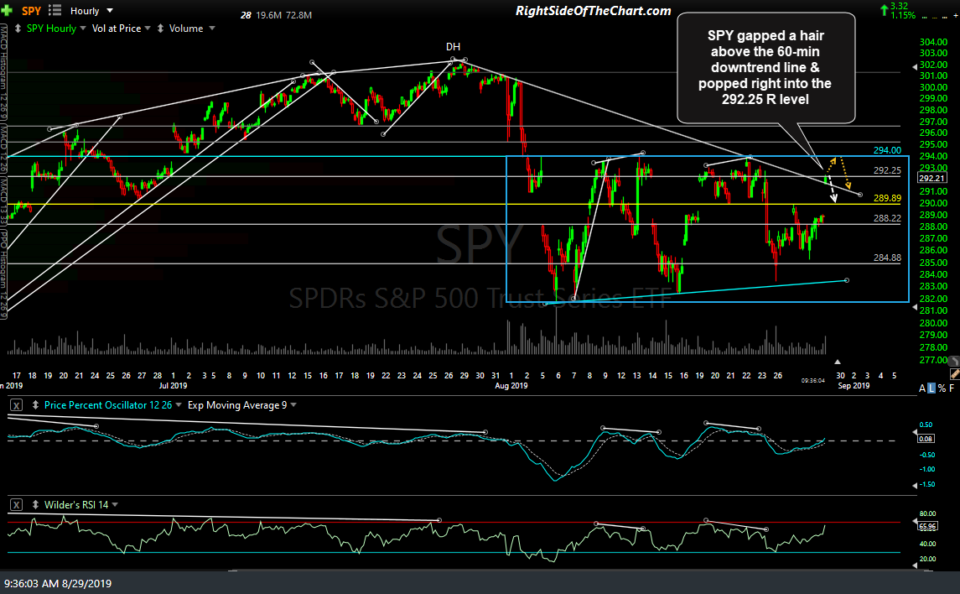

SPY, QQQ & IWM have all rallied into downtrend line + price resistance on this morning’s gap & pop rally. I’ve outlined the two likely scenarios which I would give nearly equal odds to at this time. My slightly preferred scenario with the white arrows has the indexes reversing around these post-opening highs while my alternative scenario with the orange arrows has the large-cap indexes (SPY & QQQ) rallying about another ½% or so for another test of the top of the August trading ranges before reversing. That scenario would also have IWM hitting my third & final price target (T3) from yesterday, before reversing (T2 was just hit).

- QQQ 60-min Aug 29th

- SPY 60-min Aug 29th

- IWM 60-min Aug 29th

Click first chart to expand, then click on right of chart to advance to the next full-size image. Multiple charts in a gallery format as above may not appear on email notifications but can be viewed on RSOTC.com by clicking on the post title.