There has been a lot of buzz & warnings of an impending recession for quite some time now yet the economy, and the stock market right along with it, has just continued to chug along with the S&P 500 less than 3% from its recent all-time highs. This has left a lot of economists as well as technicians (those using technical analysis, such as myself) quite surprised at the resiliency of the economy & stock market, both of which will ebb & flow together over the larger & inevitable business cycle of expansions followed by contractions (recessions).

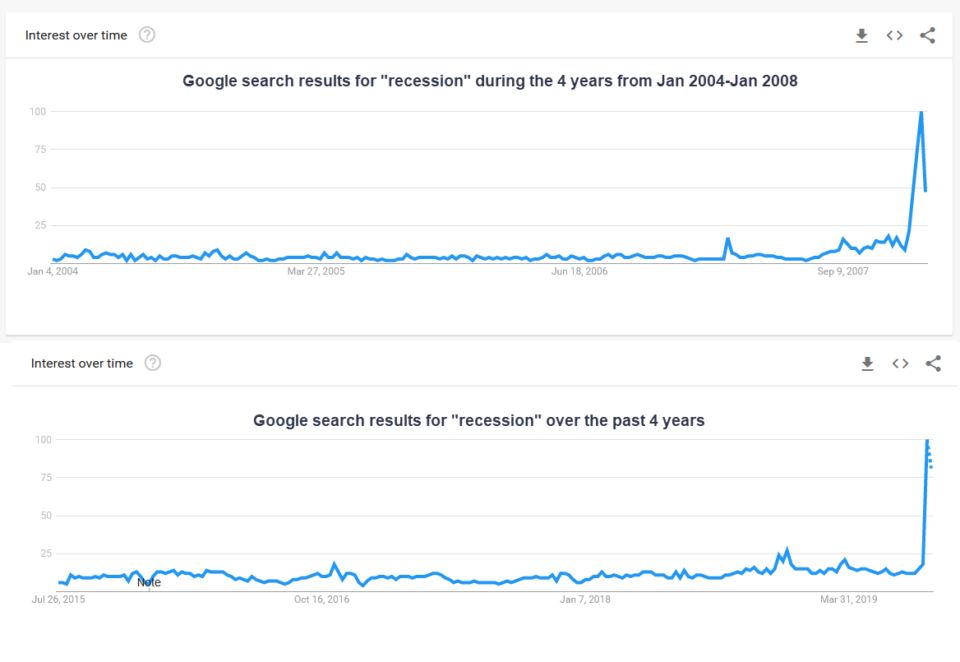

While economists have a large arsenal of various tools & complex methods to predict the peaks & troughs in the business cycle, it will be very interesting to see if this extremely simple indicator, which appears to have just triggered a “recession now imminent” signal, pans out. As of now, I can’t call this an accurate recession indicator or at least certainly not a ‘tried & true’ indicator as there is only one previous recession in which to use. From a statistician’s perspective, an indicator that has gone one for one so far certainly doesn’t include enough data points to provide a useful working model for predicting the reliability of an indicator so only time will tell if it goes two for two now that the second “impending recession” signal has just fired. (The previous signal from late 2007 was the first and only in the 15-year history available).

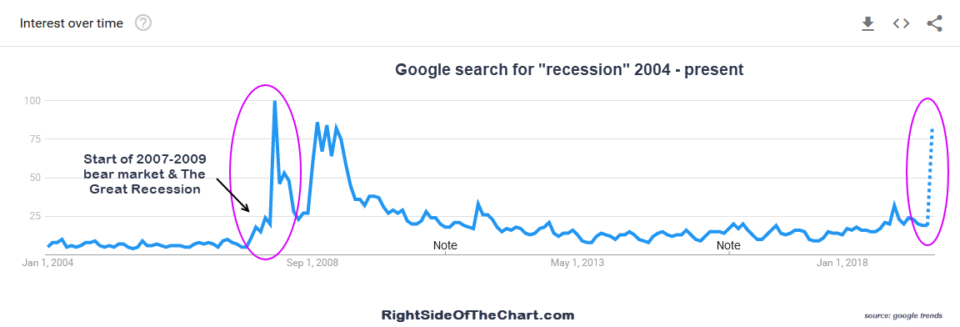

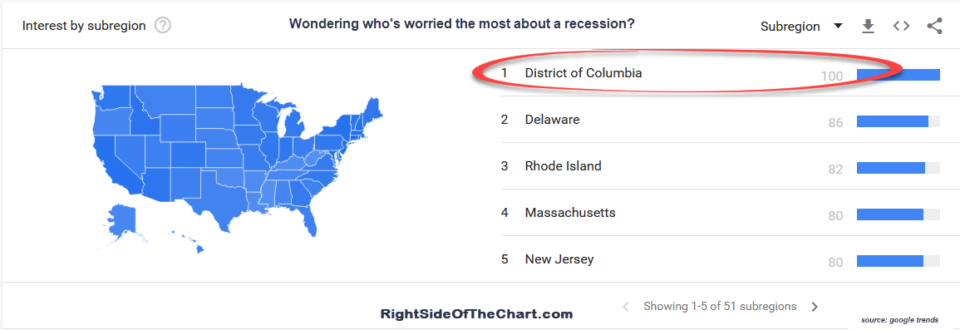

Using Google Trends, I pulled the graph showing the interest in the search term “recession”. The first chart above shows all available data which goes back to January 1, 2004, nearly 4-years before the end of the 2002-2007 bull market which peaked in Oct 2007, followed by a ~55% bear market along with what has since been labeled as The Great Recession. Other than the obvious surge in searches for the term “recession” back then and now, there are some nuances & parallels in the charts along with some other considerations that I discuss in the video below. I’ve also included a couple some of the charts from the video at the bottom of the page for quick reference as well.

playback speed can be increased in the settings to reduce video duration

charts will expand if clicked & may then be panned & zoomed