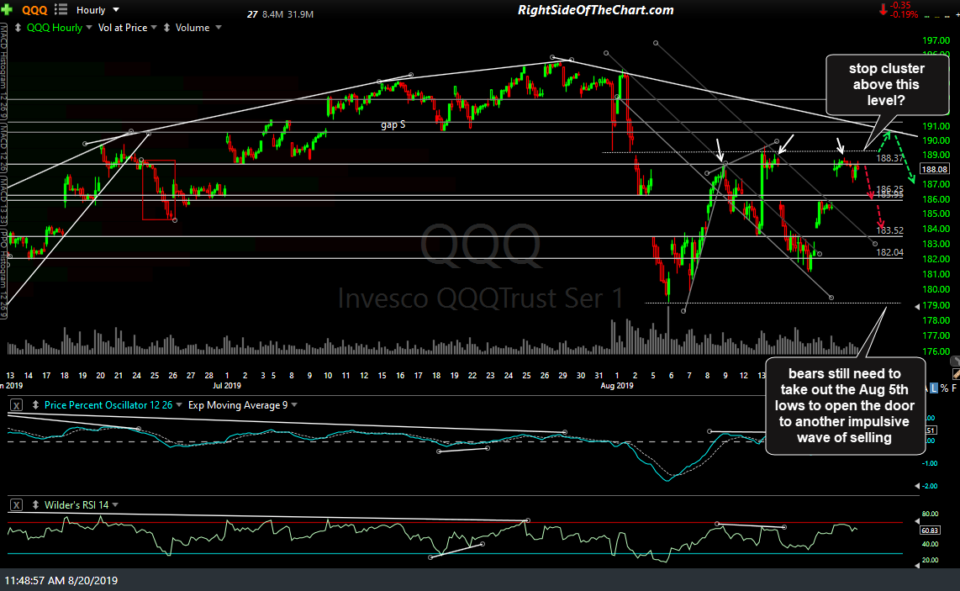

The battle for the 188-189 resistance level continues. That’s the top of that bounce target zone from two weeks ago which has capped all advances since then including yesterday & (so far) today. I have to imagine there is a big cluster to stops that the algos would like to pop just above the recent highs but still plenty of resistance overhead on QQQ & SPY if they do manage to take out 189 as well as the 294 resistance level on SPY.

Until & unless that happens, I’m still leaning towards another failure here at resistance with a move back down to & below the recent 2-week trading range although I’m more open to the stop-raid /pop above QQQ 189 & SPY 294 scenario now simply because the sellers failed to take out the August 5th lows following the first and second tests of those resistance levels.

I will also add that swing trading becomes very difficult when the stock market is grinding around in large (5%+) trading range such as it has for the past 2+ weeks as price targets are swing trades are less likely to be reached and stops have a much higher chance of being hit in the back & forth swings of the market. Trading ranges don’t last forever & typically, the longer they last & the larger the range within, the bigger & more impulsive the next trend emerging out of the range.