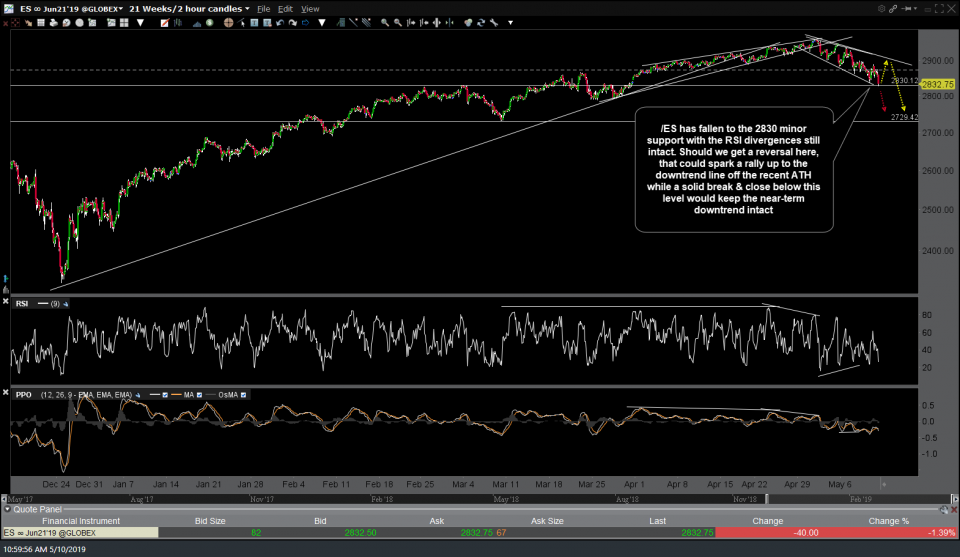

I wanted to highlight that /ES (S&P 500 E-mini futures contract) has fallen to the 2830 minor support with the RSI divergences still intact. Should we get a reversal here, that could spark a rally up to the downtrend line off the recent ATH while a solid break & close below this level would keep the near-term downtrend intact. SPY is coming up on the 282 minor support while near-term oversold as /ES also falls to minor support.

Likewise, QQQ is also coming up on the 180.72ish minor support level in which the second price target on the QQQ Active Short Trade was set just above. Basically, the story is the same as with SPY: The market either catches support & reverses soon, with a potential snapback rally as high as the 188ish level on QQQ and/or the downtrend line on SPY or we cut through the levels & continue down to the next target/support level.

- QQQ 60-min 2 May 10th

- SPY 60-min 2 May 10th

Should the market catch support & bounce soon, which I would put decent odds on, then the QQQ short trade could reverse just shy of the 2nd price target. Once again, typical/less-active swing traders should not be overly concerned with all the potential minor zigs & zags along the way of a trend that they have positioned for unless something compelling changes in the technicals and as of now, the charts still indicate more downside in the coming days to weeks, despite any counter-trend rallies along the way.