There is potential negative divergences forming on the 60-min chart of QQQ & SPY with confirmed negative divergence on the 60-min PPO of the index futures. AMZN (Amazon.com) also just hit my 1616 first bounce target where a pullback is likely on that top-heavy weighted Nasdaq 100 component. As such, even though /NQ & /ES have already backtested those key breakout levels from Friday (now support) & are still trading above them, we could see a dip back below those levels before a resumption of the uptrend, as per Friday’s closing market wrap video.

- QQQ 60-min Jan 7th

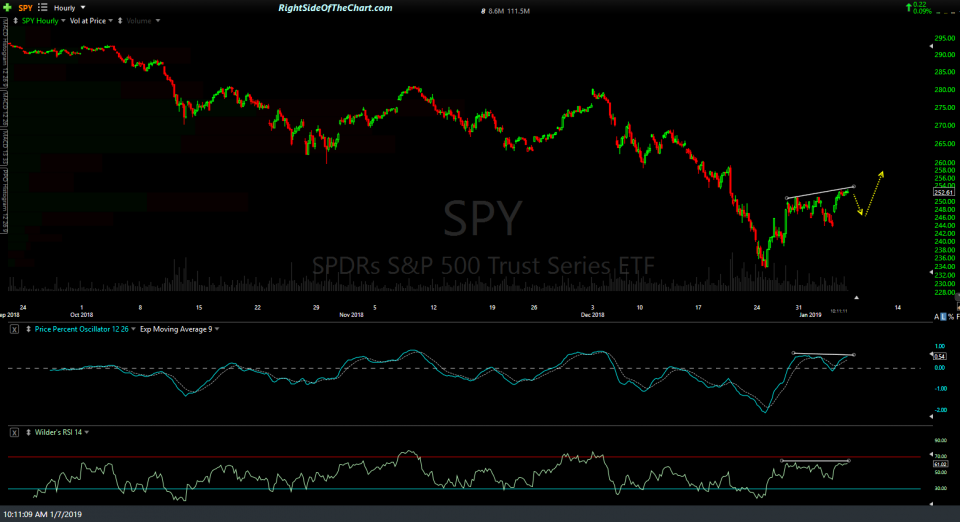

- SPY 60-min Jan 7th

- AMZN daily Jan 7th

/NQ is backtesting the key 6408.50 level that was taken out on Friday & which should now act as support. However, negative divergences on the PPO as well as potential divergences on the QQQ & SPY 60-min charts coupled with the near-term overbought conditions increase the odds for a pullback to the 6272ish level if /NQ breaks below 6405.

/ES is backtesting the key 2522.50 level that was taken out on Friday & which should now act as support. However, negative divergences on the PPO as well as potential divergences on the QQQ & SPY 60-min charts coupled with the near-term overbought conditions increase the odds for a pullback to the 2493ish level if /ES breaks below 2520.

FWIW, my preferred scenario is that those support levels will be taken out today with a decent pullback in the US stock indices today & possibly into tomorrow as well although as I like to say, support is support until & unless broken.