It appears that the rally off last week’s divergent low in the U.S. stock index futures has run its course, with the negative divergences that were pointed out in the trading room on Friday afternoon (first charts below) playing out for a reversal & continued move down in the futures so far in the pre-market trading session.

- ES 60-min 3 Nov 16th

- ES 60-min Nov 19th

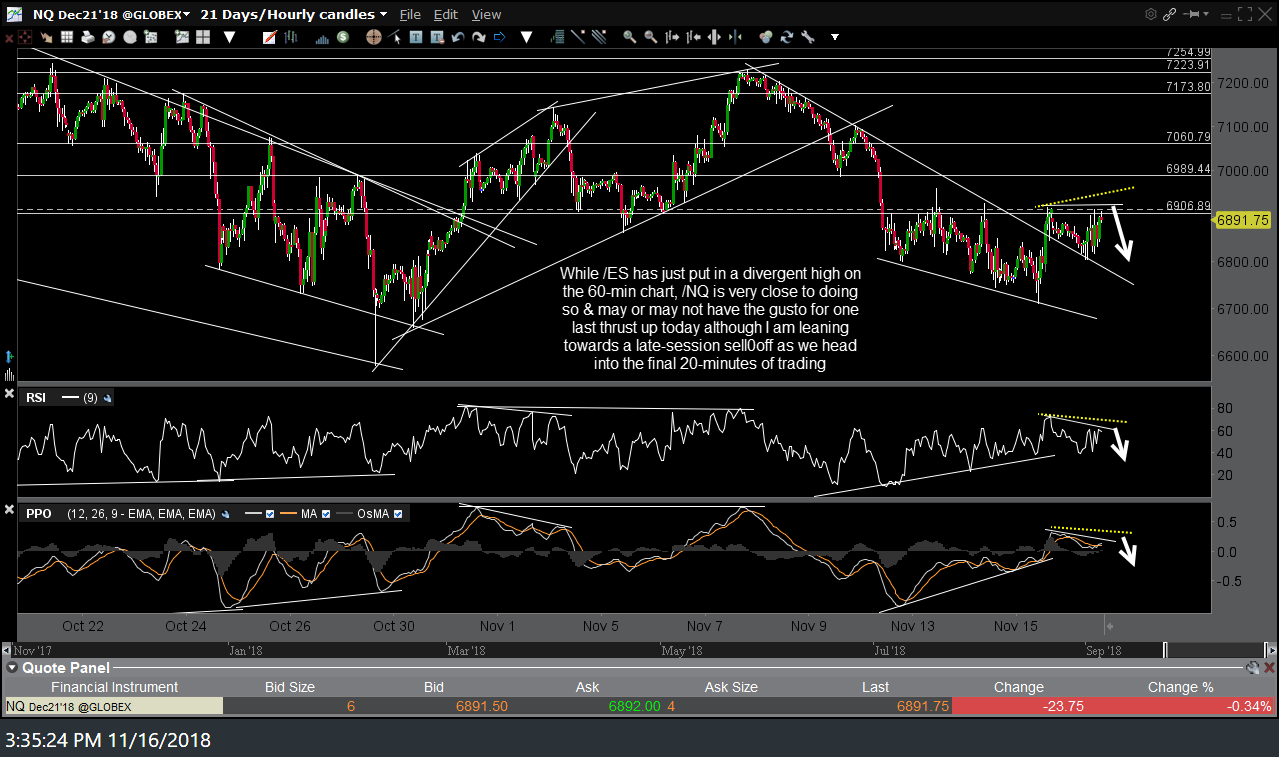

- NQ 60-min 3 Nov 16th

- NQ 60-min Nov 19th

click on first chart to expand, then click on right of each chart to advance. expanded charts can be panned & zoomed

There haven’t been any material changes in the intermediate to long-term outlook for the U.S. equity markets that typical swing & trend traders should be concerned with. However, active traders should be aware that trading volumes are likely to taper off as we head into the Thanksgiving holiday, with the U.S. stock market closed on Thursday followed by an abbreviated trading session on Friday. From my experience, low-volume trading sessions surrounding holidays often lead to an increase in whipsaw signals & can make active trading difficult.