So far today, SPY has bounced after backfilling the Oct 30/31 gap with the PPO poised to make a bullish crossover on any more upside. A break of the near-term downtrend line below could spark a rally up to the 275.13 resistance level while a failure to make an impulsive & convincing break above the trendline, along with a break below today’s low, would likely send SPY down to the next support around 261.50.

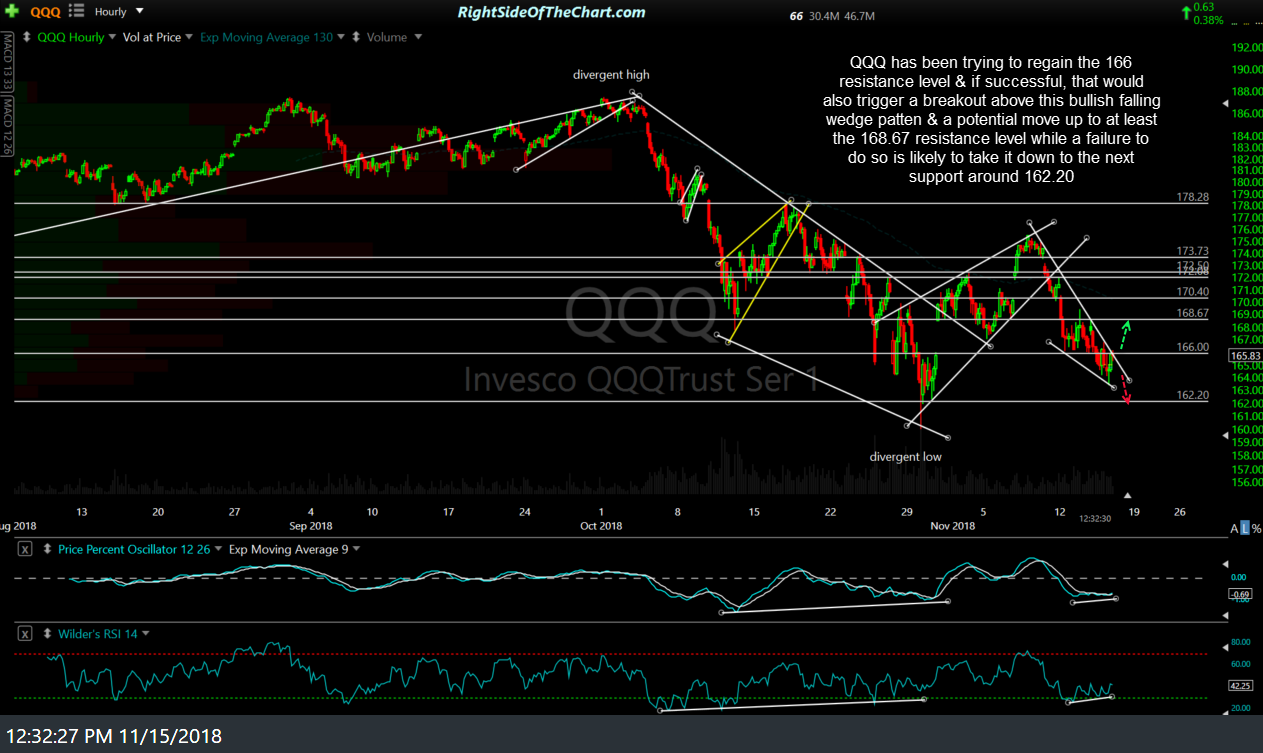

Likewise, QQQ has been trying to regain the 166 resistance level & if successful, that would also trigger a breakout above this bullish falling wedge patten & a potential move up to at least the 168.67 resistance level while a failure to do so is likely to take it down to the next support around 162.20.

Taking a look at the 60-minute charts of the index futures, /ES (&P 500) continues the battle to hold the 2696 support level with the bullish divergences still intact while /NQ (Nasdaq 100) bounced off the bottom of the 60-min bullish falling wedge so far today. Hard to say which of these two opposing scenarios will play out although one would have to put the odds in the favor of the prevailing trend, which has been & remains bearish at this time, while also respecting any convicing/impulsive breakout in both SPY & QQQ, should it occur.

- ES 60-min Nov 15th

- NQ 60-min Nov 15th

These developments on the intrday charts shouldn’t be much of a concern to less-active swing traders position short as even a bounce up to those initial overhead resistance levels wouldn’t have a material impact on the more significant daily & weekly charts, which still indicate more downside in the US equity markets in the coming days to weeks. Should both SPY & QQQ breakout & start to rally, we’ll have to assess any bounce as/if it begins to materialize. As of now, the near-term & intermeidate-term trends remain bearish & the recent pattern has been one of the rips being sold into and while I don’t see a high likelihood of that changing anytime soon, if something material changes in the technicals soon, I will do my best to recongize it as such & communicate my thoughts asap.