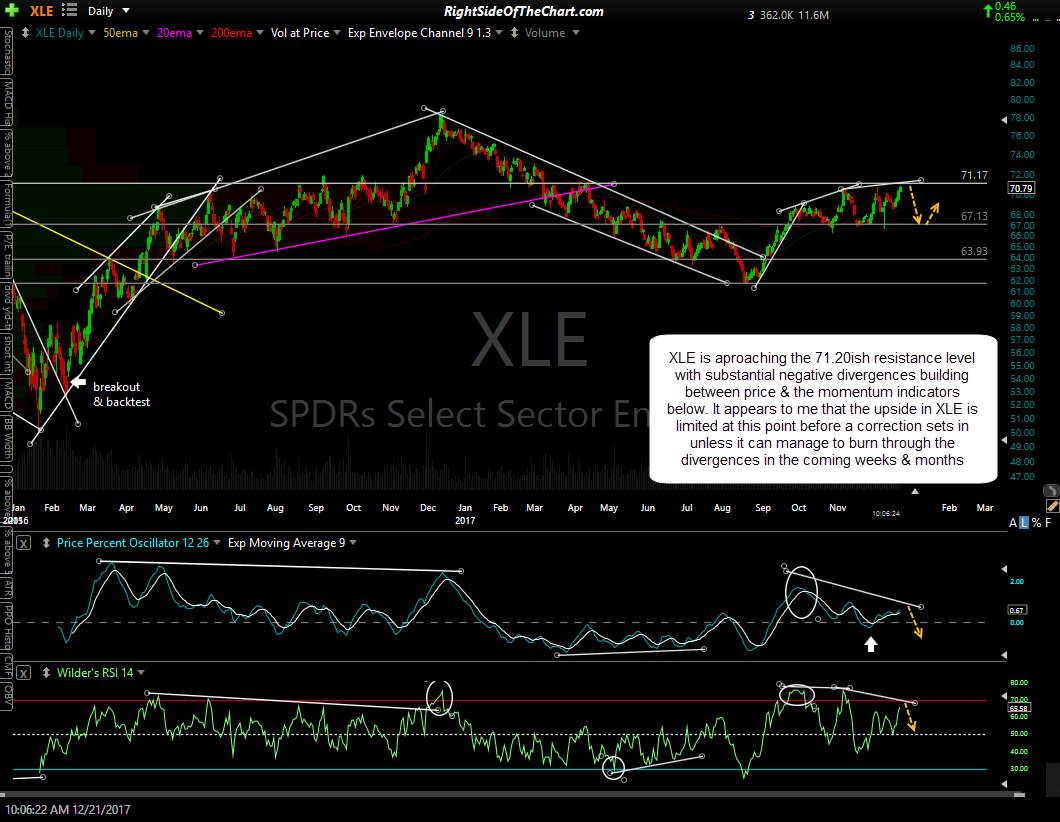

Here’s a look at XLE (SPDRs Select Sector Energy ETF) along with a handful of the top components. XLE is aproaching the 71.20ish resistance level with substantial negative divergences building between price & the momentum indicators below. It appears that the upside in XLE is limited at this point before a correction sets in unless the energy stocks can manage to burn through these divergences in the coming weeks & months. We don’t have any sell signals at this time & with the momentum still to the upside, it is still too early to short the sector although it would be prudent to tighten up stops on any long positions.

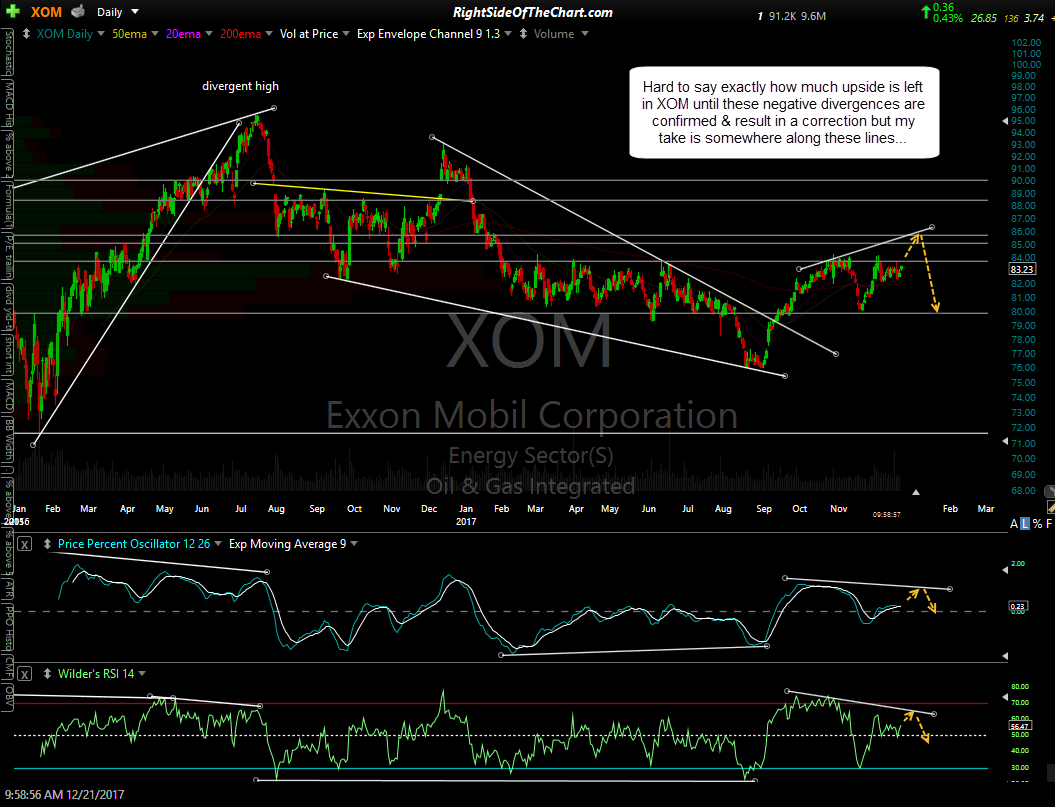

XOM (Exxon Mobil) is by far the largest component of XLE, comprising a very top-heavy 22.73% weighting so definitely a stock worth monitoring if trading XLE or any related ETFs. Hard to say exactly how much upside is left in XOM until these negative divergences are confirmed & result in a correction but my take is somewhere along these lines…

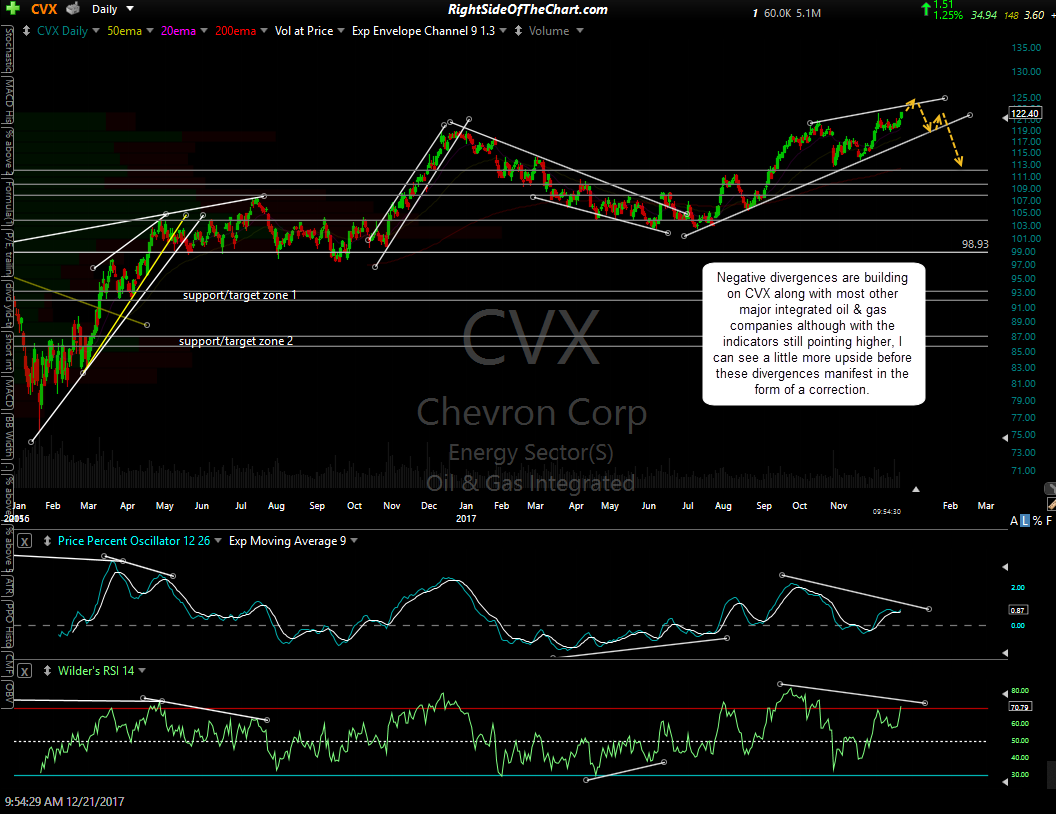

CVX (Chevron Corp) is the second largest component of XLE, also with significant over-weighting as this stock accounts for 17.08% of the returns. That puts XOM & CVX at a combined weighting of nearly 40% of XLE. Negative divergences are building on CVX along with most other major integrated oil & gas companies although with the indicators still pointing higher, I can see a little more upside before these divergences manifest in the form of a correction.

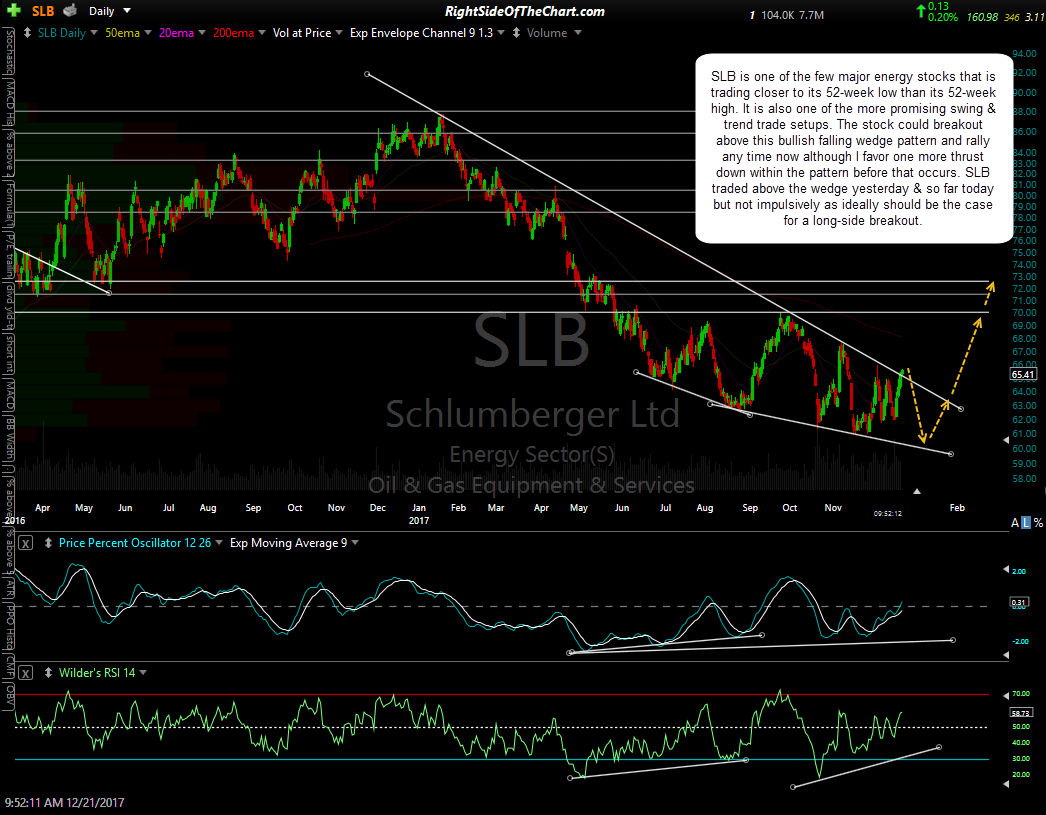

SLB (Schlumberger Ltd) is one of the few major energy stocks that is trading closer to its 52-week low than its 52-week high. It is also one of the more promising swing & trend trade setups. The stock could breakout above this bullish falling wedge pattern and rally any time now although I favor one more thrust down within the pattern before that occurs. SLB traded above the wedge yesterday & so far today but not impulsively as ideally should be the case for a long-side breakout.

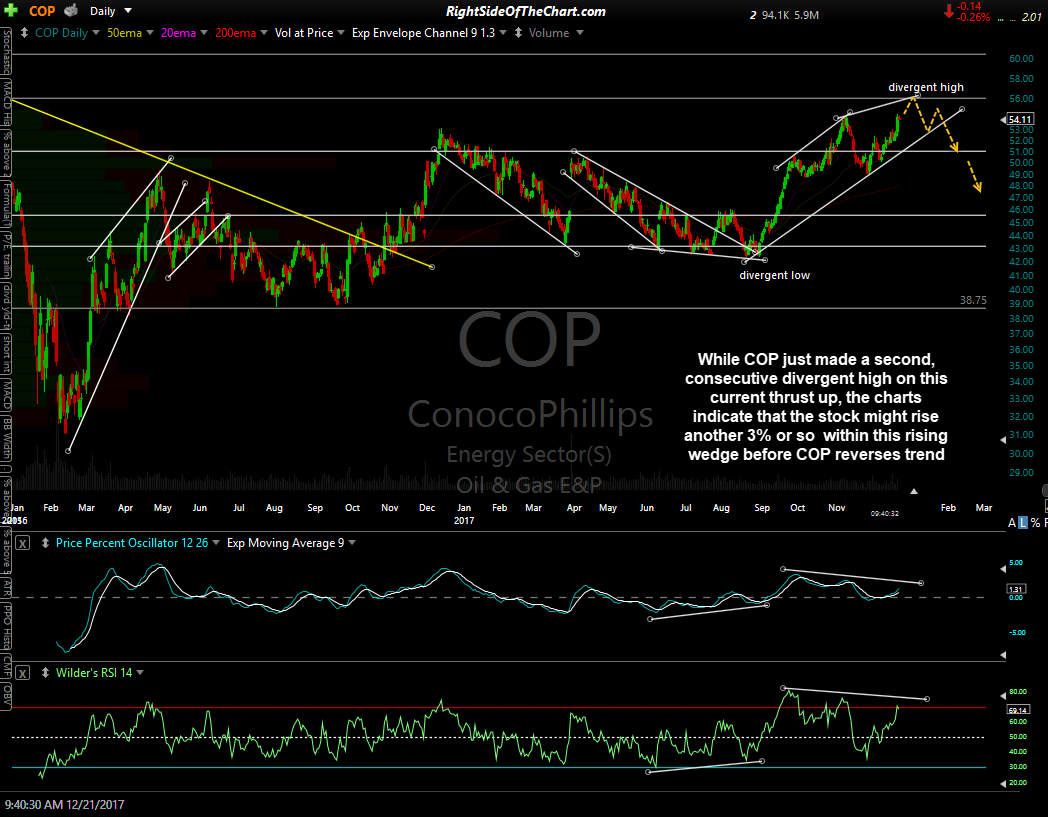

While COP just made a second, consecutive divergent high on this current thrust up, the charts indicate that the stock might rise another 3% or so within this rising wedge before COP reverses trend.

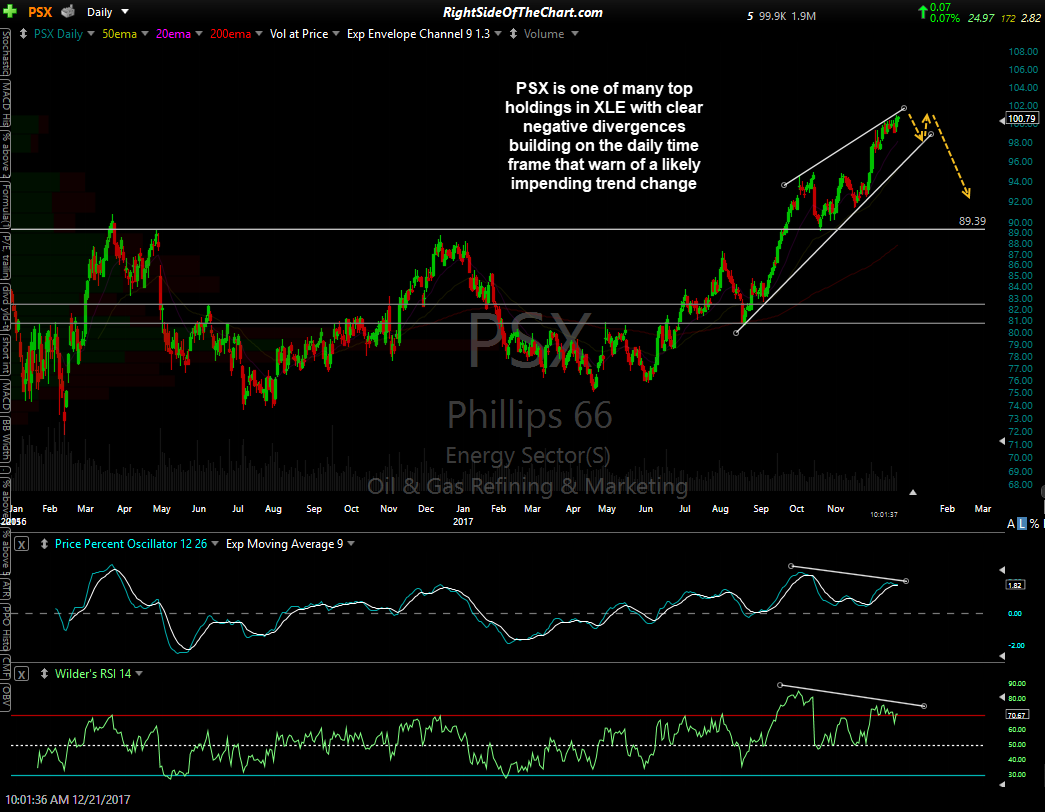

PSX (Phillips 66) is one of many top holdings in XLE with clear negative divergences building on the daily time frame that warn of a likely impending trend change. Bottom line is that while the trend remains bullish in the energy sector for now, it appears that the R/R is starting to shift from the bullish/long side to the bearish/short side. I remain longer-term bullish on the energy sector although as of now, it appears that a correction may be close at hand. Should my outlook for the energy sector change, I will do my best to communicate my thoughts asap.