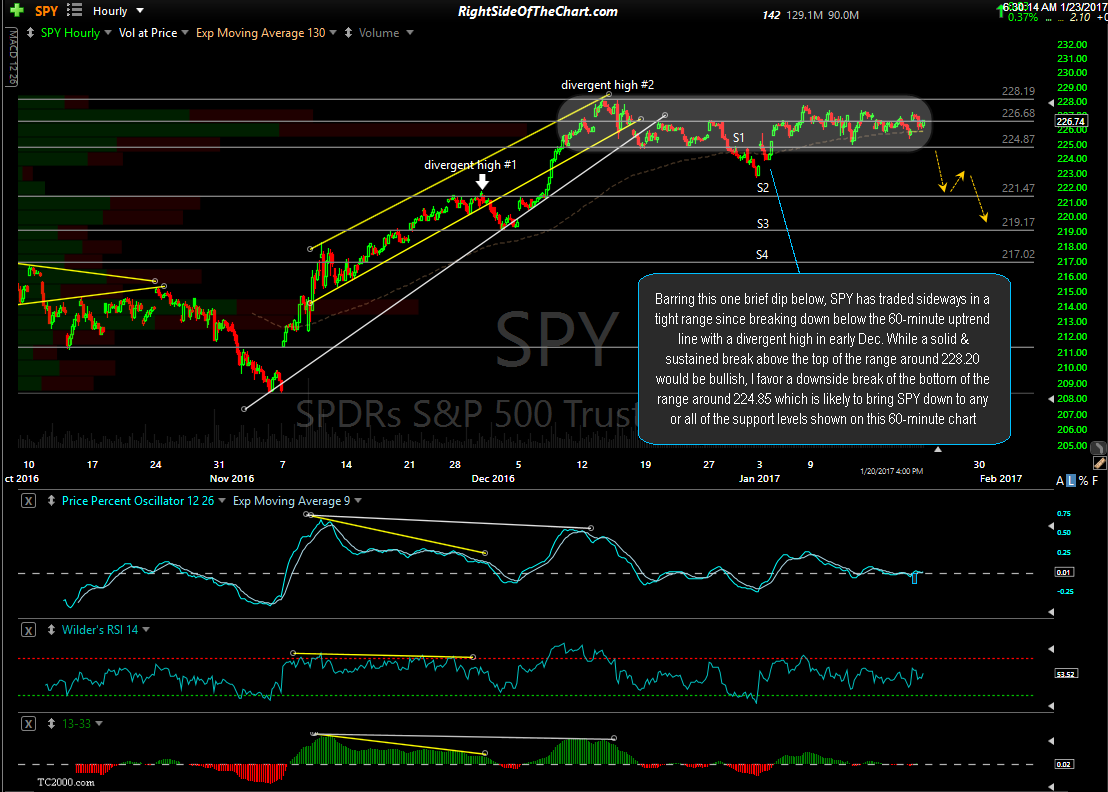

Here’s a quick glance at the near-term outlook for the U.S. equity markets on a few of the major index tracking ETFs:

Barring this one brief dip below, SPY has traded sideways in a tight range since breaking down below the 60-minute uptrend line with a divergent high in early Dec. While a solid & sustained break above the top of the range around 228.20 would be bullish, I favor a downside break of the bottom of the range around 224.85 which is likely to bring SPY down to any or all of the support levels shown on this 60-minute chart.