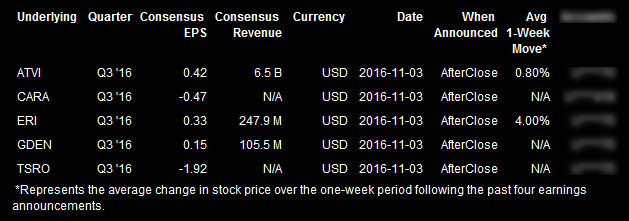

Just a heads up that several of the official & unofficial trade ideas recently posted on RSOTC are scheduled to report earnings after the markets close tomorrow, including ATVI, CARA, ERI, GDEN & TSRO. Keep in mind that list is far from inclusive of all of the recently highlighted trade ideas. There are numerous sources on the web to find the upcoming earnings dates for your positions, such as this earnings calendar from Yahoo Finance, the company’s website (usually found under Investor Relations or a similar link at the bottom the company’s home page) or even a quick Google search for “XYZ earnings date”.

Although the ATVI trade idea that was posted yesterday is reported to have a relatively muted post-earnings average trading range of only 0.80% in the week following earnings announcements, the chart below tells a very different story, with some large post-earnings gaps & price swings over the last couple of years.

Each trader must decide whether to hold a swing position into earnings vs. closing or hedging the position (via options) before the position is scheduled to report earnings and provide any forward guidance. Some stocks have a history of large price swings immediately following their quarterly earnings reports, including large gaps which can bypass any well-placed stop-loss orders, thereby exceeding the expected loss allowance on the trade, should the gap go against your position.

While many swing trades close out positions ahead of earnings at a rule, sometimes I will close, reduce or hedge a position before earnings with some examples being if my trade is already close to my preferred profit target or if the charts no longer look as compelling as they did when I entered the trade. However, on balance, I find that any earnings-induced gaps are more often than not inline with the technical outlook for the stock. In other words, stocks with clearly bullish chart patterns tend to gap up while those with clearly bearish patterns tend to gap down more often than gapping up.

‘More often than not’ is far from ‘always’ so the most important consideration when holding a position into earnings is to be aware of the historical post-earnings trading history for that stock & make sure that you will be comfortable with the losses incurred should your position gap against you at or beyond the upper-end of the historical range of post-earnings gaps on that company & never put all of your eggs in one basket, meaning don’t put too much of your total trading or investing capital into any one stock or sector. Diversification and position size/loss management are paramount in trading & investing.