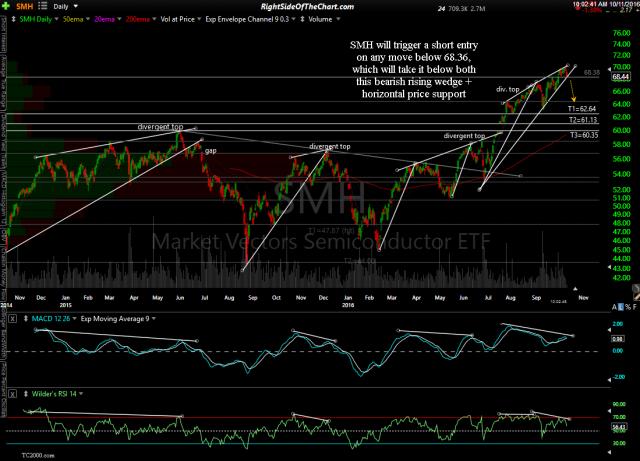

If at first you don’t succeed,… After reviewing the semiconductor sector & individual components in detail last night, I have decided to go ahead and add SMH (with SOXL, the 3x bullish semiconductor ETF, as a possibly proxy for those that have the ability to short it) as Short Trade Setup once again. The official entry for both will be any move below SMH 68.36 (just below support). For simplicity in tracking these trades, the entry price, targets & suggested stop for SOXL will be correspond to those levels on SMH (1x or non-leveraged semiconductor ETF). However, I have provided some approximate targets for those that prefer to short SOXL in order to take advantage of the possible price decay due to the 3x leverage.

- SMH daily Oct 11th

- SOXL daily Oct 11th

SMH will trigger a short entry on any move below 68.36 with price targets at 62.64, 61.13 & 60.35 with a suggested stop above 70.50. The suggested beta-adjustment for SMH is 0.9 and 0.3 for SOXL (in order to account for the 300% leverage). My preferred target at this time is T2 at 61.13 which is set just above the July 18th gap. Also note that I have numerous individual semiconductor short trade ideas that will also likely be added as official trade ideas. As such, one should make so to leave room for additional exposure to the semiconductor sector if they plan to add any individual stocks in addition to the sector ETFs (which would provide overlap & possible over-exposure to the sector).

note: As I finished composing this post, SMH/SOXL has now triggered an entry on a move below 68.36 and as such, is now an Active Short Trade.