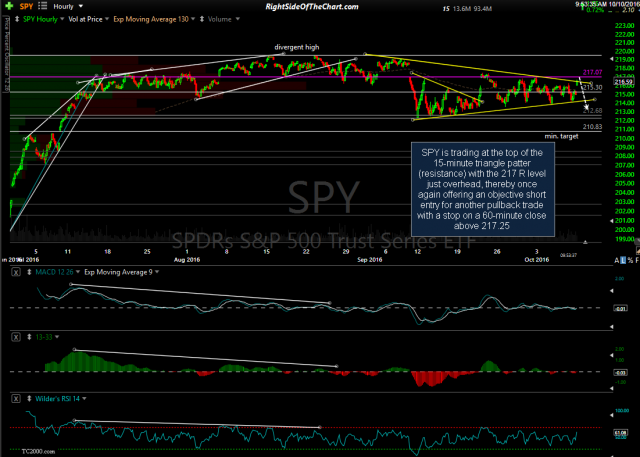

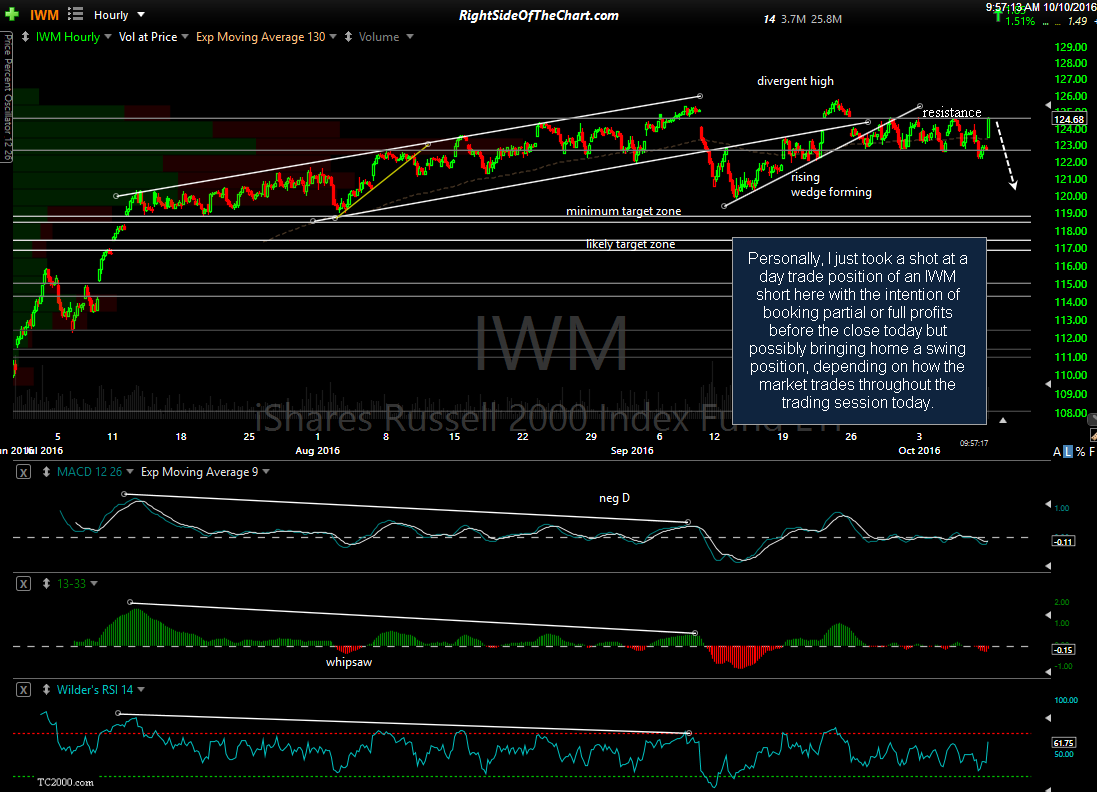

QQQ is trading slightly above the 119.20ish resistance level which has contained this leading index ETF on all prior attempts, while SPY is also trading at resistance. As such, this appears to be an objective level to short the broad market for a pullback trade with the potential to morph into a longer-term swing trade. Also note that with all key price & momentum indicators still well below their previous reaction highs, any marginal new high will be a divergent high & as such, is likely to fail.

- QQQ 60-min Oct 10th

- SPY 60-min Oct 10th

As the current trend remains sideways & very choppy, these are not official trade ideas, I’m just pointing out a potential pullback trading opp with a very attractive R/R (minimal downside if stopped out with a shot at a quick (1-5 day) pullback trade & the potential to morph into a multi-week or multi-month swing trade, should the market reverse soon & go on to break down below the recent trading range. Personally, I just took a shot at a day trade position of an IWM short here with the intention of booking partial or full profits before the close today but possibly bringing home a swing position, depending on how the market trades throughout the trading session today. My stop will be on 60-minute close above 125.22 with a minimum target of 122.84, again, reducing to a swing position (or flat) before the close if not stopped out before then.