Best to keep things light throughout this week as we have a slew of potentially market moving economic releases culminating with Q2 GDP (at a pretty lofty consensus of +2.6%) on Friday before the market opens. We also have the 2-day FOMC meeting kicking off and at least 7 of the 30 blue-chip Dow components reporting earnings today.

- SPY 60-minute July 26th close

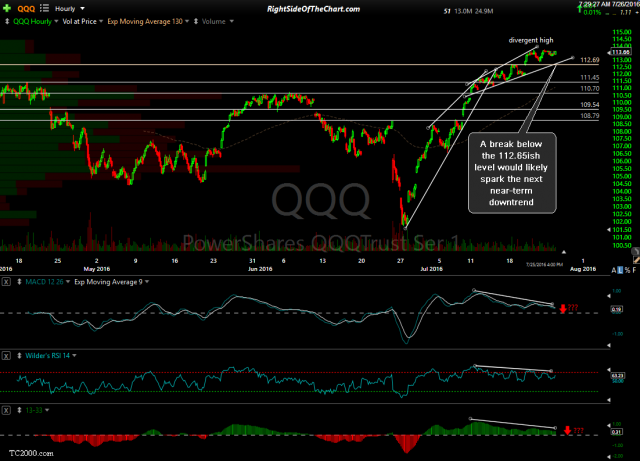

- QQQ July 25th close

Regarding the technicals, both the SPY & QQQ still look on the verge of triggering the aforementioned sell signals on the 60-minute time frames, which if so, would indicate a pullback in the US equity markets lasting anywhere from several days to several weeks & possibly more. While GLD is still holding above the recently highlighted 125.10 support level, the intermediate-term outlook (several weeks to months) for gold & the mining sector remains bearish.

It appears that earnings season will start to wind down after next week at which time the chances of false buy & sell signals & large earnings-induced gaps should begin to diminish and ideally, start presenting us with a more conducive environment for swing trading.