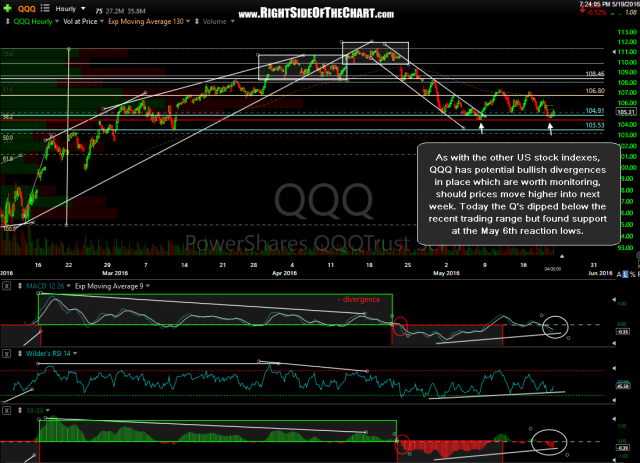

As with the other US stock indexes, QQQ has potential bullish divergences in place which are worth monitoring, should prices move higher into next week. Today the Q’s dipped below the recent trading range but found support at the May 6th reaction lows. (edit: the previous posted 60-minute charts for QQQ & SPY were the same charts posted earlier today. The updated charts, as of today’s close, have been added below)

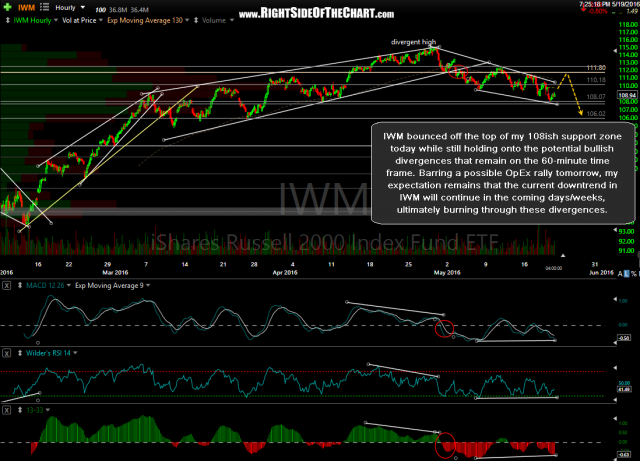

IWM bounced off the top of my 108ish support zone today while still holding onto the potential bullish divergences that remain on the 60-minute time frame. Barring a possible OpEx rally tomorrow, my expectation remains that the current downtrend in IWM will continue in the coming days/weeks, ultimately burning through these divergences.

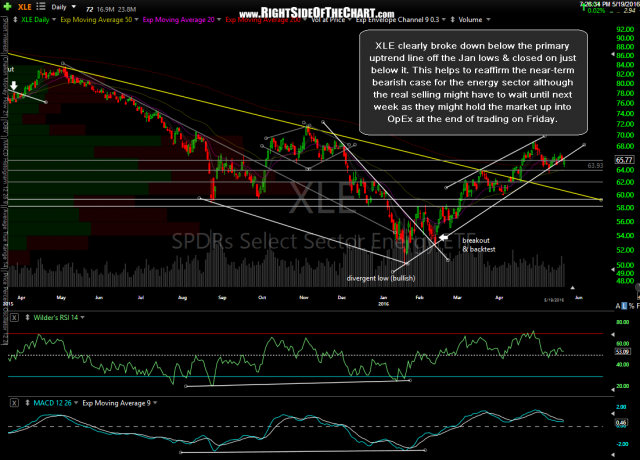

XLE clearly broke down below the primary uptrend line off the Jan lows & closed on just below it. This helps to reaffirm the near-term bearish case for the energy sector although the real selling might have to wait until next week as they might hold the market up into OpEx at the end of trading on Friday.