As to avoid any confusion or ambiguity, I wanted to be clear on my reason for reducing short exposure before the close on Friday yet not reversing to a net long position even though I stated the odds for a reaction were likely. The minimum initial downside targets that were hit on Friday were exactly that: minimum & initial downside targets meaning that I do favor more downside from there in the coming weeks.

With that being said, I couldn’t (and still can’t, despite the fact that the markets are currently poised to gap open substantially higher) rule out the chances that the markets continue lower to my additional downside targets before any meaningful bounce. I also believe that any bounce from Friday’s lows is likely to be limited in both scope & duration so I have little to no desire to go to a long or market neutral positioning at this time.

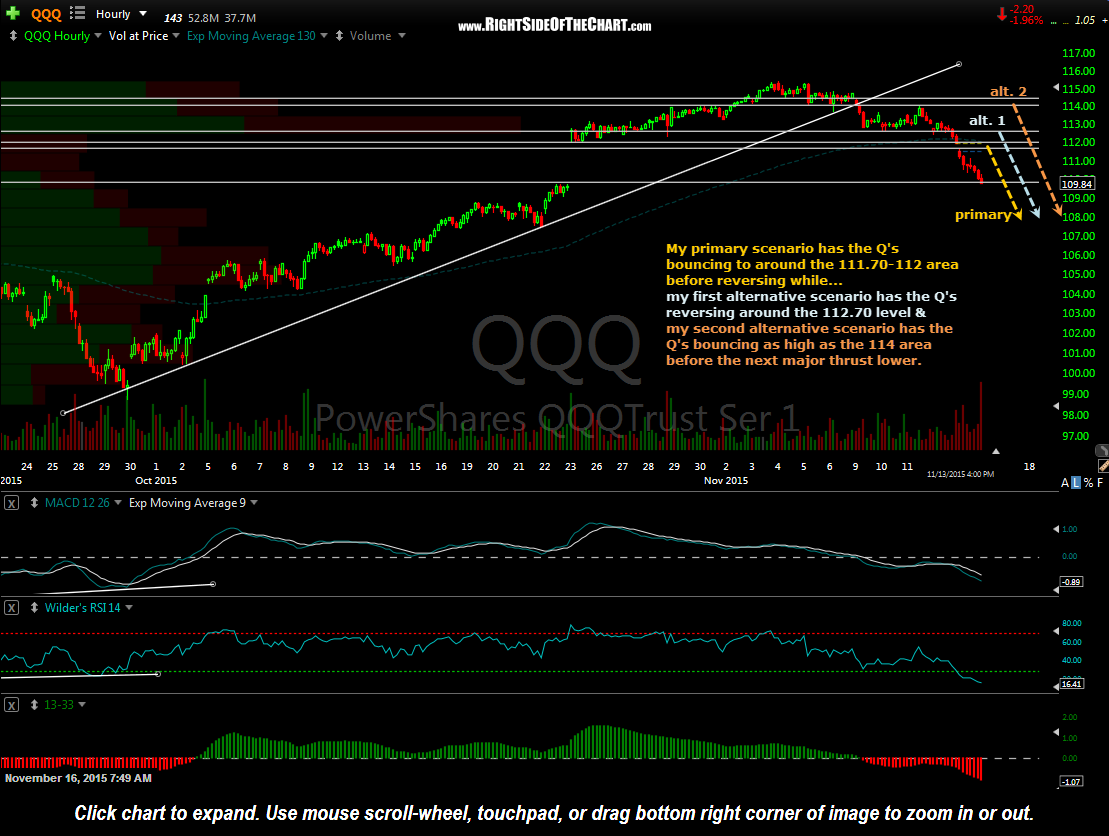

Should the charts convince me otherwise, I will close some more short positions and/or take some long-side hedges. As of now, I plan to add back the short exposure (and possibly some more) as/if the Q’s approach the bounce targets on my primary & first alternative scenarios on this 60-minute chart but will not add beyond there & will likely start reducing short exposure if QQQ exceeded the 114.30ish area.

My primary scenario has the Q’s bouncing to around the 111.70-112 area before reversing while my first alternative scenario has the Q’s reversing around the 112.70 level & my second alternative scenario has the Q’s bouncing as high as the 114 area before the next major thrust lower.