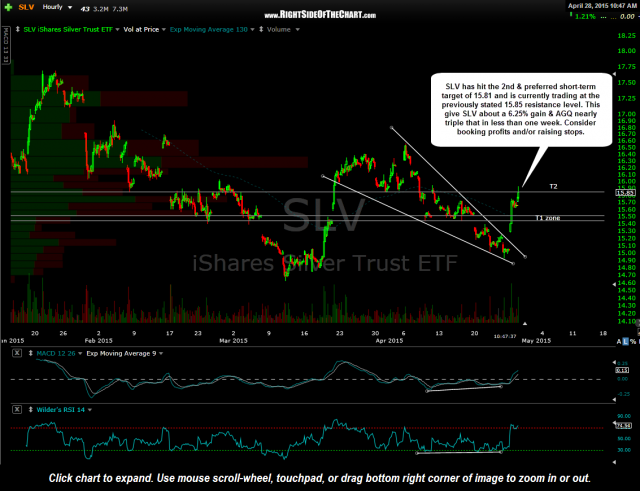

SLV (Silver ETF) has hit the 2nd & preferred short-term target of 15.81 and is currently trading at the previously stated 15.85 resistance level. This give SLV about a 6% gain & AGQ nearly triple that in less than one week. Consider booking profits and/or raising stops.

SLV and AGQ (3x long silver etf) were posted as a “unofficial” trade ideas in Wednesday’s Silver Poised To Rally post when prices were trading at the bottom of a bullish falling wedge pattern on the 60-minute time frame. From there, SLV went on to undercut one slightly lower low shortly thereafter, making a slightly lower low & one last kiss of the bottom of the wedge before exploding higher on a near vertical ascent to hit the second & preferred price target.

While the odds for a reaction are elevated here, I remain intermediate & quite possibly longer-term bullish on SLV as well as GLD & the mining stocks at this time (possibly, because there is still some work to be done from a technical perspective to help firm up the L/T bullish case). I also continue to expect more downside in the $USD as well as downside in most US equities in the coming weeks which should help place a bid beneath the precious metals.

On an admin note: The site was upgraded to a more powerful server yesterday which should result in faster page load times, fewer outages or downtime, as well as improved functionality of the e-mail notification system for those signed up to receive immediate notification when a new post is published.

If you are experiencing any issues with the immediate email notifications and have already added the domain RightSideOfTheChart.com to your safe-sender’s list as well checked your junk mail filter, please contact us with the details of your issue (e.g.- some or all email notifications are no longer being received) along with your internet service provider (e.g.- Comcast, Gmail, AT&T, etc…) and we will look into the issue at our earliest convenience. Remember, the option to receive a single daily digest of all new post sent every evening (typically just after 5pm EST) is now available for those who prefer the daily digest format (one email per day) vs. the immediate notifications.

With the server upgrade as well as the surge in market volatility lately (that’s when traders make $$), my time available to mock up charts & composes detailed notes on trade ideas is somewhat constrained at this time. As such, I might rely a bit more on the Twitter feed in sending out brief updates on existing trades, new trade ideas, & market developments. With the new server upgrade, I’m still testing to see if the Twitter timeline widget on the left of the homepage is automatically refreshing in all browsers although I only run the latest versions of Firefox, Chrome, Internet Explorer & Safari. Therefore, even if we correctly configure that feed to auto-populate each time a new Tweet is sent, your own unique browser version or setting may not be properly configured. In that case, you would either need to refresh the page in order to view any new tweets or you could also access our Twitter feed directly on Twitter via this link: https://twitter.com/RSOTC.