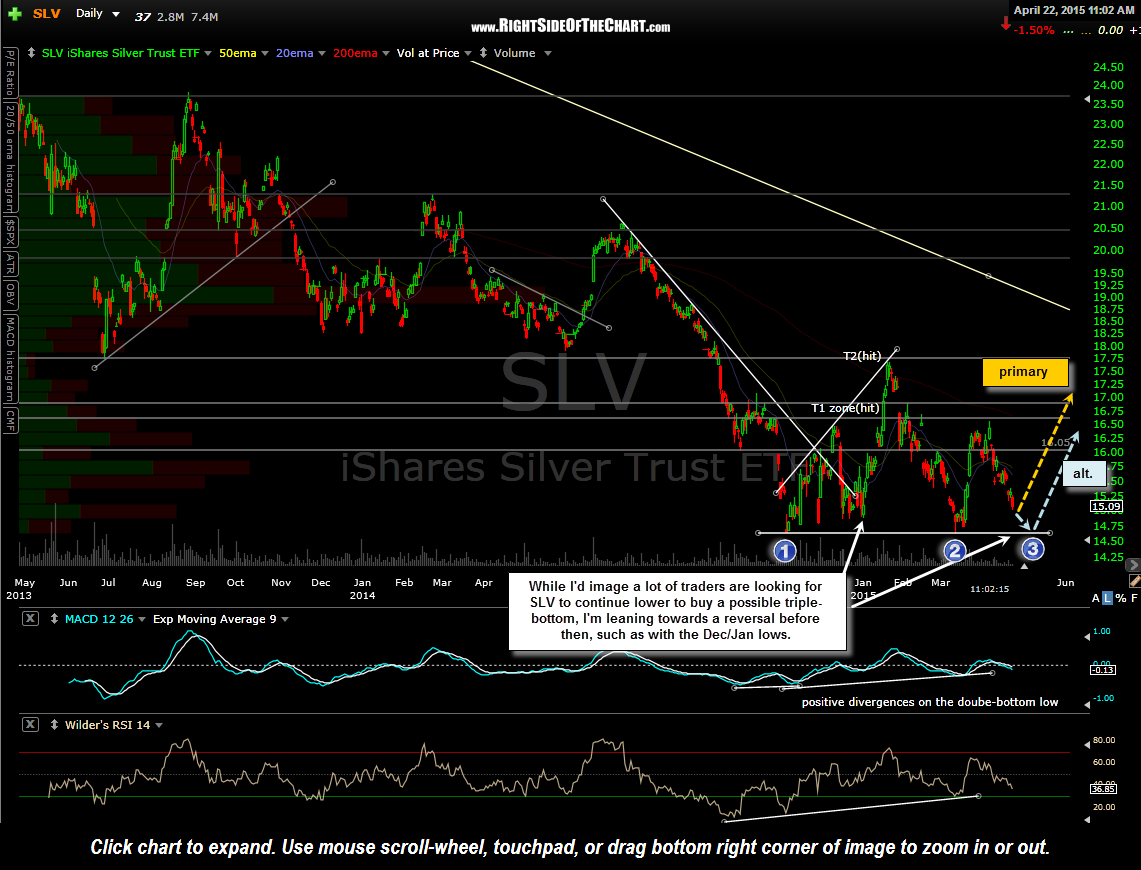

While I’d image a lot of traders are looking for SLV (Silver ETF) to continue lower to buy a possible triple-bottom, I’m leaning towards a reversal before then, such as with the Dec/Jan lows. Primary & alternative scenarios shown on this daily chart:

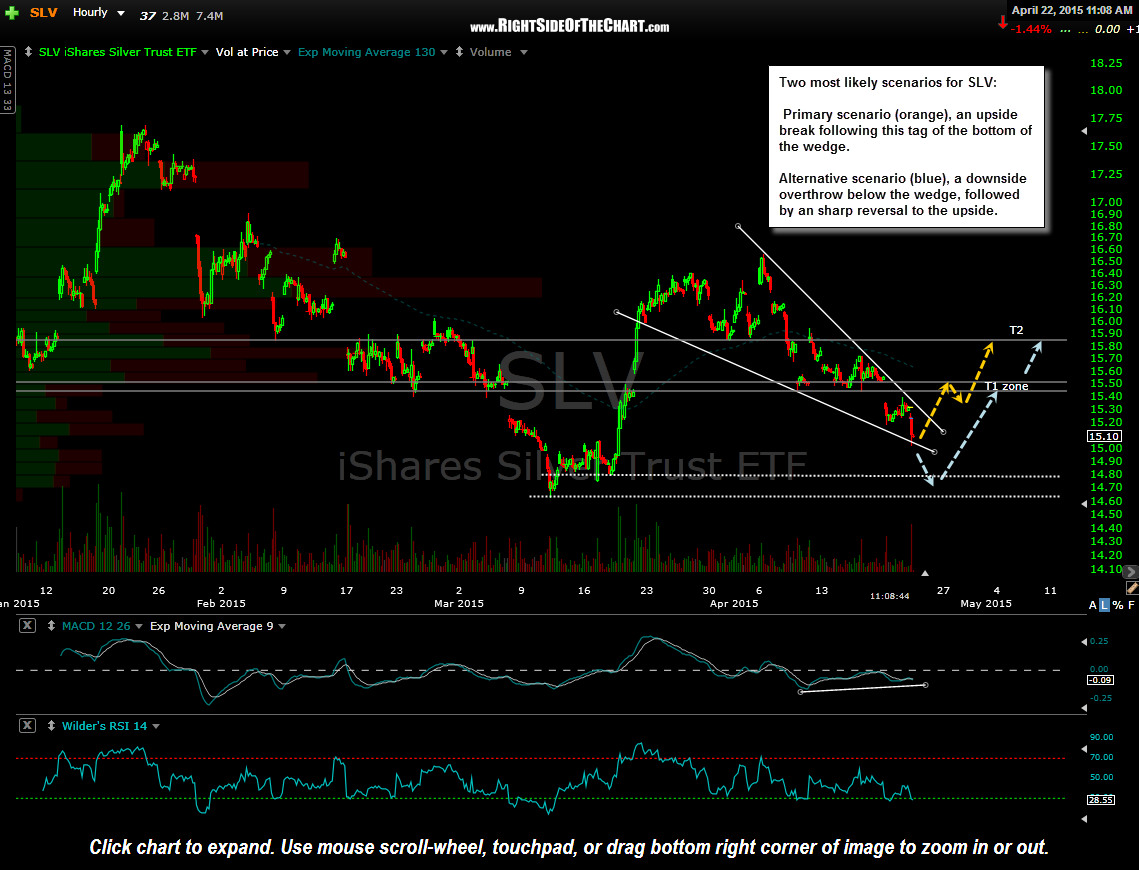

Zooming down to a 60-minute time-frame, my two most likely scenarios for SLV are:

- Primary scenario (orange), an upside break following this tag of the bottom of the wedge.

- Alternative scenario (blue), a downside overthrow below the wedge, followed by an sharp reversal to the upside.

Should either of these two scenarios play out, I would expect these two target to be hit within several days. As such, AGQ (2x long silver etf) is an alternative to SLV for aggressive traders. As I’m behind on updating the trade ideas on the site, I’m not going to add SLV or AGQ as official trades at this time although I have taken a long position here with T2 (resistance at 15.85, sell limit at 15.81) as my preferred target and a stop slightly below 14.86. However, I may likely extend my profit target(s), depending on how SLV & the $USD play out over the next few sessions.